The Budget Analyst Simulation plunges participants into the high-stakes world of public finance. Experience first-hand the challenges and trade-offs involved in crafting a municipal budget that balances fiscal responsibility with constituent needs.

Public Sector Budgeting Cycle

Incremental vs. Zero-Based Budgeting

Fiscal Constraints and Budget Gaps

Cost-Benefit Analysis

Stakeholder Management

Operational vs. Capital Expenditures

Revenue Forecasting

Performance-Based Budgeting

In the simulation, participants will:

Analyze detailed departmental budget requests and historical spending data.

Conduct variance analysis to identify trends and anomalies.

Comb through interviews with department heads to justify their requests.

Evaluate different revenue enhancement and cost-cutting scenarios.

Build a balanced budget proposal using a dynamic financial model.

Present and defend their budget recommendations to a mock City Council, addressing their questions and concerns.

Re-calibrate their proposal based on feedback and new economic data.

Interpret the key components of a public sector budget and financial statements.

Apply both incremental and zero-based budgeting principles to real-world scenarios.

Develop a strategic, balanced budget under strict fiscal constraints.

Evaluate the trade-offs between funding different public services and programs.

Construct a compelling narrative to justify budgetary decisions to stakeholders.

Utilize quantitative and qualitative data to support funding recommendations.

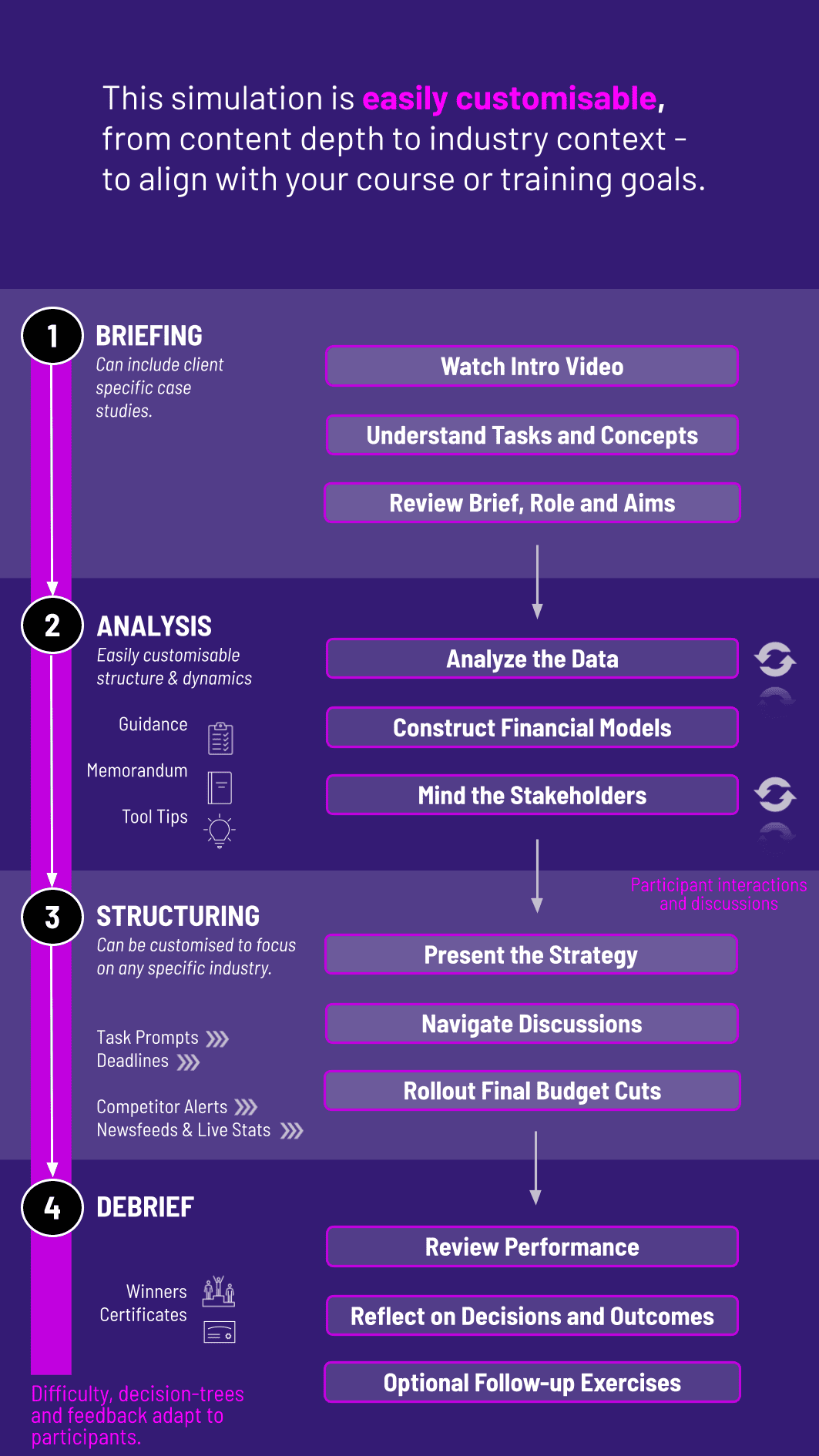

1. Introduction and Data Review Participants receive the "Mayor's Budget Directive" and dive into the city's financials and department requests.

2. Analysis and Scenarios Using the simulation's dashboard, participants analyze data, run different scenarios (2% across-the-board cuts vs. targeted strategic cuts), and see the impact on the budget gap and key performance indicators.

3. Stakeholder Negotiation Participants receive input and pushback from various stakeholders, forcing them to prioritize and refine their strategy.

4. Proposal Submission Each participant or team submits their final balanced budget proposal and a written justification memo.

5. Council Presentation and Debrief In a culminating phase, participants present their budget highlights and are questioned by the mock council. A detailed debrief compares their choices against benchmarks and best practices.

Who is the target audience for this simulation? It is ideal for university students in public administration, business, and economics, as well as early-career professionals in government, non-profit management, and corporate roles involving budget planning.

What are the technical requirements to participate? Participants only need a standard web browser and an internet connection. Our platform is cloud-based and requires no software installation.

How long does the simulation typically take to complete? The core simulation can be completed in 4-6 hours. Instructors can extend the timeline with additional rounds or supplemental assignments to fit a semester schedule.

Is this simulation focused on the U.S. budgeting system? While the core principles of budgeting are universal, the simulation uses a U.S. municipal government context (property taxes, city council structure). The concepts are easily translatable to other countries' public sectors and the simulation can be adapted to suit your specific needs.

Do participants work individually or in teams? The simulation is highly flexible and supports both individual and team-based participation, fostering either independent learning or collaborative decision-making.

How is the performance of participants assessed? Performance is measured through a combination of the quantitative outcome (a balanced budget) and the qualitative rationale provided in their final proposal and presentation. A detailed assessment rubric is provided to instructors.

Can this simulation be customized for our specific program or organization? Yes, we offer customization options, including changing city department names, adjusting revenue structures, or incorporating specific local fiscal challenges. Please contact us for a quote.

Budget Accuracy

Gap Closure

Scenario Analysis

Strategic Thinking

Analytical Rigor

Communication and Persuasion

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.