While accrual accounting is the standard for large corporations, Cash Basis Accounting is the lifeblood of millions of small businesses, startups, and solo practitioners.

Cash vs. Accrual Accounting

Cash Flow Management

Accounts Receivable and Payable

Financial Decision-Making

Tax Implications

Profit vs. Cash Flow

Financial Statements

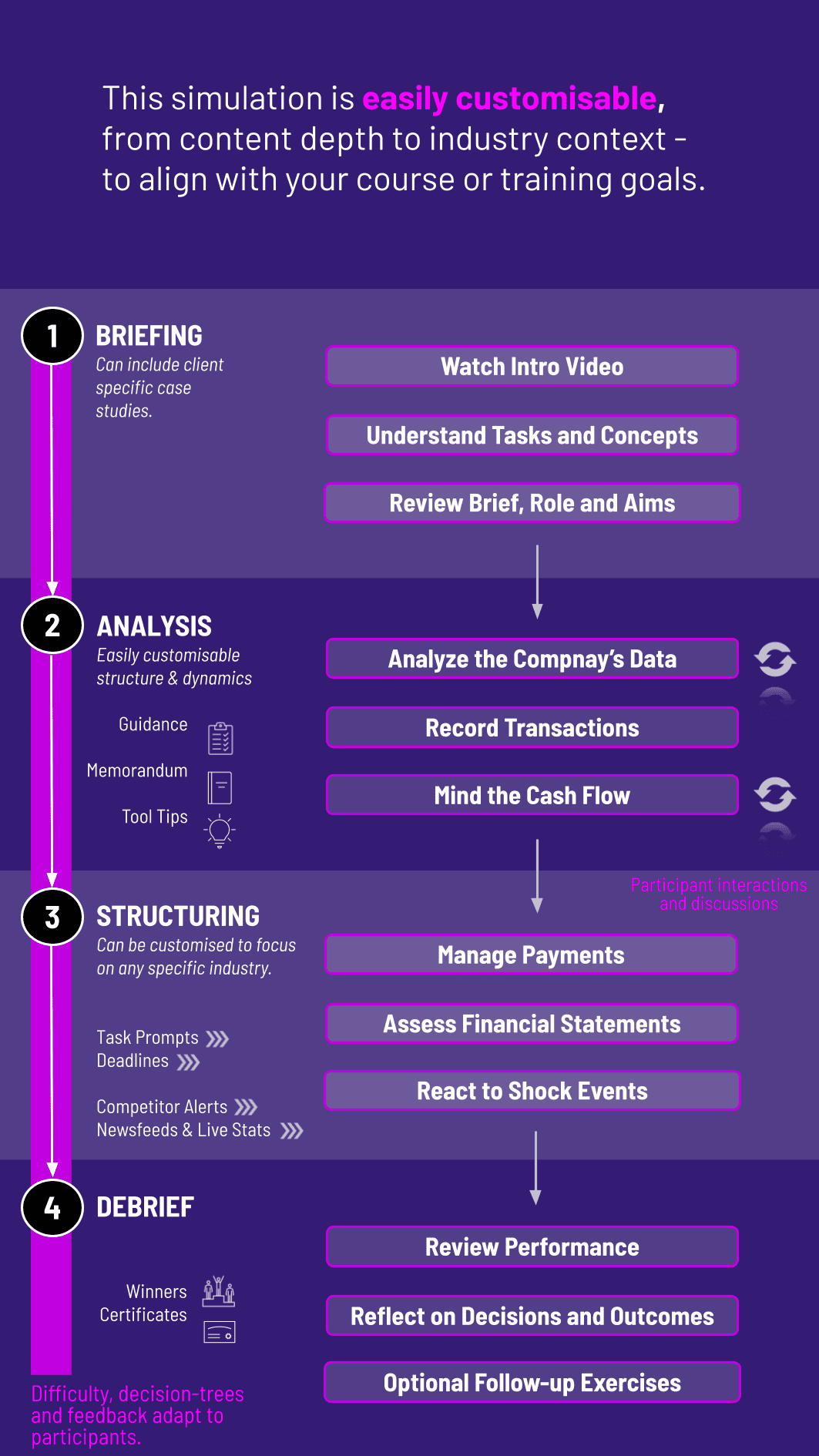

In the simulation, participants will:

Record financial transactions for a simulated business using the cash basis method.

