Participants step into the volatile world of commodities trading - balancing supply shocks, geopolitical risk, and pricing strategies - in our Commodities Course.

Commodity Types: Energy, metals, agriculture, and softs

Spot vs Futures Markets: Physical delivery vs financial settlement

Supply and Demand Dynamics: Seasonal effects, geopolitical tensions, and inventory cycles

Price Volatility: Natural disasters, trade embargoes, and currency shifts

Hedging Strategies: Using futures, forwards, and options to manage price risk

Logistics and Procurement: Storage costs, transport timing, and quality risk

Market Participants: Producers, consumers, speculators, and arbitrageurs

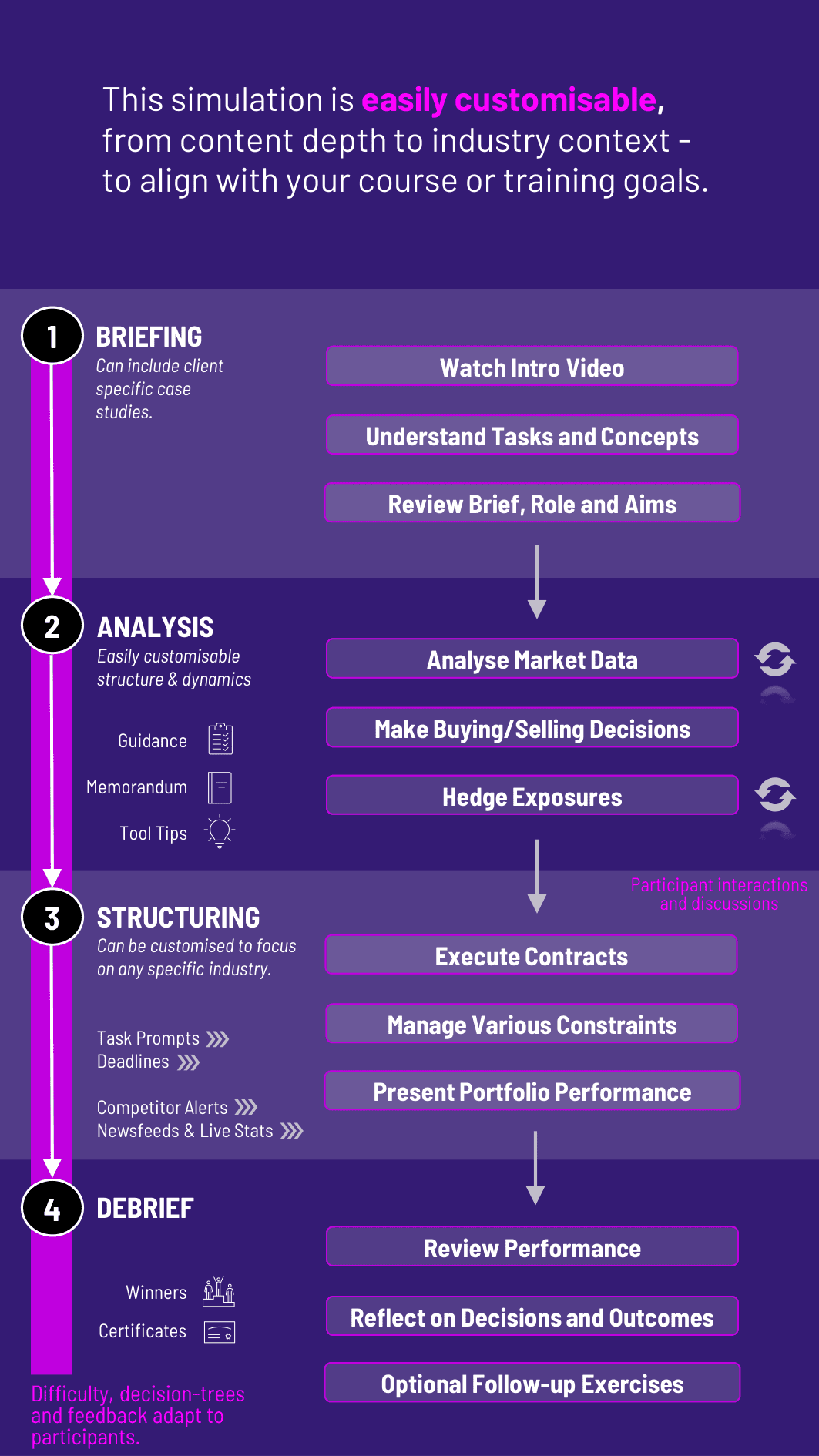

Analyze market data, weather reports, and global news affecting commodity prices

Make buying or selling decisions under supply and demand uncertainty

Execute spot, futures, or forward contracts based on timing and strategy

Hedge commodity exposure using derivative instruments

Manage working capital, delivery schedules, and storage constraints

Present portfolio performance and pricing rationale to simulated stakeholders

Participants experience the fast-paced, high-stakes environment of commodities trading. They learn to:

Interpret macroeconomic and geopolitical signals that drive price volatility

Manage physical and financial exposure in global markets

Choose appropriate instruments to hedge or speculate on prices

Balance operational constraints with financial strategy

Communicate pricing decisions and portfolio results clearly and confidently

Reflect on ethical and sustainability issues in global commodity flows

Do participants need prior experience in trading or commodities? No. The course includes onboarding for all major commodity types, pricing mechanisms, and trading instruments.

Which commodities are covered in the course? The default course includes oil, natural gas, gold, wheat, and copper. Additional modules are available for agriculture and softs (e.g. coffee, cotton).

Can participants use derivatives to hedge? Yes. Participants can trade futures and forwards to hedge exposure or take speculative positions based on market views.

Does the course include geopolitical events? Yes. Participants react to evolving headlines, supply chain disruptions, sanctions, OPEC decisions, and more.

What roles can participants play? Participants can be traders, analysts, or procurement managers depending on course objectives and team structure.

Is the course single-player or team-based? Both formats are supported. Teams often work well for strategy development, role-play (e.g., CFO + trader), and internal negotiations.

How long does the course run? A full cycle typically runs 3 - 4 hours, though it can be extended over multiple sessions with evolving market conditions.

How is participants performance evaluated? Performance is based on trading P&L, hedging effectiveness, inventory management, and justification of strategy under uncertainty.

Does the course involve ethical or sustainability challenges? Yes. Optional modules include decisions around sourcing, carbon emissions, supply chain labor risk, and ESG-aligned procurement.

Is this suitable for non-finance participants (e.g. operations or sustainability)? Absolutely. The course bridges finance, supply chain management, and sustainability, making it ideal for multidisciplinary cohorts.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.