Step into the high-stakes world of corporate auditing. Move beyond textbook exercises and develop the critical judgment, risk assessment, and client management skills essential for a successful career in audit.

Client Acceptance and Continuance

Audit Risk Model

Materiality and Scoping

Fraud Risk Assessment

Internal Controls Evaluation

Substantive Procedures

Professional Skepticism and Judgment

Audit Documentation

Client Management and Communication

Engagement Economics and Budgeting

In the simulation, participants will:

Analyze a potential client's financials and industry to make an accept/decline decision.

Develop a comprehensive audit plan based on a risk assessment.

Allocate a limited budget and staff hours across different audit areas.

Review staff-level workpapers and provide constructive feedback.

Evaluate the results of audit tests and make conclusions on key accounts.

Communicate with the simulated client CEO/CFO to obtain evidence and address their concerns.

Determine whether identified misstatements are material and require adjustment.

Choose the appropriate audit opinion (Unqualified, Qualified, Adverse) based on findings.

Apply the audit risk model to plan an effective and efficient audit engagement.

Demonstrate professional skepticism when evaluating audit evidence and client representations.

Formulate evidence-based conclusions on complex accounting issues, such as revenue recognition and fair value measurements.

Develop crucial client management and communication skills to navigate challenging discussions.

Evaluate the materiality of audit findings and their impact on the financial statements as a whole.

Manage an audit team and budget, making strategic trade-offs between audit scope, cost, and risk.

Defend the choice of audit opinion in a simulated partner review meeting.

