In this hands-on Central Banking Simulation, participants take on policymaker roles to balance inflation, growth, and stability. They explore real-time trade-offs between interest rates, money supply, communication, and credibility.

Monetary policy tools: interest rates, open market operations, and reserve requirements

Inflation targeting vs. dual mandate decision-making

Central bank independence and political pressure

Currency stability and foreign exchange dynamics

Forward guidance and market signalling

Crisis management and lender-of-last-resort actions

Communication strategy and central bank credibility

Quantitative easing and tightening

Coordination with fiscal policy

Global economic interdependence and spillover effects

Review macroeconomic indicators like inflation, GDP growth, employment, and currency movements

Debate rate-setting decisions and policy statements

Evaluate policy trade-offs under external and political pressures

Coordinate with fiscal authorities and respond to public/media expectations

Issue central bank press releases and minutes

React to market, public, and international stakeholder feedback

By the end of the simulation, participants will be able to:

Understand the role of central banks in modern economies

Navigate real-time policy trade-offs between growth, inflation, and currency stability

Apply monetary tools to changing economic scenarios

Recognize how communication impacts expectations and credibility

Distinguish between short-term response and long-term stability goals

Manage coordination (or conflict) between central and fiscal policy

Explore the political economy of central banking

Handle crisis situations with limited tools and public scrutiny

Translate macroeconomic data into action

Reflect on decision impact and iterate across policy cycles

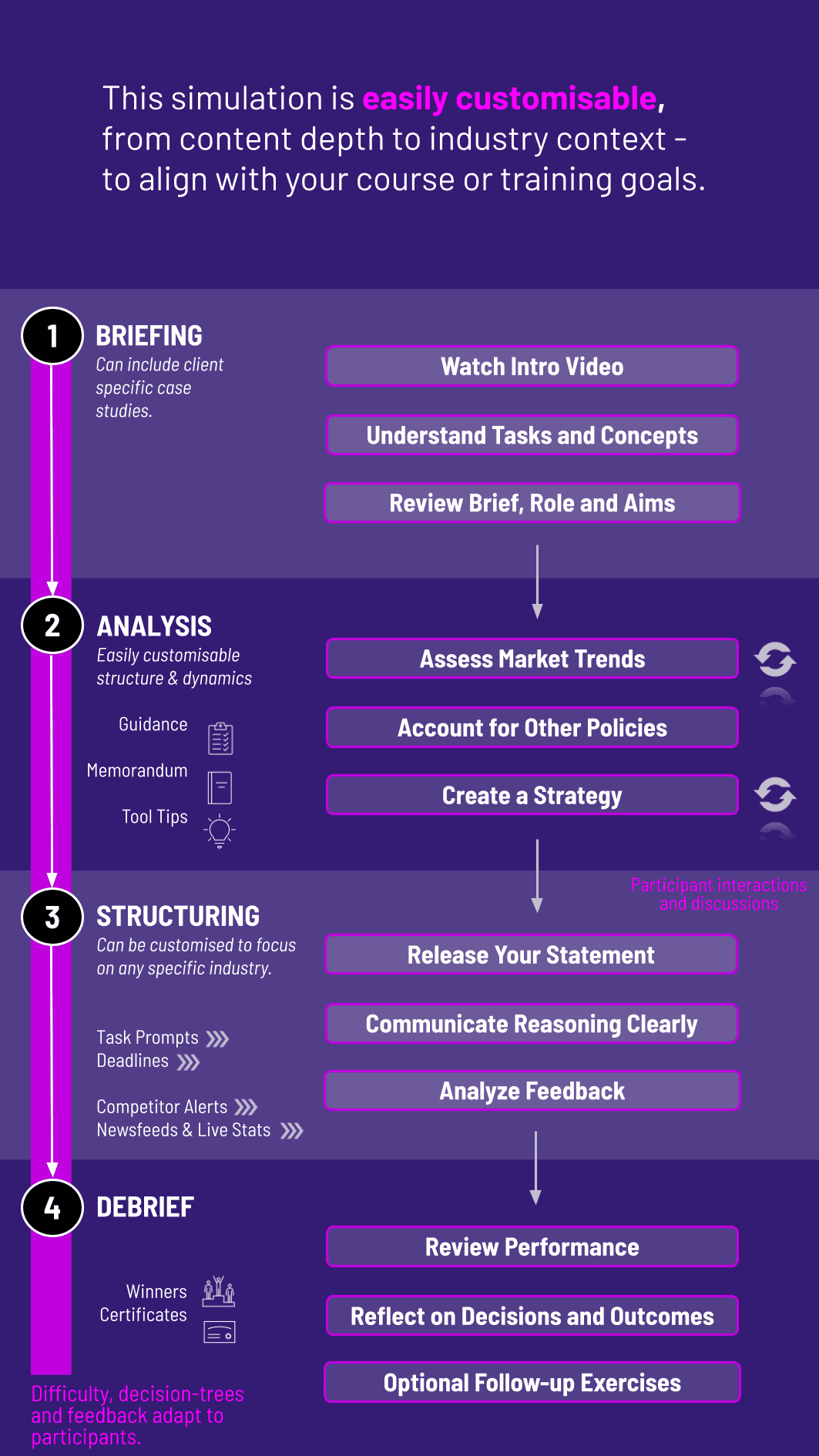

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

This simulation can be run in teams or individually, and is adaptable for academic programs, public policy workshops, or corporate training. Each cycle of the game builds pressure and realism.

1. Receive a Macro Brief: Each round starts with an economic update, including GDP forecasts, inflation trends, employment stats, and geopolitical developments. Participants review this macro context and set goals.

2. Analyse and Debate: Participants examine economic indicators and weigh different priorities—growth vs. inflation, market stability vs. employment. They explore trade-offs and formulate a proposed monetary response.

