Navigate complex financial landscapes, identify risks, and deliver assurance with confidence. The Audit Simulation transforms theoretical knowledge into practical, high-stakes professional experience.

Audit Planning & Risk Assessment

Internal Control Evaluation

Substantive Testing Procedures

Fraud Risk Considerations

Accounting Estimates and Fair Value

Related Party Transactions

Subsequent Events and Going Concern

Audit Sampling and Data Analytics

Professional Skepticism and Judgment

Forming the Audit Opinion

Ethics and Independence

In the simulation, participants will:

Analyze a complex case company with operations across multiple jurisdictions.

Develop a comprehensive audit strategy and detailed audit plan.

Evaluate the design and implementation of key internal controls.

Perform analytical procedures to identify unusual transactions and potential misstatements.

Design and execute substantive audit procedures for high-risk areas like revenue recognition, inventory, and liabilities.

Utilize data analytics tools to test 100% of a population for specific attributes.

Document audit work in working papers that meet professional standards.

Navigate ethical dilemmas and independence issues as they arise.

Draft sections of the audit report and present findings to a mock committee.

Integrate the end-to-end process of a financial statement audit, from client acceptance to report issuance.

Apply International Standards on Auditing in a practical, case-based context.

Demonstrate professional skepticism by critically assessing audit evidence and management representations.

Identify and assess risks of material misstatement, both at the financial statement and assertion level.

Design and select appropriate audit procedures responsive to the assessed risks.

Communicate complex audit issues clearly and professionally, both in writing and orally.

Collaborate effectively within an audit team to manage tasks and meet deadlines.

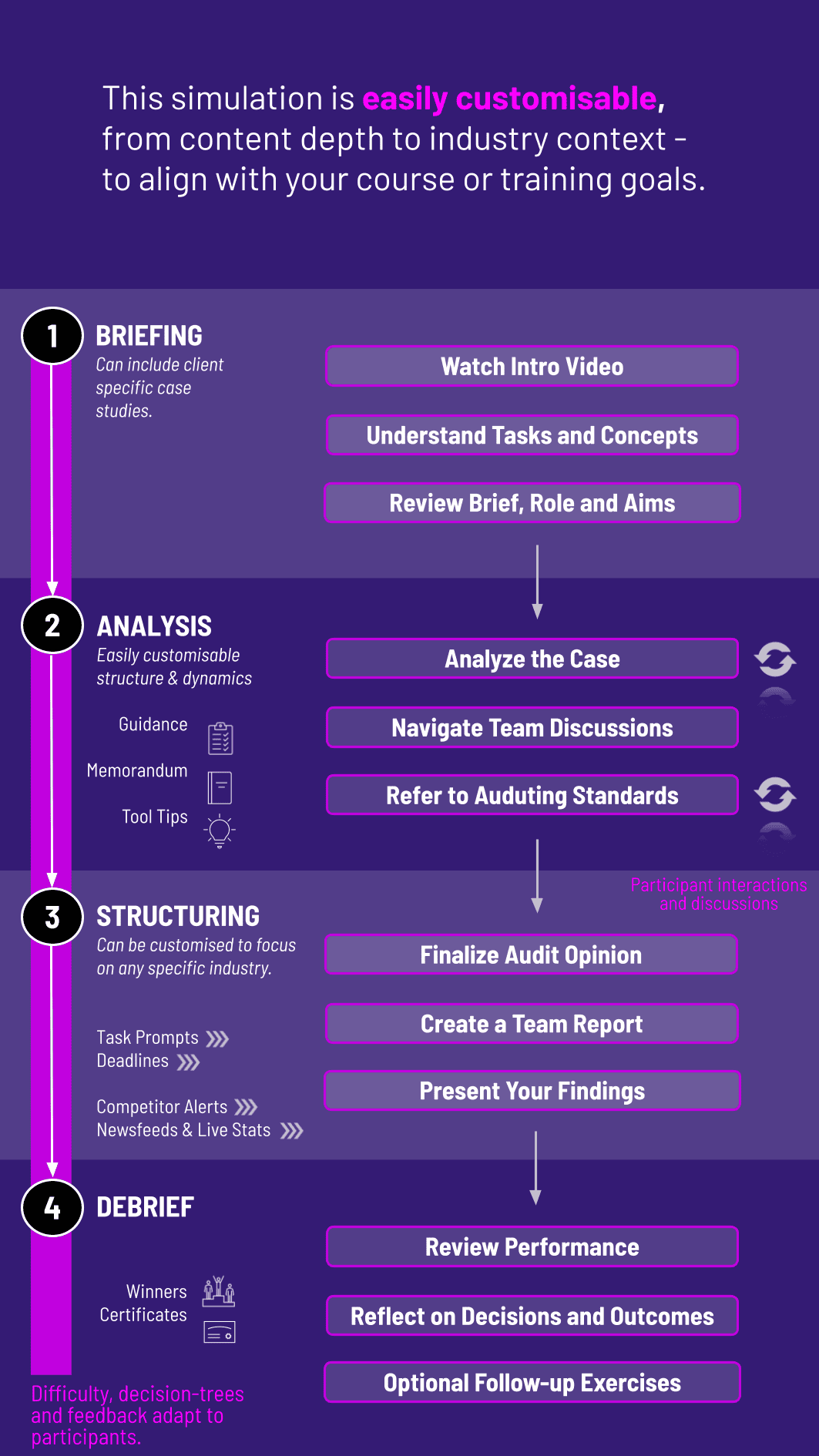

1. Case Introduction Teams receive the client's financial statements, board minutes, and background information.

2. Phased Release of Information The simulation unfolds in phases with new data, client inquiries, and unexpected events released at each stage.

3. Interactive Decision Points Teams make critical decisions at each phase, such as setting materiality, assessing control risk, and determining the nature and extent of testing.

4. Real-Time Feedback The platform provides feedback on submitted work and decisions, showing the potential consequences of their choices on audit quality and efficiency.

5. Final Deliverable Teams consolidate their findings, resolve outstanding issues, and prepare a final presentation for the mock committee, defending their audit opinion and key judgments.

What are the technical requirements to run the simulation? The simulation is browser-based and requires only a stable internet connection. No specialized software is needed.

**How long does the simulation take to complete? The core simulation can be run intensively over 2-3 hours for business training or extended over a 4-6 week academic module, requiring 3-5 hours of team work per week.

Is this simulation aligned with professional standards? Absolutely. The simulation is meticulously designed around International Standards on Auditing and global best practices.

How does this audit simulation prepare students for the CPA/CA/ACCA exams? This simulation provides the practical application for the concepts tested in professional exams. By experiencing the "why" behind the standards, participants gain a deeper, more memorable understanding of audit principles, which significantly enhances their exam preparedness and long-term retention.

What makes this different from a traditional case study in auditing? Unlike a static case study, our simulation is dynamic and reactive. Your decisions change the course of the engagement. You receive new information, face time pressures, and must adapt your plan, creating a much more realistic and engaging learning experience that builds true competency.

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.