Create and analyze cash-based income statements and cash flow statements.

Manage customer invoicing and collections, experiencing the lag between service delivery and cash receipt.

Prioritize vendor and bill payments based on available cash and payment terms.

Make strategic decisions on purchasing equipment, hiring staff, or launching marketing campaigns with immediate cash outlays.

Navigate a "cash crunch" scenario, requiring tough prioritization to maintain operations.

Forecast short-term cash needs and prepare for tax payments.

Analyze their company's performance at the end of the simulation cycle.

Define the core principles of cash basis accounting and contrast them with accrual accounting.

Record business transactions accurately using the cash basis method.

Construct key financial documents, including a cash-based income statement and a statement of cash flows.

Analyze a company's financial health by interpreting its cash flow patterns.

Evaluate the cash flow impact of operational and strategic business decisions.

Develop a short-term cash flow forecast to anticipate surpluses and shortfalls.

Appreciate the critical importance of cash flow management for small business survival and growth.

1. Setup Participants are given the starting cash balance and a set of existing clients and recurring expenses.

2. Process Transactions Record new sales (only when cash is received), pay bills (only when cash is sent), and handle other cash events.

3. Make Strategic Choices Decide whether to pay for a new advertising campaign, buy a new piece of equipment, or hire a part-time therapist—all with immediate cash consequences.

4. Manage Collections Send reminders to "slow-paying" clients to accelerate cash inflows.

5. Feedback and Analysis After each round, the simulation generates updated financial statements. Participants see the direct result of their decisions on their cash balance and can compare their performance to key metrics.

6. Scenario Injection Unexpected events, such as a key client delaying payment or an emergency repair, test participants' ability to adapt.

7. Final Review At the end of the multi-period simulation, a comprehensive dashboard provides a final score based on cash growth, profitability, and effective cash flow management.

What is the primary benefit of a Cash Basis Accounting Simulation? This simulation provides practical, hands-on experience in managing a business's cash flow, a critical skill for entrepreneurs, small business owners, and consultants that is often overlooked in traditional accounting courses.

Do participants need an accounting background? No prior accounting knowledge is strictly necessary. The simulation is designed to be intuitive and teaches the core concepts of cash accounting from the ground up, making it accessible to a wide audience.

How long does it take to complete the simulation? The core simulation can be completed in approximately 2 to 3 hours, depending on the participant's pace. It can be easily integrated into a single class session or workshop.

Is this simulation relevant for understanding business failure? Absolutely. It vividly demonstrates the concept of a "cash flow crunch," where a business becomes insolvent not because it isn't profitable, but because it runs out of liquid cash to pay its immediate obligations.

Can this simulation be used in online or hybrid courses? Yes, the simulation is hosted on our platform and is perfectly suited for both in-person and remote learning environments, allowing for flexible curriculum integration.

What makes this simulation different from reading a textbook chapter on cash accounting? Instead of passively learning rules, participants actively make decisions and immediately see the consequences. This experiential learning leads to deeper understanding and better knowledge retention.

How does the simulation assess participant performance? Performance is scored based on key metrics like ending cash balance, growth in net cash from operations, ability to avoid overdrafts, and overall business valuation, providing a quantitative measure of their cash management skills. The assessment can be adjusted with regards to your specific needs

The final cash position, reflecting overall cash accumulation throughout the simulation.

Measures the net cash generated from the core business activities, indicating operational health.

The net income calculated on a cash basis, showing the ability to generate surplus after all cash expenses.

Assessed by the ability to avoid cash shortfalls and emergency financing.

Qualitative evaluation of the choices made regarding investments and expenses relative to cash availability

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.