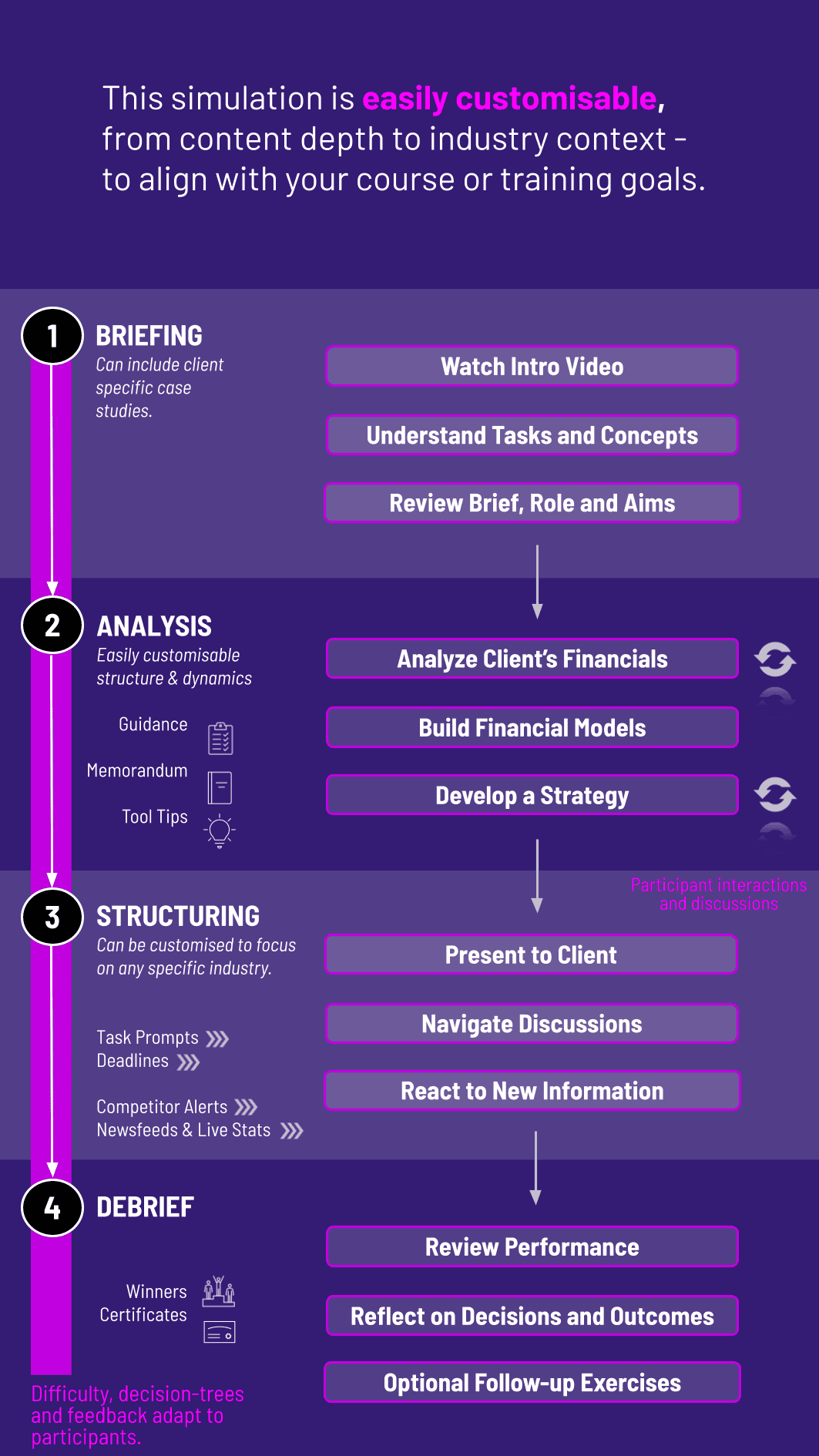

1. Introduction Participants receive a background briefing on the client company, its industry, and the audit team.

2. Planning and Risk Assessment Participants analyze the client, perform preliminary analytics, set materiality, and develop an audit strategy and budget.

3. Execution and Internal Controls Participants review the results of control testing, make decisions on the extent of substantive procedures, and address initial audit findings.

4. Substantive Testing and Evaluation Participants analyze the results of detailed testing, identify potential misstatements, and communicate with the client management team to resolve issues.

5. Final Review and Reporting Participants review the overall audit file, assess the aggregate of uncorrected misstatements, and make the final decision on the audit report opinion.

6. Debrief and Scoring A comprehensive debrief report is generated, scoring participants on key performance indicators like Audit Quality, Client Satisfaction, Team Efficiency, and Profitability, providing a holistic view of their performance.

Is this simulation suitable for students with no full-time audit experience? Absolutely. The Audit Manager Simulation is designed not only for advanced accounting students and early-career auditors. It provides a safe environment to apply theoretical knowledge to complex, realistic scenarios, accelerating the learning curve.

What makes this different from traditional case studies? Unlike static case studies, our simulation is dynamic and responsive. Your decisions change the narrative, the client reacts, and the financial data can evolve. This creates a more engaging and realistic experience that truly tests judgment.

Can the simulation be customized for our specific curriculum? Yes, we offer a range of customization options. We can tailor the client company's industry, the specific accounting issues (e.g., focus on inventory or financial instruments), and the difficulty level to match your course objectives.

What is the typical duration of the simulation? The core simulation can be completed in 4-6 hours. We provide flexible scheduling options to fit within a typical university module or corporate training program, either as a concentrated exercise or spread over several weeks.

Do participants work individually or in teams? The platform supports both modes. We often recommend team-based participation as it fosters discussion, debate, and collaboration, closely mimicking the real-world audit environment.

What technical requirements are needed to run the simulation? Our simulation is web-based and requires only an internet connection and a modern web browser (Chrome, Firefox, Safari). There is no software to install, making it accessible from anywhere.

How does the simulation incorporate professional auditing standards? The simulation is meticulously designed around the core principles of ISA (International Standards on Auditing) and can be aligned with US GAAS. The scenarios force participants to consider the requirements for evidence, documentation, and reporting as they make their decisions.

Audit Quality, technical correctness of the audit.

Participant's ability to maintain a professional yet skeptical relationship with the client.

Team and Budget Efficiency, participant's skill in managing the engagement's resources. This includes staying within budget, allocating staff hours effectively, and focusing testing on the highest-risk areas.

Profitability reflects the business aspect of audit management. Participants are scored on their ability to complete the engagement profitably, balancing the investment of time and resources with the fixed audit fee.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.