The Capital Markets and Securities Simulation plunges participants into the high-stakes, fast-paced world of global finance, where participants, acting as traders and portfolio managers at competing investment firms, maximize their portfolio value.

Market Mechanics and Liquidity

Asset Valuation

Economic Indicators

Portfolio Management

Risk Management

Trading Psychology

Derivatives

Fixed Income

In the simulation, participants will:

Actively trade a diverse portfolio of equities, bonds, ETFs, and derivatives on a live, simulated platform.

React to a simulated news feed with real-time economic data, earnings reports, and geopolitical events.

Formulate and implement both long-term strategic asset allocation and short-term tactical trading strategies.

Monitor portfolio risk metrics and employ hedging strategies to protect gains and limit losses.

Compete against other teams to generate the highest risk-adjusted returns and absolute portfolio value.

Justify their investment decisions and performance in a final debriefing session, mimicking a fund manager's report to stakeholders.

Analyze the direct impact of macroeconomic news and corporate events on different asset classes.

Construct and manage a multi-asset investment portfolio aligned with a specific risk-return profile.

Execute a variety of trade orders and understand their strategic implications.

Apply core principles of risk management to protect portfolio value.

Evaluate portfolio performance using industry-standard metrics.

Articulate a coherent investment rationale, linking market analysis to specific trading decisions.

Function effectively under pressure in a dynamic, team-based trading environment.

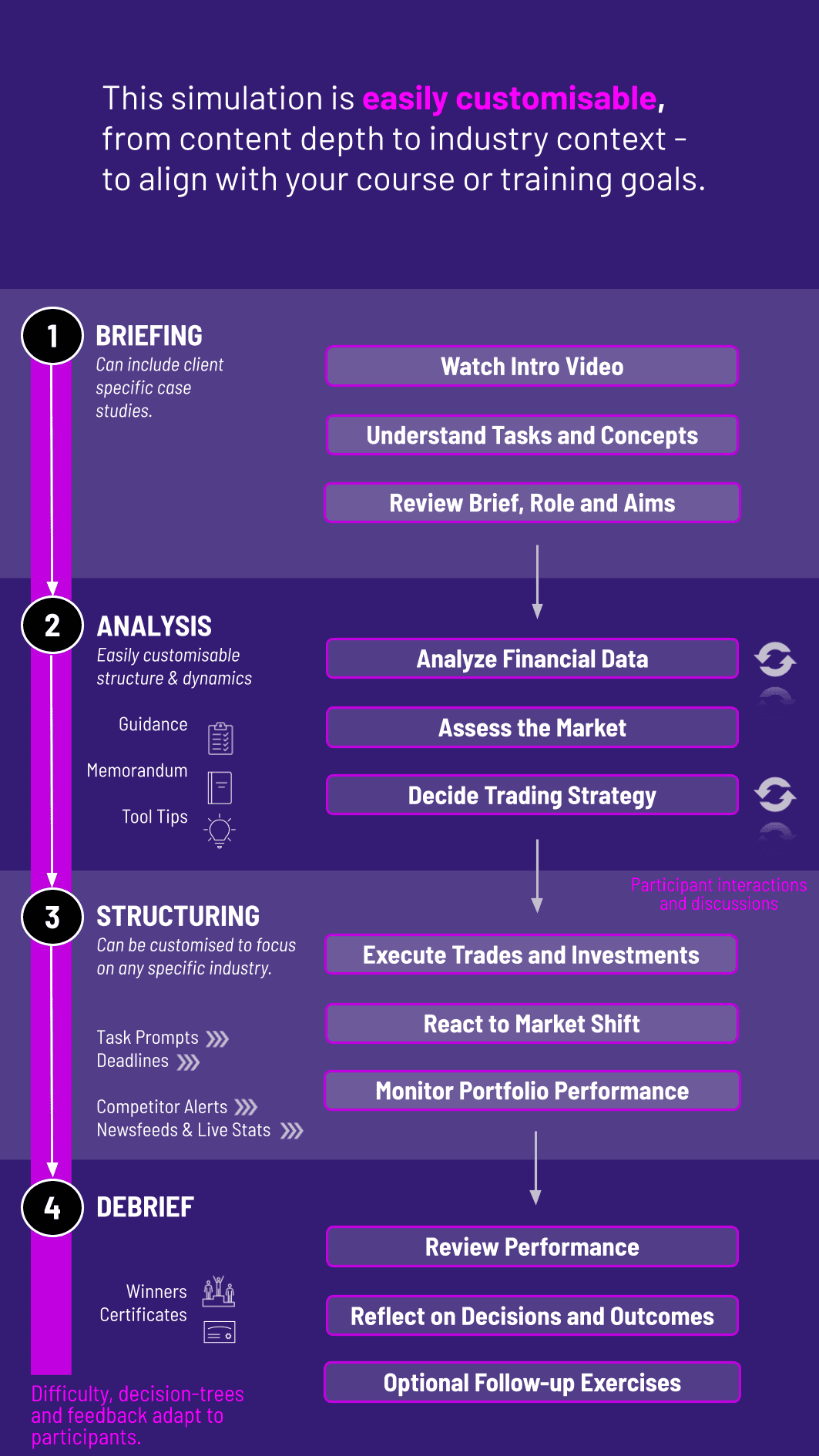

1. Team Formation and Briefing Participants are divided into teams, each managing a virtual investment fund with a defined seed capital.

2. Platform Training A guided session familiarizes participants with the trading platform's interface, tools, and order types.

3. Live Simulation Rounds The core experience consists of multiple accelerated trading sessions, representing weeks or months of market activity. Each round is driven by a new set of economic data and news events.

4. Decision-Making and Execution Teams analyze information, decide on their strategy, and execute trades. The instructor acts as the central bank and can introduce unexpected market shocks.

5. Performance Review Between rounds, teams review their P&L, portfolio composition, and risk metrics to adjust their strategy for the next session.

6. Final Debrief The simulation concludes with a comprehensive review of market outcomes, team rankings, and a facilitated discussion linking the experience to theoretical concepts.

Who is this simulation designed for? It is ideal for MBA students, finance undergraduates, junior analysts, and professionals in corporate roles seeking to understand how financial markets operate. It requires a basic understanding of financial concepts.

What prior knowledge do participants need? A foundational knowledge of finance is helpful. The simulation is designed to reinforce and apply theoretical concepts, making it suitable for students who have completed introductory finance courses.

What assets can be traded in the simulation? The platform typically includes a global universe of equities, government and corporate bonds, exchange-traded funds, and key derivatives like options and futures contracts.

How long does the simulation last? Programs can be tailored, ranging from an intensive one-day workshop to a multi-week module integrated into a semester-long course.

Is this a good team-building activity for finance professionals? Absolutely. It fosters teamwork, communication under pressure, and strategic alignment—all critical skills for high-performing finance teams. It is an excellent corporate training tool.

How is performance evaluated and graded? Performance is primarily evaluated based on risk-adjusted returns, absolute portfolio growth, and adherence to a stated strategy. A final presentation or report is often used to assess analytical depth and reasoning.

Can the simulation be customized for our specific learning goals? Yes. We can tailor the asset classes, market scenarios, economic variables, and group structure to focus on specific areas like equity valuation, fixed income, or global macro strategies.

Portfolio Performance

Assesses the quality of participants' thought process.

Professionalism, structure, persuasiveness, and effective use of visual aids during the presentation.

Ability to think on foot, handle objections, and defend strategic choices under pressure from the "client".

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.