This simulation plunges participants into the heart of a live carve-out transaction, challenging them to navigate the financial, strategic, and operational hurdles to unlock hidden value.

Carve-out Structuring

Financial Modeling and Valuation

Standalone Entity Creation:

Separation Costs and Synergies

Capital Structure Design

TSA (Transition Service Agreements)

Equity Story Crafting

IPO Preparation and Roadshow

In the simulation, participants will:

Analyze the parent company and the business unit to be carved out.

Build a fully integrated financial model to project the standalone performance of the new entity.

Value the carve-out using multiple methodologies (DCF, Comparables, Precedent Transactions).

Design an optimal capital structure, including the appropriate level of debt.

Negotiate the terms of Transition Service Agreements (TSAs) with the parent company team.

Calculate one-time separation costs and manage a separation budget.

Create a compelling investor presentation and equity story.

Pitch the investment opportunity in a final "roadshow" to a panel of "investors".

Understand the strategic rationale and entire process of executing a corporate carve-out.

Construct a comprehensive financial model to analyze and value a standalone business unit.

Evaluate and design an appropriate capital structure for a newly independent company.

Identify and quantify the major financial, operational, and legal complexities of a separation.

Develop and articulate a persuasive investment thesis for a carve-out transaction.

Enhance critical skills in financial analysis, negotiation, and strategic communication.

