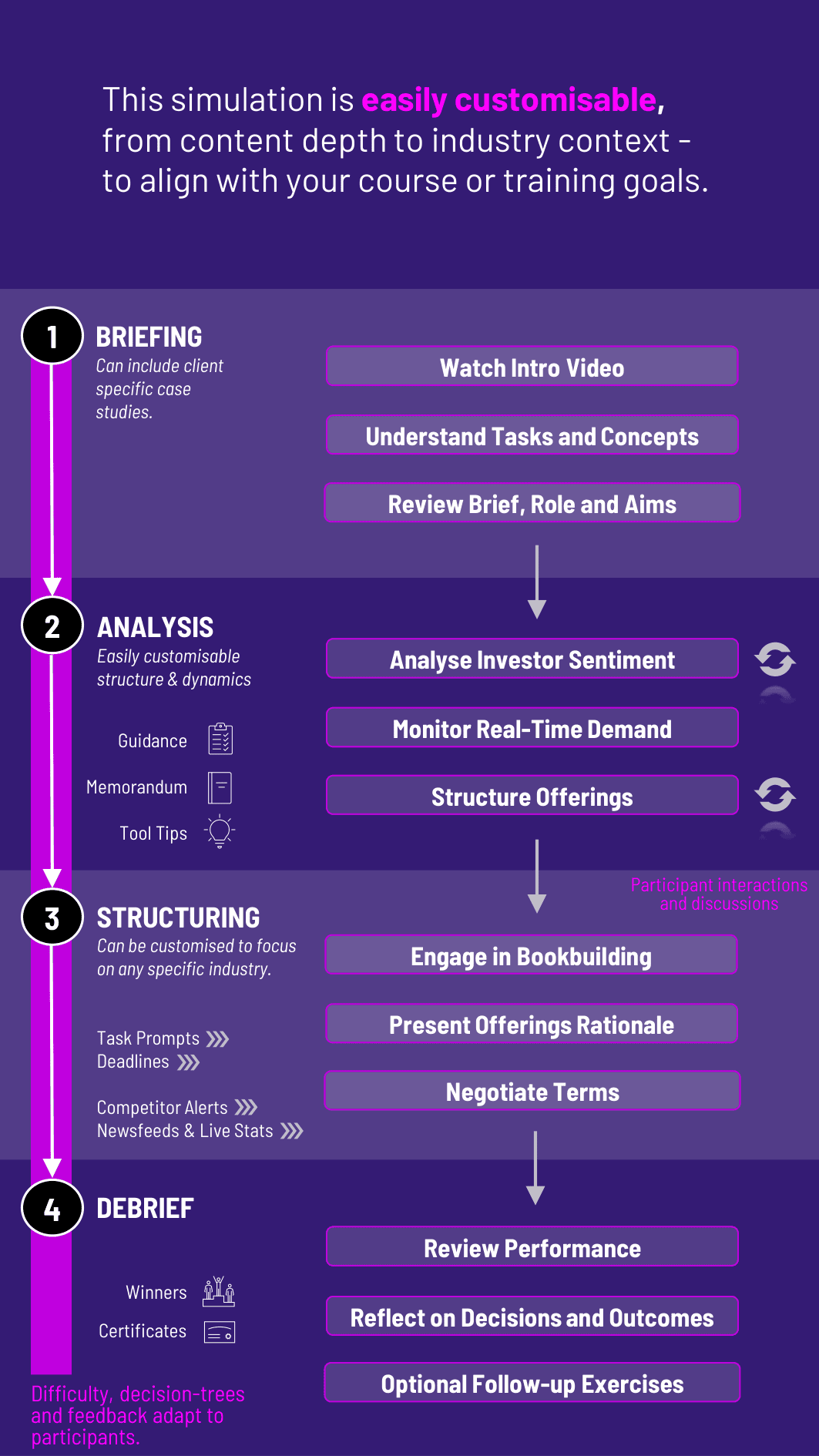

Participants take on the role of capital markets professionals, structuring equity and debt offerings, analyzing investor demand, and executing deals under real-world pressures with our capital markets simulator.

The Capital Markets Training immerses participants in the dynamic environment of global financial markets. Participants take on roles such as investment bankers, traders, sales professionals, or market strategists - making fast-paced decisions that mirror the pressures and complexity of real capital market activity. They’ll issue securities, analyze investor behavior, respond to market movements, and manage deal flow across equity, debt, and hybrid instruments.

Built to replicate the structure and volatility of real capital markets, this capital markets training challenges participants to interpret economic signals, structure capital raises, price deals, and react to investor sentiment in real time. Whether negotiating IPO terms, managing a bond issuance, or adjusting to central bank announcements, participants gain the real-world mindset and financial acumen essential for careers in capital markets and institutional finance.

This capital markets training is especially powerful because it’s not just about making financial decision - it’s about understanding capital market dynamics holistically. Participants must integrate technical, strategic, and behavioral insights to succeed, all while navigating a fast-paced and evolving scenario. The result is a truly immersive experience that builds skill, confidence, and career relevance.

Who is this capital markets training for? Ideal for participants interested in investment banking, capital markets, corporate finance, or asset management careers.

Do I need prior market knowledge? Some understanding of finance basics is helpful, but the capital markets training includes context and guidance to support learners of all levels.

What asset classes are included? The capital markets training includes equity, debt, and hybrid securities with exposure to pricing and issuance mechanics.

How long does the capital markets training last? Typically 3-5 hours, delivered as a single session or broken into modules for flexibility.

Can teams collaborate? Yes, the capital markets training supports both individual and team formats to mimic real-world finance team structures.

What tools or platforms are required? The capital markets training is entirely web-based and requires only a browser and internet connection.

What decisions do participants make? Participants make real-time decisions on offering structure, timing, pricing, and communication.

Are participants graded or assessed? Instructors can assess performance based on decision outcomes, reasoning, and presentation quality.

Can the capital markets training reflect current market events? Yes. It includes customizable scenarios with real-world context or market trend tie-ins.

What roles does this prepare participants for? The capital markets training prepares learners for investment banking, trading, capital markets advisory, and financial strategy roles.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the capital markets training.

or

Book a 15-minute Zoom demo with one of our experts to explore how the capital markets training can benefit you.