Navigate the high-stakes role of a Chief Financial Officer. Make critical decisions on capital structure, investment, and risk management to maximize firm value and ensure long-term solvency.

Capital Structure Optimization

Cash Flow Management

Financial Statement Analysis

Valuation Techniques

Cost of Capital

Investment Appraisal

Dividend Policy

Credit Ratings and Debt Markets

Risk Management

Stakeholder Communication

In the simulation, participants will:

Analyze dynamic market data and the company's financial performance.

Issue corporate bonds or take out loans, negotiating interest rates and maturities.

Execute equity issuances or share buybacks to optimize the capital structure.

Allocate capital to R&D and evaluate major capital expenditure projects.

Set the company's dividend policy and manage retained earnings.

Monitor and react to changes in the company's credit rating.

Manage financial risks through various hedging instruments.

Present their financial strategy and results to the "board" (instructors or peers).

Articulate the strategic role of the CFO in creating enterprise value.

Evaluate the trade-offs between different sources of capital (debt vs. equity).

Implement a coherent financial strategy aligned with corporate goals.

Analyze the impact of financial decisions on key metrics and valuation.

Manage corporate liquidity and cash flow to avoid financial distress.

Appraise long-term investment opportunities using capital budgeting techniques.

Communicate financial performance and strategy effectively to stakeholders.