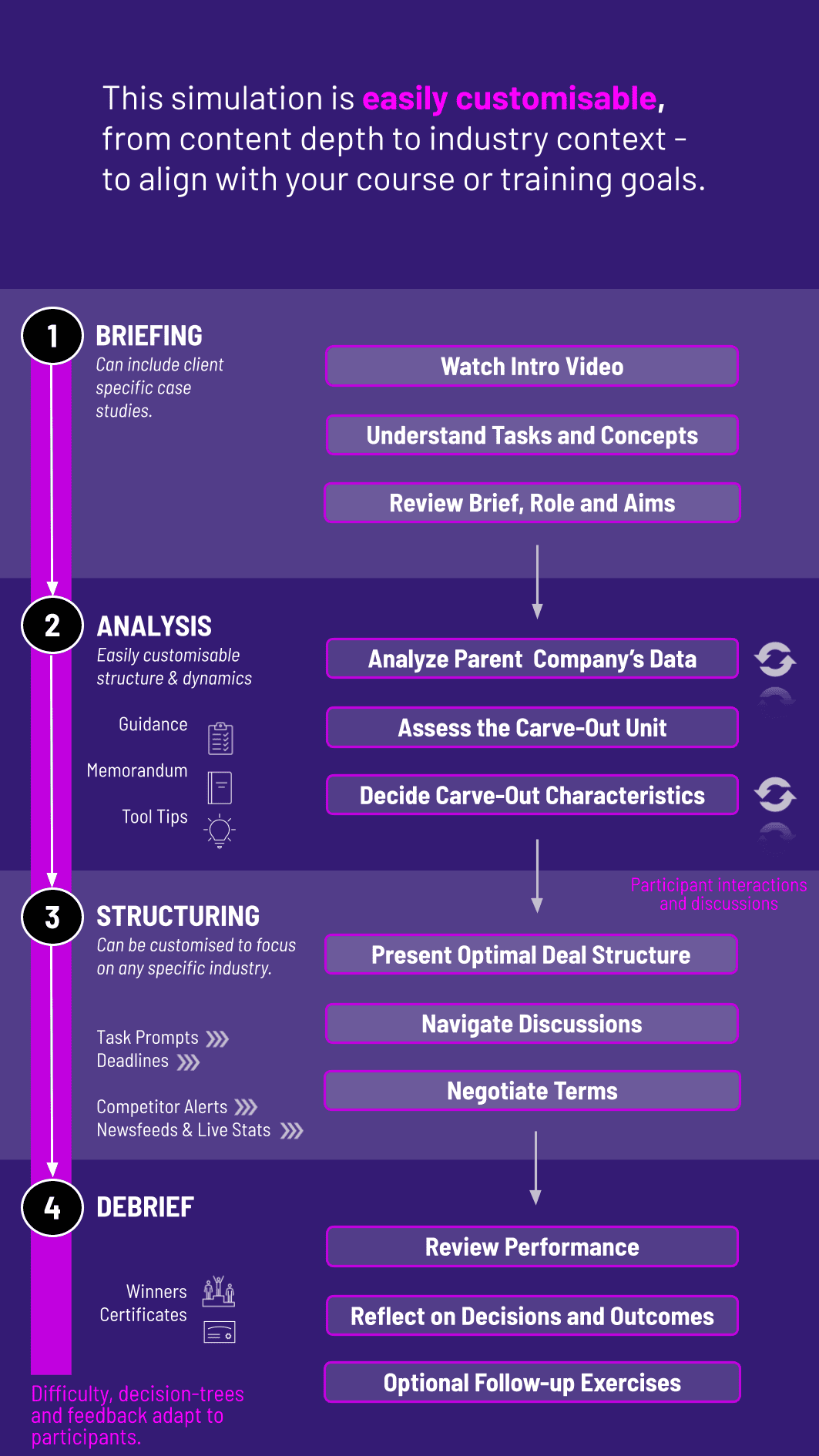

1. Team Formation and Briefing Participants are divided into teams representing the investment bank advising on the carve-out. They receive a detailed case study featuring the parent company's financials, the business unit's data, and market information.

2. Analysis and Modeling Teams analyze the case materials, build a three-statement financial model for the carve-out, and perform a preliminary valuation.

3. Structuring and Strategy Teams design the carve-out structure, propose a capital structure, and develop a strategic plan for the separation, including a TSA negotiation with another team representing the parent company.

4. Investor Preparation Teams synthesize their analysis into a professional investor presentation (pitchbook), crafting a clear equity story and investment rationale.

5. Final Presentation (The Roadshow) Teams present their carve-out proposal and investment pitch to a panel of instructors acting as the board of the parent company and potential investors, defending their analysis and recommendations.

6. Debrief and Feedback A comprehensive instructor-led debrief reviews the key learning points, financial model choices, and strategic decisions made by each team.

What is the difference between this Carve-out Simulation and a standard M&A simulation? While M&A simulations focus on buying or merging entire companies, this carve-out simulation deals with the complexities of separating a business unit from its parent, creating a new standalone entity, and establishing its value from the ground up. It involves unique challenges like TSAs, separation costs, and crafting a new equity story.

What level of finance knowledge is required to participate? Participants should have a foundational understanding of corporate finance and financial accounting (familiarity with financial statements and basic valuation concepts). The simulation is designed to be challenging for MBA students, finance graduates, and early-career professionals in banking or corporate development.

How long does the simulation typically take to complete? The simulation can be run as an intensive 1-2 day workshop or extended over several weeks as part of a university course, with weekly sessions dedicated to each phase.

Do participants work individually or in teams? The simulation is designed as a team-based exercise to foster collaboration, division of labor, and realistic replication of an ideal team environment.

Can this simulation be customized for our specific corporate training needs? Absolutely. We can customize the case study to reflect your industry (tech, industrials, consumer goods, etc) and focus on specific learning objectives relevant to your team, such as portfolio strategy or capital allocation.

How does this simulation help with career advancement in finance? Mastering carve-outs is a highly specialized and valued skill in investment banking, private equity, and corporate M&A. This simulation provides tangible, resume-building experience and a deep, practical understanding that sets candidates apart in interviews and on the job.

Accuracy and integrity of the integrated three-statement model.

Appropriateness of valuation assumptions and methodologies.

Clarity and professionalism of the model's structure.

Strength and clarity of the investment thesis and equity story.

Coherence of the strategic and financial rationale.

Professionalism of slide design and data visualization.

Effectiveness of the oral presentation and delivery.

Ability to handle Q&A and defend recommendations convincingly.

Peer and facilitator assessment of individual participation and teamwork.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.