In this simulation, participants act as CFOs tasked with optimizing the capital structure. They balance debt and equity under changing market, credit, and strategic conditions to maximize firm value.

Debt vs. Equity Trade-offs

Optimal Capital Structure Theory (Modigliani-Miller, trade-off theory, pecking order)

Cost of Capital (WACC adjustments based on capital mix)

Credit Ratings and Interest Rates

Market Signaling and Investor Perception

Covenants and Financial Flexibility

Impact of Capital Structure on Valuation

Scenario-Based Stress Testing

Analyzing financial statements and capital costs

Evaluating leverage scenarios under varying business forecasts

Choosing between issuing debt, equity, or hybrid instruments

Assessing the impact of capital changes on WACC, credit rating, and shareholder value

Communicating funding decisions to boards, analysts, and investors

Managing capital structure during growth phases, crises, or M&A events

Adjusting strategy based on simulated stakeholder feedback and market dynamics

By the end of the simulation, participants will:

Understand the core principles of capital structure theory

Apply capital mix decisions to real-world financial challenges

Evaluate how financing choices affect risk, cost of capital, and valuation

Respond to shifts in macroeconomic conditions, credit markets, and investor sentiment

Build persuasive narratives to justify financing strategies

Work cross-functionally to balance capital access with operational needs

Apply stress-testing and scenario planning to financial strategy

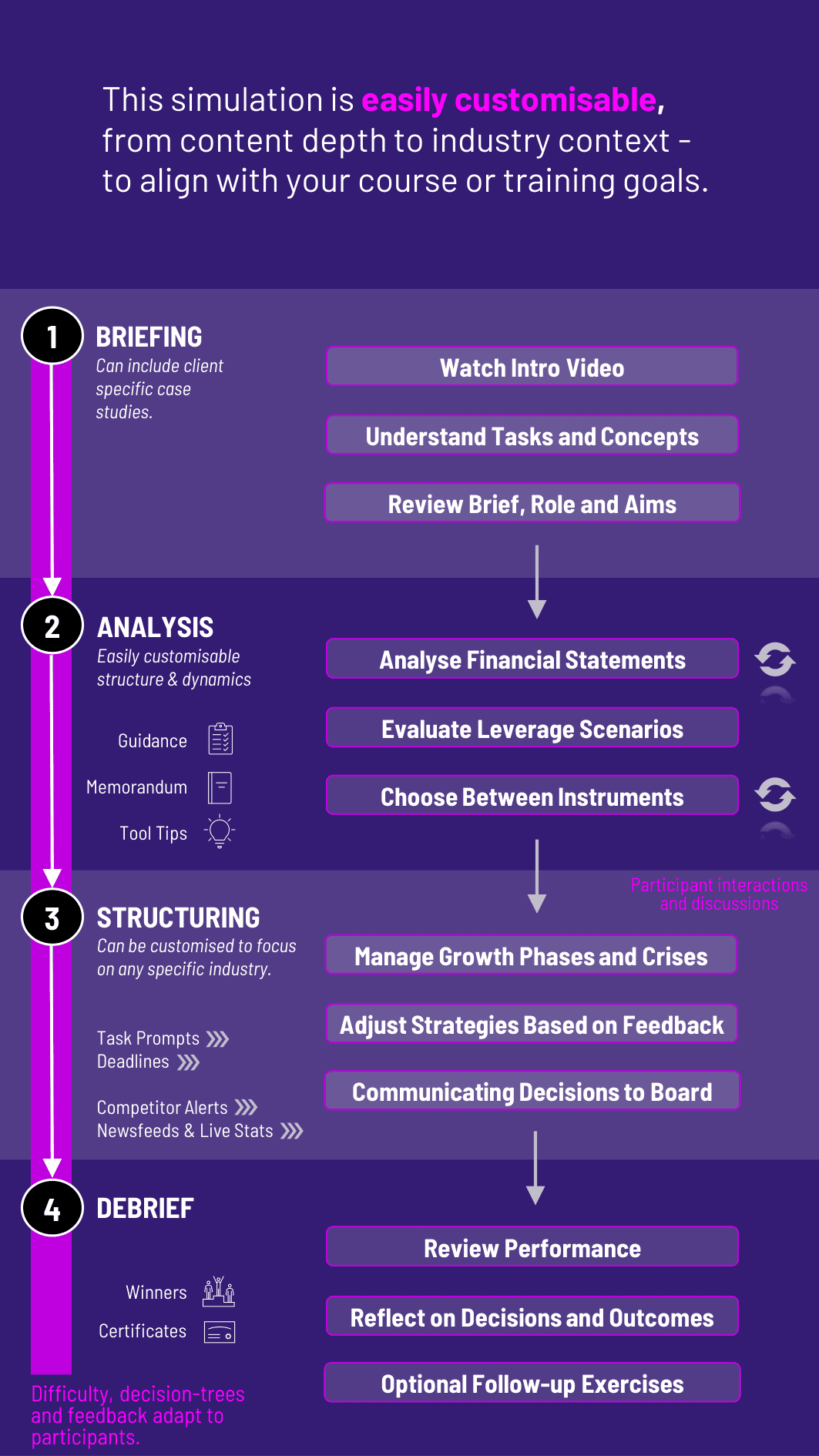

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

1. Scenario Introduction Participants receive a business case with financials, goals, and constraints.

2. Capital Assessment They evaluate existing capital structure, debt maturities, and liquidity.

3. Decision Making Participants make funding choices (e.g., refinance debt, issue new equity, or adjust mix).

4. Market and Stakeholder Feedback Their decisions affect stock price, credit score, investor sentiment, and financial ratios.

5. Board-Level Communication Participants justify their capital strategy through memos or presentations.

6. Next-Round Adaptation Each new cycle introduces a new economic context, requiring recalibration.

Is this suitable for students and professionals? Yes. It’s adaptable for MBA, undergrad, or corporate training contexts.

Does the simulation include credit ratings? Yes. Creditworthiness and market conditions influence interest rates and financing access.

Do participants use WACC? Yes. They calculate and optimize WACC to guide financing decisions.

Is it based on real industry cases? Scenarios are fictional but modeled after real market conditions and sectors.

How long is the simulation? It can be delivered in a 2 - 3 hour duration or stretched over multiple sessions.

Can it be used in valuation or corporate strategy courses? Absolutely. Capital structure decisions are central to valuation and long-term planning.

Does it simulate financial crises or economic downturns? Yes. Participants face shocks like recession, rating downgrades, or liquidity crunches.

Can it be run in teams? Yes. Teams can take on roles like CFO, treasurer, or investor relations lead.

Are stakeholder communications included? Yes. Participants justify decisions via board memos, presentations, or press releases.

How is performance assessed? Based on WACC optimization, valuation impact, financial stability, and quality of rationale.

Financial soundness and realism of capital decisions

Strategic consistency over multiple simulation rounds

Responsiveness to market signals and economic shifts

Clarity and persuasiveness in written or verbal communication

Collaboration, if run in team format

Understanding of how capital mix impacts valuation and risk

Deliverables can include investment memos, capital structure reports, or final board presentations. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.