Go beyond the P&L statement and learn to forecast, manage, and strategically optimize cash flow in a dynamic, competitive business environment.

Cash Flow vs. Profit

The Cash Conversion Cycle

Working Capital Management

Cash Flow Forecasting

Liquidity Ratios and Solvency

Financing Strategies

Scenario and Sensitivity Analysis

Stakeholder Communication

In the simulation, participants will:

Analyze starting financial statements and initial market conditions.

Make quarterly operational decisions on pricing, production, and terms.

Negotiate payment terms with suppliers and banks.

Evaluate capital investment opportunities.

Choose financing instruments to cover shortfalls or invest in growth.

React to random economic events.

Monitor a live, dynamic cash flow dashboard and update forecasts.

Present a final cash flow strategy to the simulated "Board of Directors".

Construct and interpret detailed cash flow statements.

Identify and mitigate key drivers of cash flow risk within a business model.

Apply strategies to shorten the Cash Conversion Cycle and improve liquidity.

Build a practical, rolling 12-month cash flow forecast.

Evaluate the cash flow implications of investment and financing decisions.

Make strategic trade-offs between aggressive growth and conservative cash preservation.

Communicate cash flow performance and strategy effectively to stakeholders.

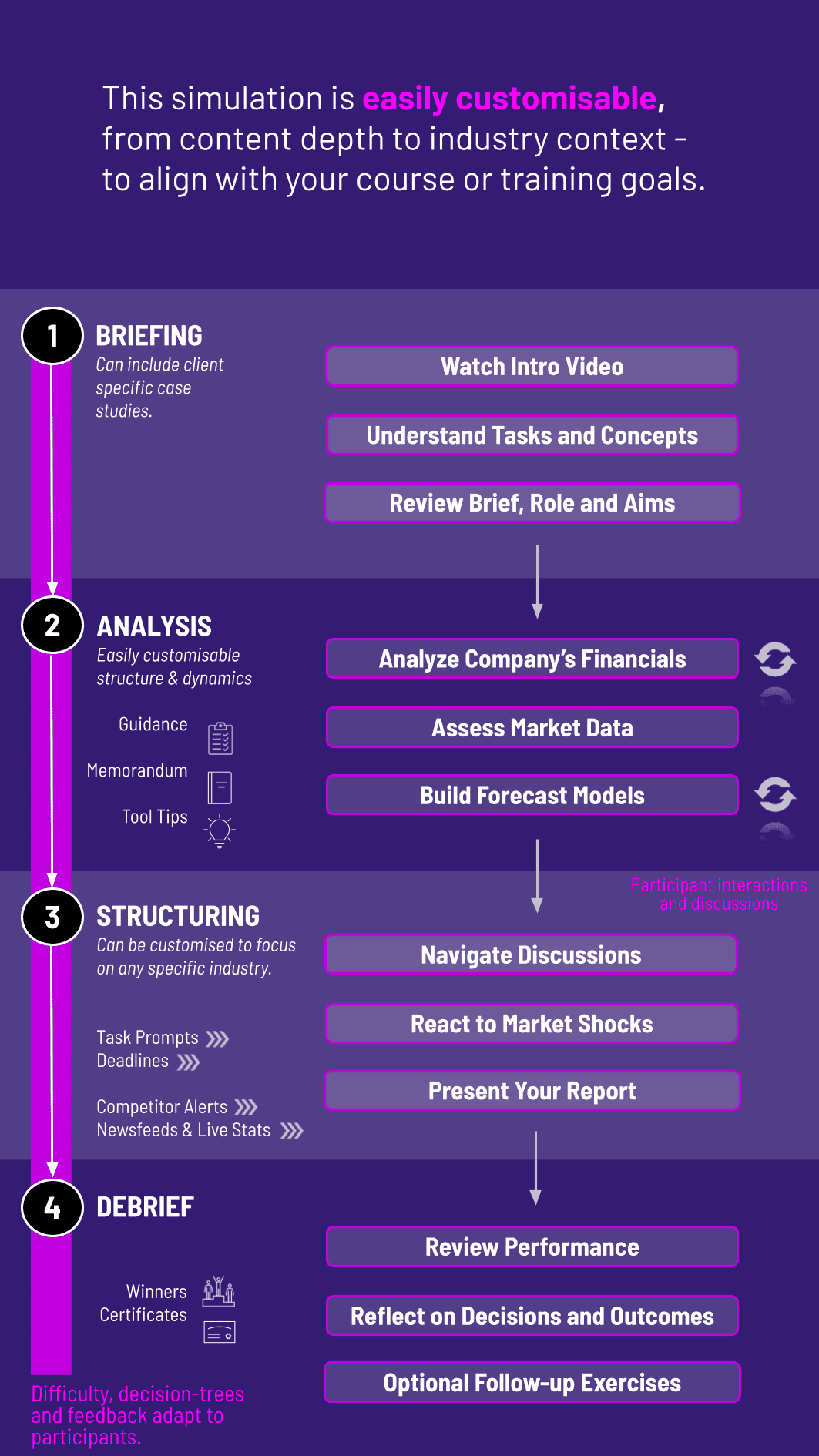

1. Team Formation Participants are grouped into management teams of 3-5.

2. Initial Briefing Receive the company’s financial history, market position, and Q1 forecast.

3. Decision Rounds Each round represents a fiscal quarter. Teams analyze data, use forecasting tools, and submit decisions on operations, financing, and investments.

4. Results and Feedback The simulation engine processes all decisions, generating updated financial statements, cash flow reports, and market rankings.

5. Economic Events Random events inject real-world uncertainty, forcing adaptive management.

6. Final Presentation Teams synthesize their performance into a board report, defending their strategy and lessons learned.

7. Debrief An instructor-led session ties simulation outcomes to core financial principles.

Is this simulation suitable for entrepreneurs or non-finance managers? Absolutely. Cash flow is critical for all business leaders. The simulation is designed to be intuitive, teaching practical, actionable skills without requiring an accounting degree.

What is the ideal group size and duration for the simulation? It works best with teams of 3-5 participants. The full simulation can be run in 4-8 hours, making it ideal for a one-day workshop or split across multiple sessions.

Do we need advanced Excel skills to participate? No. The simulation runs through a user-friendly web-based platform with built-in dashboards and forecasting tools. However, teams can export data for deeper analysis if desired.

How is the simulation scored or who wins? Performance is measured on a balanced scorecard including liquidity metrics, cumulative free cash flow, successful growth investments, and overall firm value, encouraging holistic management.

Can the simulation be customized for our specific industry? Yes. Core parameters like the business model, cost structures, and key ratios can be tailored to reflect industries like retail, SaaS, or manufacturing more closely.

What are the technical requirements to run it? Participants only need a modern web browser (Chrome, Safari, Edge) and an internet connection. No special software installation is required.

Is this a turn-based or real-time simulation? It is typically run in synchronous turn-based rounds (each quarter), allowing for team discussion and strategic planning. It can also be adapted for an asynchronous format.

How does this simulation complement an MBA or corporate finance curriculum? It bridges the gap between textbook theory and real-world application. Participants actively apply concepts from accounting, corporate finance, and treasury management in a risk-free, experiential environment.

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Accuracy in judgement of company’s assets and quality of assumptions

Ability to adapt and revise valuations in light of news shocks or changes

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.