In this simulation participants step into the role of a bank’s senior risk and compliance team navigating the requirements of Basel III (and its evolving framework) and apply them in a competitive, decision-based scenario.

Common Equity Tier 1 capital, Tier 1 capital, Total capital ratios and how they relate to risk-weighted assets

Leverage ratio and its role as a back-stop to risk-weighted measures

Liquidity standards: Liquidity Coverage Ratio and Net Stable Funding Ratio

Macro-prudential dimension of regulation and capital buffers

Risk-weighted asset calculation

Stress testing, business model resilience, regulatory implementation timeline

Analyse the bank’s business model, risk profile and regulatory baseline

Calculate and simulate compliance with Basel ratios under various scenarios

Make strategic decisions: raise capital, shrink or re-allocate RWAs, adjust business lines, alter funding mix, hedge or reduce exposures

Respond to regulatory updates or surprise events

Communicate decisions internally under time pressure

Compare performance across rounds/teams: measure how well banks stay compliant while maintaining profitability, competitiveness and growth

Reflect and debrief: review outcomes, discuss which strategies succeeded or failed, and link decisions to regulatory mechanics

Understand the nature of uncertainty and how executives must make decisions without full information

Apply scenario-planning and adaptive thinking in strategic leadership contexts

Make resource allocation decisions that balance growth, risk and resilience

Detect early signals of disruption or competitive shifts and respond appropriately

Communicate strategic choices and rationale clearly to diverse stakeholders under pressure

Learn how to pivot strategy dynamically in response to new data or environmental changes

Build confidence in leading through ambiguity, not just in stable environments

Enhance collaboration across functions (strategy, operations, finance, communications) under uncertain conditions

Use feedback loops (metrics, outcomes) to refine decisions and close the “learning loop”

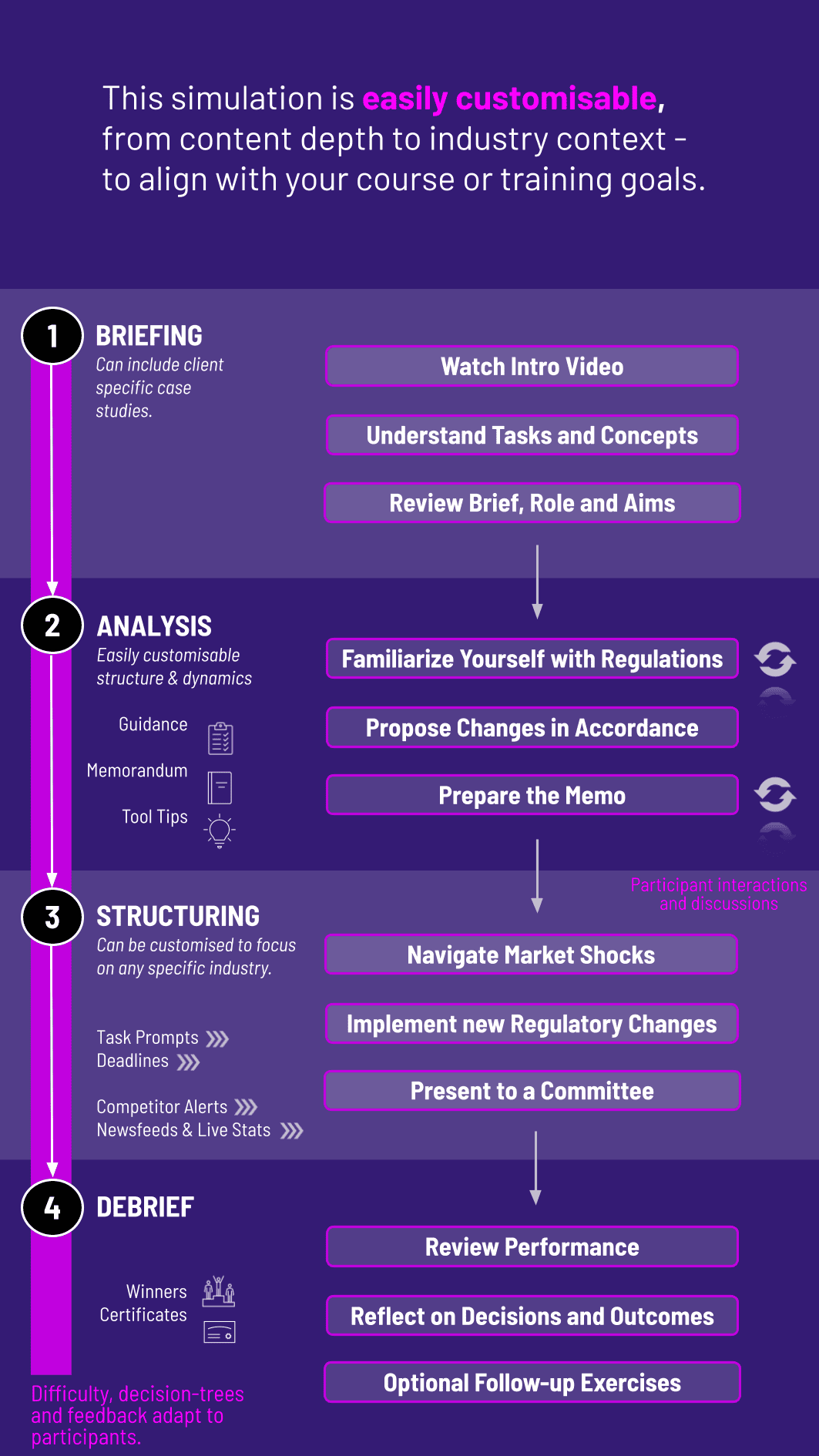

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

1. Make Financial Decisions Teams choose strategic moves (capital raise, business reduction, funding shift, hedging) under defined constraints and timing.

2. Respond to Shock Events The system introduces regulatory change or stress forcing teams to react.

3. Update your Strategy Accordingly The simulation calculates updated ratios, profitability, risk exposures and gives performance summaries.

4. Prepare and Present a Memo Teams prepare a board/ investor memo or regulatory submission based on their decisions and outcomes.

5. Review Performance Participants review performance, identify learning points, adjust their strategy, and begin the next round with updated context.

Compliance to the regulatory metrics

Ability to effectively strategise under pressure

Flexibility in face of shock events

Clarity and quality of investor/board/regulator memos or presentations.

Depth and logic of scenario analysis and sensitivity ranges

Rating by peers and self-reflection on approach and decisions (optional)

Assessment can combine numeric scoring, qualitative feedback, peer review, and instructor debriefing. This flexibility allows the simulation to serve both graded university courses and corporate finance training environments.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.