In this hands-on simulation, participants act as turnaround leaders, analysing data, negotiating with stakeholders, and making tough decisions to revive a struggling company under real-world pressure.

Strategic cost reduction

Crisis communication and stakeholder trust

Leadership during business distress

Restructuring operational inefficiencies

Cash flow management under duress

Vendor and creditor negotiations

Employee morale and change management

Short-term vs long-term trade-offs

Rebuilding strategic focus

Financial performance turnaround indicators

Reviewing internal financials, market positioning, and team performance

Making decisions about layoffs, cost-cuts, investment reallocations, and vendor contracts

Prioritising cash flow while keeping long-term viability in mind

Crafting messaging to employees, board members, and the media

Navigating stakeholder negotiations with banks, suppliers, and teams

Responding to unexpected developments like employee exits or policy changes

By the end of the simulation, participants will be able to:

Assess a company’s turnaround potential using financial and operational indicators

Identify the key drivers of business decline and possible intervention points

Design cost containment strategies without destroying future growth

Communicate tough decisions clearly and credibly

Manage conflicting priorities from stakeholders under pressure

Make fast, data-informed decisions with incomplete information

Navigate leadership challenges during crisis and transformation

Apply restructuring tools to real-world business challenges

Reposition the business with a new, strategic focus

Build resilience and adaptive decision-making skills

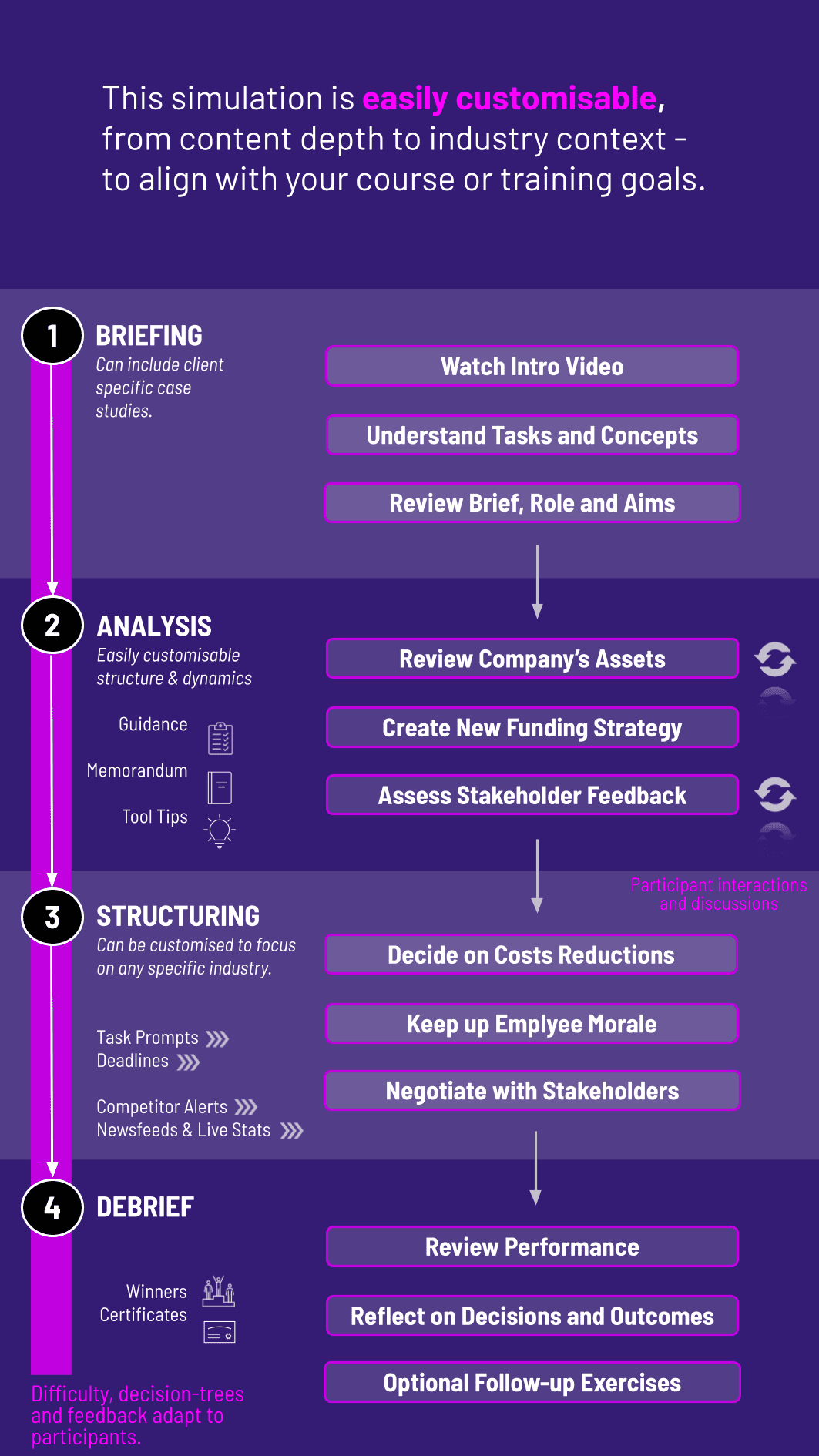

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

This simulation works well across business schools, consulting firms, and corporate L&D. It's modular and can be adapted for solo play or team collaboration. A typical run includes:

1. Receive a Scenario or Brief: Each round starts with a new update - board concerns, financial red flags, market disruptions. Participants are briefed on key issues and objectives.

2. Analyse the Situation: Participants explore performance reports, customer data, staff feedback, and industry insights. They weigh what’s fixable, what’s critical, and where to start.

3. Make Turnaround Decisions: From cost-cutting and cash prioritisation to strategy shifts and morale boosts - participants input decisions in the simulation dashboard with immediate financial and operational impact.

