Our Break-Even Analysis Simulation transforms a core financial concept into a dynamic, hands-on learning experience and moves beyond static formulas and spreadsheets to manage a virtual company.

Break-Even Point

Fixed Costs

Variable Costs

Contribution Margin

Cost-Volume-Profit Analysis

Operating Leverage

Pricing Strategies

Sensitivity Analysis

In the simulation, participants will:

Assume the role of a Product Manager or Startup Founder.

Set the initial sales price for a new product.

Analyze and make decisions on fixed cost investments.

Manage variable costs through supplier negotiations and process efficiency.

Run the simulation over multiple decision rounds.

Analyze dynamic financial dashboards showing revenue, costs, profit, and the break-even point.

Adjust their strategy based on performance reports and changing market conditions.

Compete with other teams to achieve the highest cumulative profit.

Calculate the break-even point using both formula-based and graphical methods.

Differentiate clearly between fixed and variable costs in a real-world business context.

Analyze the impact of pricing decisions on the contribution margin and the break-even volume.

Evaluate the trade-offs between high fixed-cost and high variable-cost business models.

Develop a strategic plan to lower the break-even point and accelerate the path to profitability.

Interpret financial dashboards to make data-driven operational and strategic decisions.

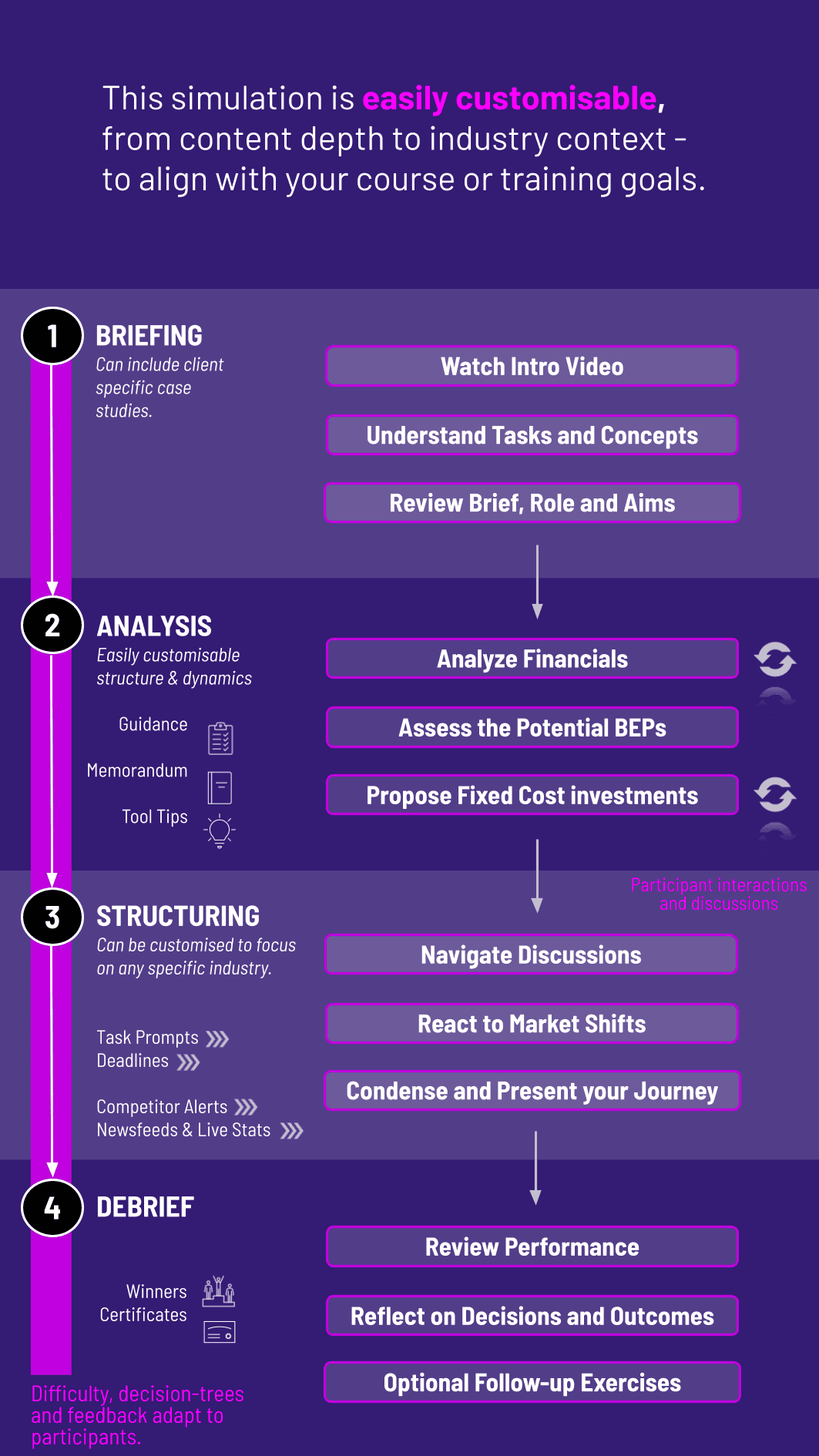

1. Setup Participants are introduced to their virtual company, its product, and the initial market data.

2. Decision Rounds Each round represents a business period. Participants input their key decisions on price, fixed costs, and variable costs.

3. Simulation Engine The algorithm processes these decisions against a realistic market model, calculating sales volume, revenue, and costs.

4. Results and Feedback Participants receive a detailed financial dashboard and report showing their P&L, cash flow, current break-even point, and market share.

5. Analysis Strategy Adjustment Based on the results, participants analyze their performance, identify what drove their success or shortfall, and adjust their strategy for the next round.

6. Debrief The experience concludes with an instructor-led debrief that consolidates the key learnings and connects the simulation outcomes to theoretical concepts.

Why is a break-even analysis simulation better than learning from a textbook? Textbooks teach the formula; our simulation teaches the feel. You experience the direct, cause-and-effect relationship of your decisions on profitability, making the learning stick through experiential engagement.

What business backgrounds is this simulation suitable for? It is ideal for a wide range of participants, including MBA students, entrepreneurship program attendees, non-finance managers, and early-career analysts in finance, marketing, and operations.

Do I need advanced Excel or finance skills to participate? No. The simulation is designed to be intuitive. A basic understanding of business concepts is helpful, but the platform is user-friendly and guides you through the decision-making process.

How long does a typical simulation session last? A complete simulation experience, including introduction, decision rounds, and debrief, can be run in as little as 2-3 hours. It can also be extended over a longer period for deeper analysis.

Can this simulation be used for corporate training? Absolutely. It is highly effective for training managers in business acumen, financial literacy, and strategic decision-making, helping them understand how their departmental decisions impact the company's bottom line.

Is this a team-based or individual activity? The simulation is highly flexible. It can be run as an individual challenge or as a competitive team-based exercise, fostering collaboration and strategic debate.

How is the simulation delivered and accessed? The simulation is 100% cloud-based. Participants can access it from any standard web browser on a computer or tablet, requiring no software installation.

Simulation Financial Performance

Strategic Decision Memo

Collaboration, division of work, integration of roles, and final coherence

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.