Master the art of wealth management and become the trusted advisor to your ultra-high-net-worth clients. Navigate volatile markets, build bespoke portfolios, and learn the delicate balance of risk, return, and client relationships.

Credit Analysis and Underwriting

Asset-Liability Management

Capital Adequacy

Liquidity Risk Management

Net Interest Margin

Interest Rate Risk

Loan Loss Provisioning

Deposit Pricing Strategy

Macroeconomic Analysis

Bank Valuation

In the simulation, participants will:

Analyze loan applications from various businesses and decide on approval, amount, and interest rate.

Set competitive interest rates for consumer deposits and corporate loans.

Manage the bank's investment portfolio, including government and corporate bonds.

Issue subordinated debt or equity to raise capital and meet regulatory requirements.

Monitor key performance indicators (KPIs) like NIM, ROE, CAR, and Loan-to-Deposit Ratio.

React to central bank policy changes, economic shocks, and competitor actions.

Develop a coherent strategy to position the bank as a low-cost, high-risk, or balanced player in the market.

Present a strategic review to the "board" (instructors and peers) justifying their decisions and performance.

Interpret the core financial statements of a commercial bank and its key performance metrics.

Apply fundamental credit analysis techniques to make informed lending decisions.

Formulate effective Asset-Liability Management (ALM) strategies to manage interest rate and liquidity risk.

Evaluate the impact of macroeconomic events and regulatory changes on a bank's operations and strategy.

Analyze the trade-offs between risk, return, liquidity, and capital adequacy.

Create a coherent business strategy that aligns with the bank's risk appetite and market conditions.

Collaborate effectively within a team to manage a complex financial institution under pressure.

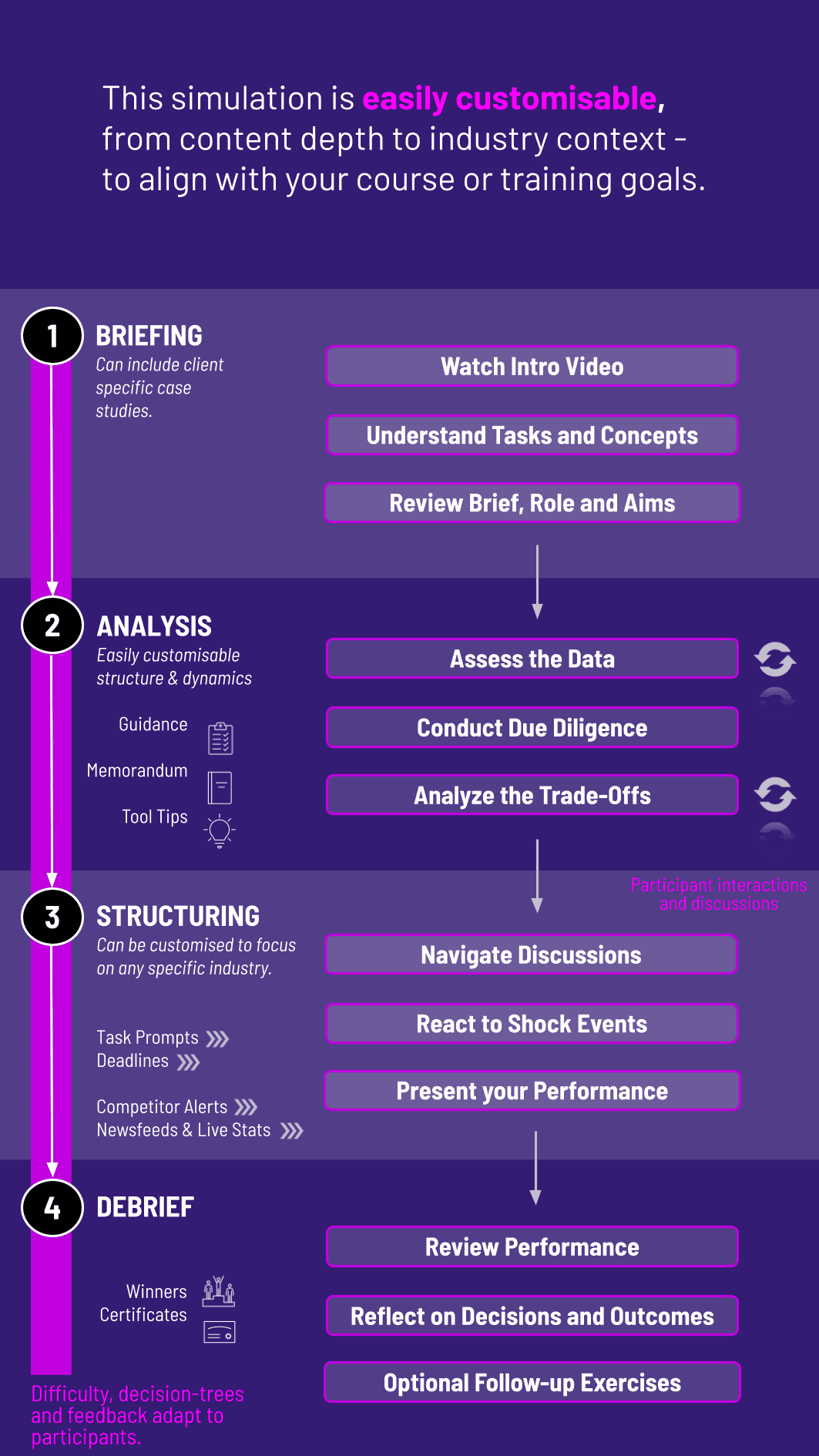

1. Form Teams and Take Over a Bank Each team is assigned a bank with a starting balance sheet in a multi-period, online environment.

2. Review the Economy and Make Decisions Each round (representing a fiscal quarter or year), teams analyze the economic climate, their current financial position, and a queue of new loan applications and funding opportunities.

3. Input Decisions Teams input their decisions on loan approvals, interest rates, funding sources, and capital management into the simulation platform.

4. Get Results and Compete The simulation engine processes all team decisions simultaneously, generating results that show each bank's financial performance, stock price, and market share relative to competitors.

5. Review and Adapt Teams receive detailed reports, including an income statement, balance sheet, and key ratio analysis. They use this feedback to refine their strategy for the next round, navigating a changing economy.

What is the primary goal of the Commercial Banking Simulation? The primary goal is to provide a realistic, hands-on understanding of how a commercial bank operates, focusing on the critical balance between generating profits through lending and managing associated risks (credit, liquidity, interest rate).

What prior knowledge is required to participate? A basic understanding of accounting and finance is helpful but not always required. The simulation includes briefing materials and tutorials that cover the essential concepts.

How long does a typical simulation run? A complete simulation experience can range from a single intensive one-day workshop to a multi-week course module, depending on the number of decision rounds and debriefing sessions.

Is this simulation focused on investment banking or commercial banking? This simulation is exclusively focused on the core functions of commercial banking (taking deposits, making loans). It is distinct from our Investment Banking and M&A simulations, which focus on deals and capital markets activities.

Can we see the impact of our loan decisions? Absolutely. The simulation models the performance of each loan you approve. You will see which loans become delinquent or default, directly impacting your income statement through loan loss provisions and charge-offs.

How does this simulation help with career preparation? It provides invaluable practical experience for roles in commercial banking, credit analysis, risk management, and corporate finance, giving you a significant edge in interviews and your early career by demonstrating a holistic understanding of bank management.

Portfolio Perfomance Score

Net Worth Growth

Simulation Performance

Strategic Review Report

Peer Evaluation

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.