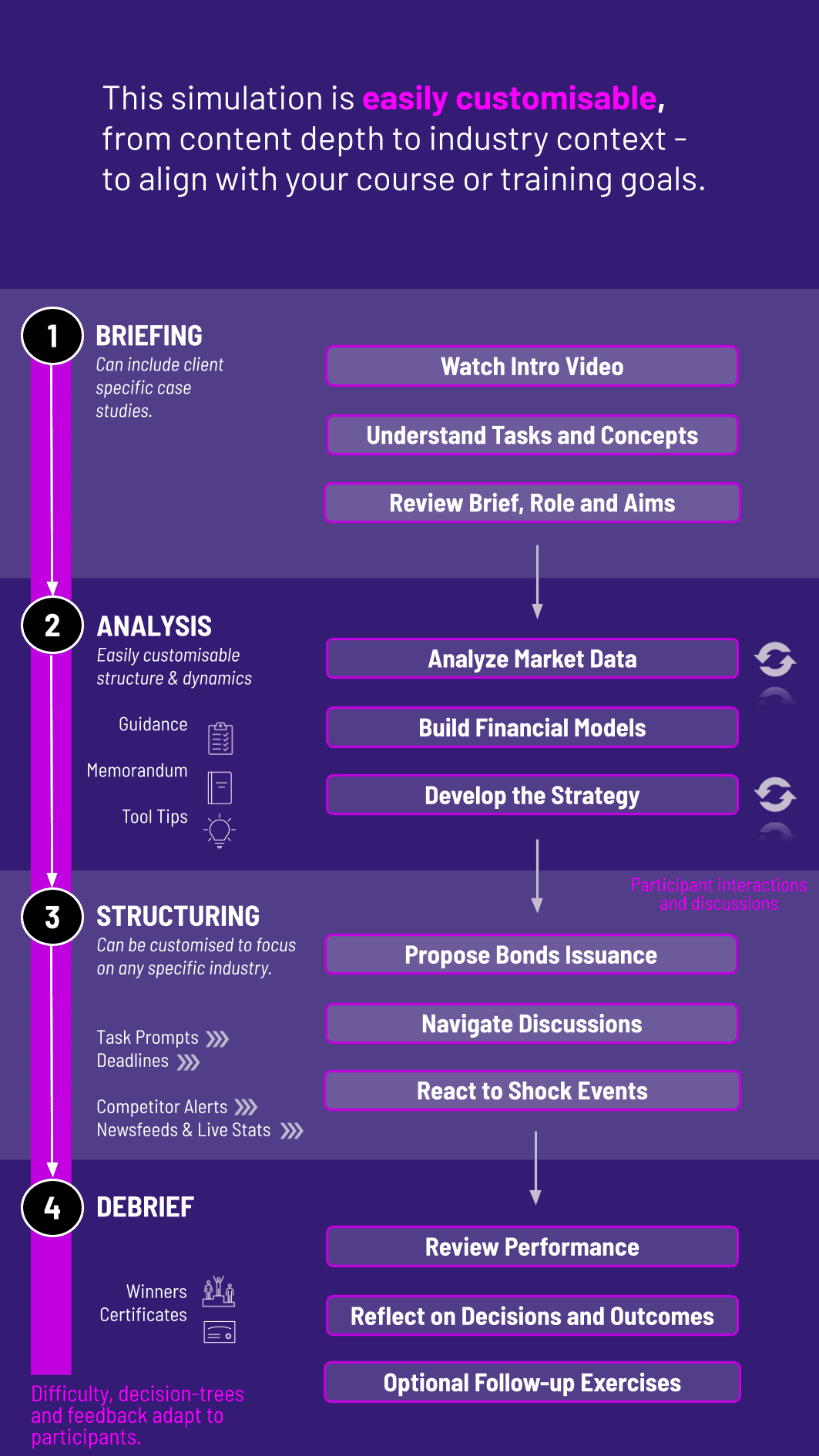

1. Form Teams and Review Participants are grouped into management teams, each running a simulated company. They review the initial company financials and market briefing.

2. Make Decisions Each round (representing a fiscal quarter or year), teams analyze their financial statements, market news, and competitor actions. They then enter a comprehensive set of financial decisions into the online platform.

3. Run Simulation The sophisticated algorithm processes all team decisions simultaneously, simulating competitive market dynamics, investor reactions, and economic conditions.

4. Review Results Teams receive detailed financial reports (Income Statement, Balance Sheet, Cash Flow Statement), an updated company valuation, credit rating, and a ranking dashboard showing their performance against other teams.

5. Debrief and Repeat Facilitators lead a debriefing session to discuss outcomes, strategic successes, and failures. The cycle repeats for multiple rounds, allowing teams to adapt and refine their long-term financial strategy.

What is the main goal of the CFO Simulation? The primary goal is to provide a hands-on, risk-free environment to understand and experience the core strategic decisions a CFO makes, and to see how those decisions directly impact a company's financial health and market value.

Is this simulation suitable for participants without a finance background? Yes. The simulation is designed with intuitive interfaces and guided learning. It is an excellent tool for MBAs, executives, and professionals from other fields (marketing, operations, for example) to gain financial acumen. Basic concepts are reinforced through practice.

What is the ideal team size for the simulation? We recommend teams of 3-5 participants. This size encourages collaboration, debate, and allows for the division of analytical tasks, mimicking a real-world finance department.

How long does a typical simulation session last? A complete simulation can be run as a half-day workshop, a full-day intensive, or extended over multiple weeks in a university course, with one decision round per class session.

Can the simulation be customized for our specific industry? Absolutely. While the core financial principles are universal, we can customize case backgrounds, financial metrics, and market conditions to reflect the specific challenges of your industry.

What kind of support do you provide during the simulation? Participants have access to a comprehensive user guide, video tutorials, and in-platform help tools. Our support team and facilitators are also available to answer technical and conceptual questions throughout the exercise.

How does the simulation incorporate competition? Teams compete directly in the same market. Your decisions on investment, pricing, and financing affect not only your own company but also the competitive landscape, influencing market share, investor sentiment, and industry benchmarks.

What technical requirements are needed to run the simulation? The simulation is web-based and runs on any modern web browser (Chrome, Firefox, Safari, Edge) on desktops, laptops, or tablets. No software installation is required.

Financial Performance: Enterprise Value, Profitability Metrics, Liquidity and Solvency Ratios, Credit Rating.

Quality and consistency of financial strategy, as evidenced by the choices made in each round and their justification.

Final Presentation and Report

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.