3. Make Policy Decisions: Participants decide on interest rates, quantitative tools, currency interventions, and the language of policy statements. Decisions are submitted through a central interface.

4. Communicate Strategy: Participants craft and release central bank statements or press briefings to influence expectations and build institutional trust—this affects stakeholder responses in subsequent rounds.

5. Respond to Feedback: Market reactions, political pressure, and international commentary shift based on participant decisions. Teams must reflect, adapt, and revise strategy accordingly.

6. Repeat Over Rounds: New data and unexpected shocks are introduced each round. Participants iterate, learn from outcomes, and aim for stability, credibility, and long-term growth.

Do participants need prior macroeconomics knowledge? Some familiarity helps, but the simulation introduces all necessary concepts during gameplay.

Is this simulation suitable for policy professionals? Yes, it’s ideal for central bank staff training, public policy workshops, and executive education programs.

Can we customise difficulty or timeframes? Absolutely. The simulation is modular - perfect for 90-minute classroom sessions or multi-day strategy courses.

How do teams interact? Participants can act as different wings of a central bank or debate policy proposals collectively. Team roles (e.g., inflation hawk vs. dove) can be assigned for deeper roleplay.

Is this based on real-world data? Scenarios are inspired by actual macroeconomic events but simplified to maintain clarity and accessibility.

Does it include crisis scenarios? Yes, the simulation can introduce crises - like stagflation, debt shocks, or political interference—to challenge participants’ agility.

Can I integrate communication tasks? Yes. Participants can write press statements, conduct mock briefings, or role-play media interactions to build soft skills.

How is performance tracked? Performance is evaluated across inflation, unemployment, currency stability, and public trust metrics - plus reflection and communication.

Can it be used for fiscal/monetary coordination lessons? Definitely. An optional finance ministry role can be introduced to simulate coordination or tension between fiscal and monetary arms.

What’s the ideal group size? It works well with small teams of 3 - 5 or with individual players - scalable to large class sizes with breakout formats.

Effectiveness of monetary policy decisions

Inflation and currency management

Quality of policy communication and credibility

Adaptability across economic cycles

Peer collaboration and stakeholder awareness

Clarity in press briefings or debrief memos

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.