In this Bootstrapping vs VC Funding Simulation, participants act as entrepreneurs deciding between self-funding and venture capital - balancing control, growth, equity dilution, and risk while navigating investor negotiations and market pressures.

Bootstrapping strategies and growth trade-offs

Venture capital funding dynamics and negotiations

Equity dilution and ownership structures

Valuation challenges for early-stage startups

Cash flow and resource constraints

Strategic control vs investor influence

Scaling pace and market timing

Team culture and founder motivation

Risk management under funding pressure

Exit strategy implications of funding choice

Evaluate bootstrapping strategies vs VC proposals

Negotiate valuation, equity, and term sheets with investors

Balance cash flow with scaling opportunities

Manage cultural and operational impacts of funding choices

Respond to external shocks like competition or market downturns

Present funding strategies to boards, mentors, or investors

By the end of the simulation, participants will be able to:

Compare trade-offs between bootstrapping and VC funding

Assess valuation, dilution, and equity structures

Manage cash flow under funding constraints

Understand investor expectations and negotiation tactics

Balance founder control with growth ambitions

Recognize cultural impacts of funding decisions

Respond strategically to market and funding shocks

Communicate funding strategies effectively to stakeholders

Develop long-term perspectives on financing and exit routes

Build confidence in navigating real-world entrepreneurial finance choices

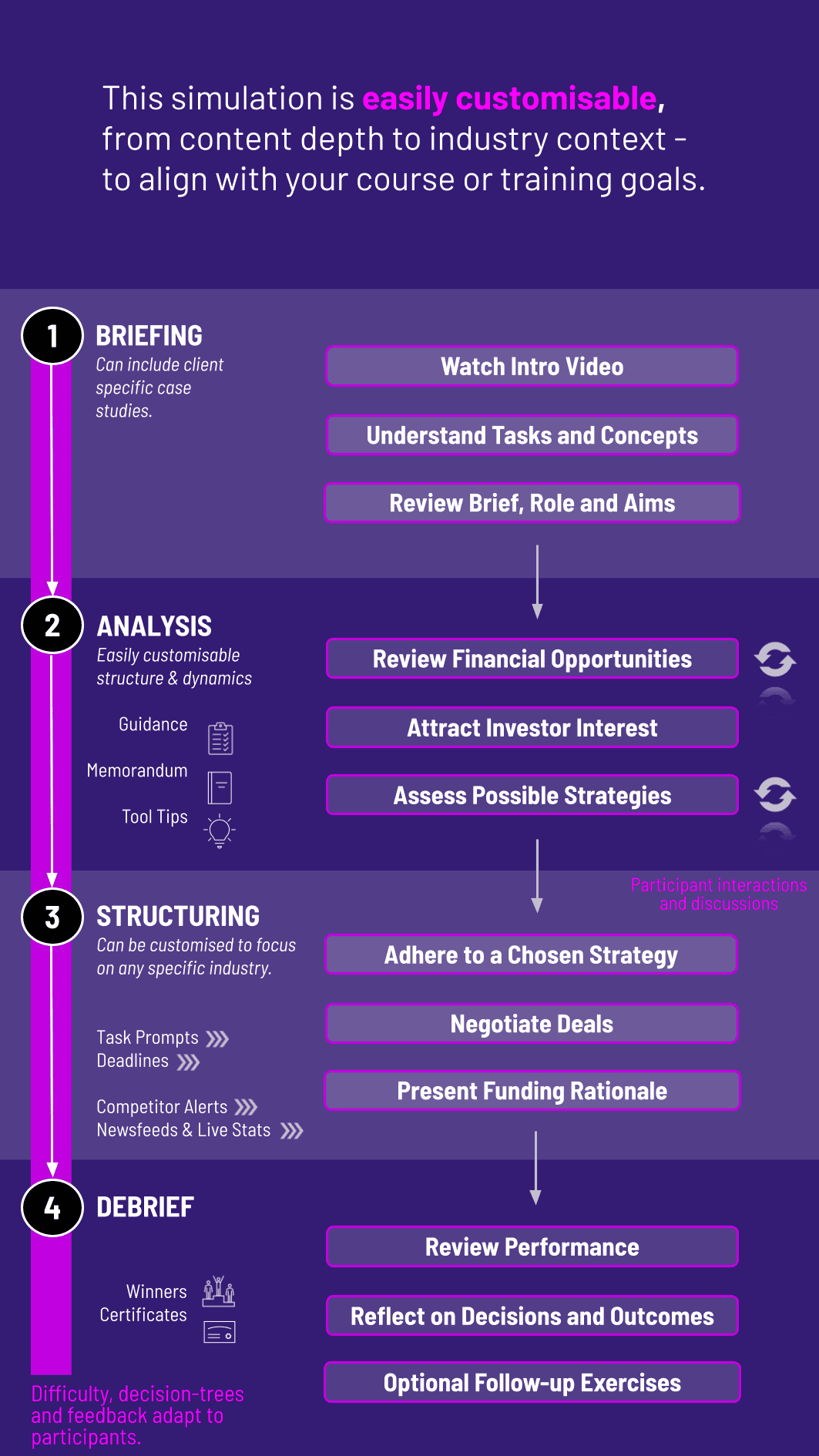

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

This simulation can run individually or in teams, across classrooms or entrepreneurship workshops. Each cycle mirrors funding decision-making.

1. Receive a Scenario or Brief: Participants are introduced to a startup with growth challenges and funding needs.

2. Analyse the Situation: They review financials, growth opportunities, and investor interest.

3. Make Strategic Decisions: Participants choose bootstrapping strategies or negotiate VC deals under time pressure.

4. Collaborate Across Roles: Teams role-play as founders, investors, or advisors debating strategies.

5. Communicate Outcomes: Participants present funding rationales through pitches, memos, or board updates.

6. Review and Reflect: Feedback highlights growth outcomes, equity impact, and cultural consequences. Participants adapt strategies across rounds.

Do participants need finance experience? No. The simulation introduces valuation and funding basics in an accessible way.

Does it cover term sheet negotiations? Yes. Participants negotiate terms, equity stakes, and investor control.

Is this suitable for accelerators and incubators? Absolutely. It’s highly relevant for founders and startup mentors.

Can it be customized by industry? Yes. Scenarios can reflect tech, consumer, or service startups.

Is it focused only on VC? No. It compares VC with bootstrapping, including hybrid strategies.

How long does it run? It can be a 3-hour workshop or a multi-day program.

Is it team-based? Yes. Teams can act as founders and investors for richer dynamics.

Can it be delivered online? Yes. The simulation supports online, hybrid, and in-person formats.

Does it cover exit strategies? Yes. IPOs, acquisitions, and founder buyouts are included.

How is success measured? By growth outcomes, equity structures, and stakeholder satisfaction.

Quality of funding decisions and strategies

Accuracy in valuation and equity calculations

Effectiveness in negotiations with investors

Responsiveness to shocks and market pressures

Clarity in communicating rationale to stakeholders

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.