4. Work Solo or in Teams: Depending on setup, participants collaborate or go head-to-head, negotiating with internal stakeholders or aligning cross-functional priorities.

5. Review Results and Reflect: Outcomes are shared post-round: P&L shifts, stakeholder trust scores, team feedback, and more. Reflection is key to build better instincts.

6. Iterate and Learn: New rounds build on the past. Participants see the consequences of earlier decisions, adjust their strategies, and track turnaround trajectory over time.

Do I need a finance background to run this simulation? Not at all. While finance helps, the simulation is designed to be accessible to anyone learning business strategy and leadership.

Can this be used for leadership development programs? Yes. It’s a powerful leadership tool - participants must communicate clearly, make tough calls, and inspire teams during crisis.

Does the simulation work in teams? Yes. It works great in team formats or solo decision-making environments.

Is industry context fixed? No. While the base simulation uses a generic manufacturing or retail company, it can be adjusted for different sectors.

How long does the simulation take? It can be completed in a few hours or spread over multiple sessions, depending on how many rounds you include.

Are results scored? Yes. Participants receive feedback on turnaround success metrics - like EBITDA growth, stakeholder trust, and cash runway.

Can I integrate it into my university syllabus? Absolutely. It’s already used in several MBA, strategy, and crisis management courses globally.

What happens if participants make bad decisions? That’s part of the learning! The simulation shows consequences in real time and encourages reflection and improvement.

Can I facilitate this online? Yes. The simulation is fully digital and runs seamlessly in both in-person and virtual environments.

Is the experience customisable? Yes. You can tweak scenarios, inputs, stakeholder prompts, and even add custom company or country contexts.

Improvement in financial performance across rounds

Strategic alignment of cost-cuts and investments

Communication clarity in crisis contexts

Ethical decision-making and stakeholder sensitivity

Learning agility and responsiveness to feedback

Peer and self-assessments to capture collaboration and iteration

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.