In this hands-on Climate Risk Simulation, participants act as corporate or financial leaders navigating environmental, regulatory, and market risks. They balance sustainability, profitability, and reputation while making high-stakes strategic decisions.

Climate-related financial disclosures and reporting

Transition risk: carbon pricing, regulation, and investor pressure

Physical risk: climate shocks, supply chain disruption, and resilience

ESG integration and stakeholder alignment

Green finance, carbon markets, and sustainable investment

Trade-offs between profit and environmental responsibility

Communication and reputation management

Scenario planning and stress testing

Innovation and sustainable product strategy

Ethics, governance, and accountability in climate-related decisions

Assess financial and operational exposure to climate risks

Decide on mitigation strategies like divestment, carbon offsets, or green innovation

Balance stakeholder pressure from regulators, investors, NGOs, and communities

Manage crises such as natural disasters or public protests

Communicate strategy in board presentations, press releases, or investor calls

Adapt decisions across multiple rounds as climate risks evolve

By the end of the simulation, participants will be able to:

Identify and assess physical and transition climate risks

Integrate ESG considerations into strategic decision-making

Balance short-term profitability with long-term sustainability

Evaluate financial trade-offs in mitigation and adaptation strategies

Communicate effectively with diverse stakeholders under pressure

Understand climate-related reporting frameworks and investor expectations

Strengthen resilience planning across business models and industries

Make ethical decisions in the face of competing pressures

Apply scenario planning to uncertain and complex environments

Collaborate across functions to build sustainable strategies

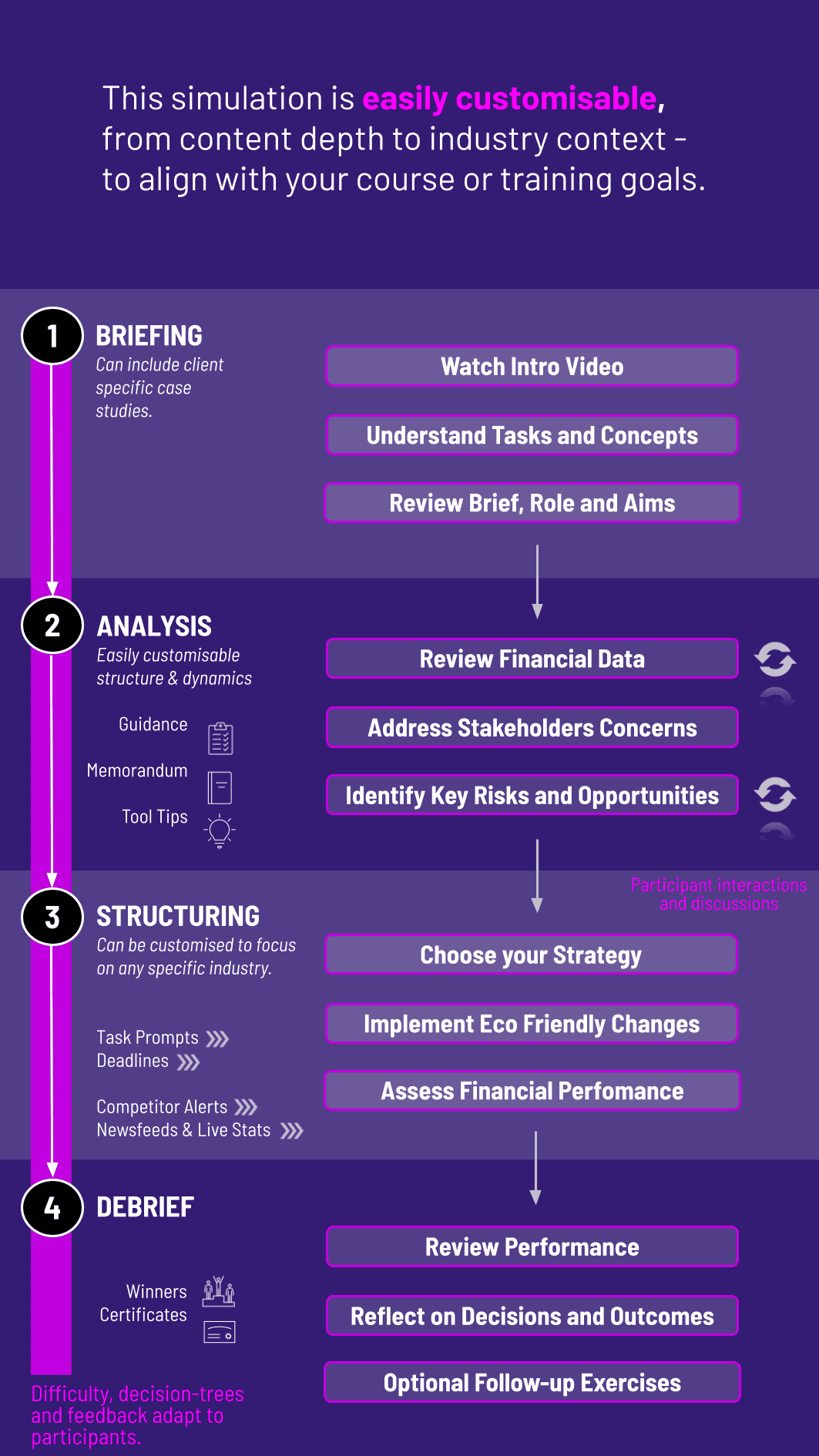

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

This simulation can be delivered in classrooms, workshops, or corporate programs, and run individually or in teams. Each cycle builds complexity and mirrors real-world climate risk dynamics.

1. Receive a Scenario or Brief: Each round begins with a scenario - such as new regulation, climate-related losses, or shifting investor sentiment. Participants are given objectives and context.

2. Analyse the Situation: They review financial data, stakeholder expectations, and environmental metrics, identifying key risks and opportunities.

3. Make Strategic Decisions: Participants choose between mitigation and adaptation strategies, resource allocations, and communication tactics - all with financial and reputational consequences.

4. Collaborate and Role-Play: In team formats, participants role-play as executives, regulators, or investors, negotiating and aligning strategies.

5. Review Results and Reflect: Feedback highlights financial performance, ESG credibility, and stakeholder reactions. Participants reflect on successes and missteps.

6. Repeat and Iterate: Each new round introduces additional complexity, requiring participants to adapt and refine strategies.

Do participants need climate finance expertise? No. The simulation provides all necessary context, making it accessible for all levels.

Can the simulation be customized for specific industries? Yes. It can reflect energy, manufacturing, banking, or consumer industries depending on the audience.

Is this simulation suitable for executive training? Absolutely. It’s ideal for boards, senior managers, and policy professionals.

Does it cover both physical and transition risks? Yes. Participants encounter climate shocks as well as policy and regulatory challenges.

How long does the simulation take? It can run as a short 2-hour exercise or be extended into multi-day programs.

Is there a role-play component? Yes. Teams can represent different stakeholders - executives, regulators, NGOs, or investors.

Does the simulation include ESG frameworks? Yes. Concepts like TCFD, ESG ratings, and carbon disclosure can be embedded.

How is performance measured? Through financial outcomes, ESG credibility, stakeholder trust, and adaptability.

Can it run online as well as in person? Yes. It’s fully digital and suitable for remote or hybrid delivery.

Is it applicable to universities? Yes. It integrates well into MBA, economics, sustainability, and policy courses.

Climate risk identification and management

Strategic alignment of adaptation and mitigation choices

Communication quality in stakeholder contexts

Responsiveness to changing external conditions

Collaboration and negotiation effectiveness

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.