Our Asset Securitization Simulation plunges participants into the heart of structured finance, providing a hands-on, dynamic environment to structure, price, and issue Asset-Backed Securities.

Asset-Backed Securities

Special Purpose Vehicle

Tranching

Credit Enhancement

Waterfall Structure

Prepayment Risk

Default Risk and Loss Analysis

Credit Ratings

Weighted Average Life

Debt Yield and Spread

In the simulation, participants will:

Evaluate and purchase a pool of underlying assets based on credit quality and yield.

Design the capital stack by creating multiple tranches to cater to different investor risk appetites.

Build and run cash flow models to project payments to each tranche under various economic scenarios.

Set coupon rates for each tranche to make them attractive to investors while ensuring the overall deal is profitable.

Market your securities to a simulated investor community, adjusting your strategy based on their feedback and demand.

Monitor the performance of your issued securities over time, managing risks like prepayments and defaults.

Compete against other teams to achieve the highest profitability and become the top structuring desk in the simulation.

Deconstruct the complete lifecycle of an asset-backed security, from origination to maturity.

Analyze the risk and return characteristics of a pool of underlying assets.

Design a multi-tranche capital structure that efficiently distributes risk and return.

Apply credit enhancement techniques to achieve desired credit ratings for various tranches.

Model the cash flow waterfall and calculate payments for different tranches under stress scenarios.

Evaluate the key risks in securitization, including prepayment, default, and interest rate risk.

Price tranches by balancing investor yield demands with the cost of funding for the issuer.

Synthesize the interplay between economic variables, investor psychology, and structured product design.

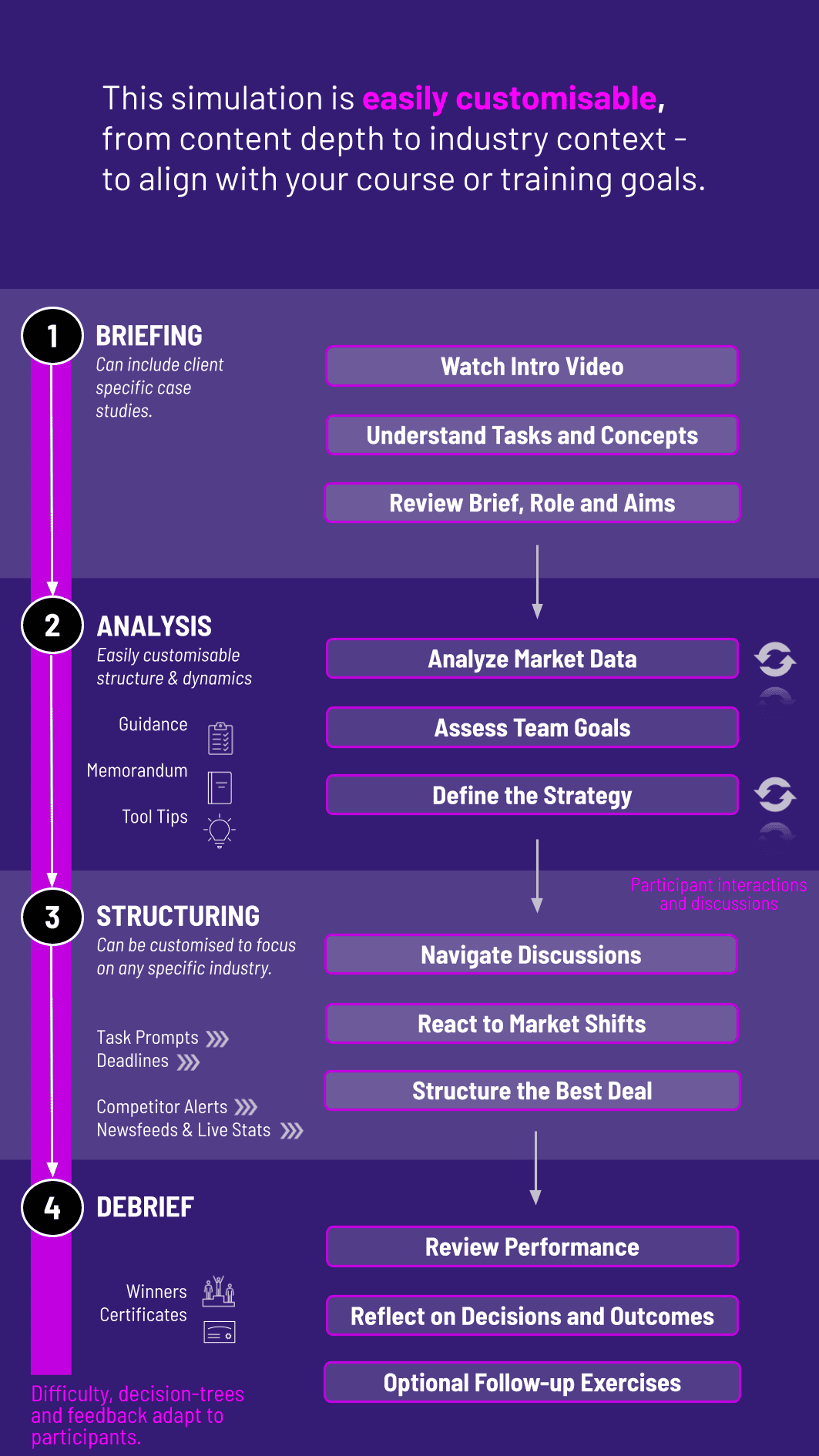

1. Form Teams and Set Strategy Participants are divided into structuring teams. Each team analyzes the initial market data and defines their strategy.

2. Asset Pool Assembly In each round, teams use their capital to bid on and acquire portfolios of assets from the primary market.

3. Structuring and Modeling Using the simulation's intuitive interface, teams create their ABS deal. They define the number of tranches, their seniority, and apply credit enhancements. The built-in cash flow model provides feedback on tranche yields, ratings, and WAL.

4. Pricing and Issuance Teams set the coupon rates for their tranches and issue them to the secondary market. A simulated investor community, driven by algorithms with different risk preferences, then bids on the issued securities.

5. Performance and Monitoring Over subsequent rounds, teams monitor the performance of their asset pools and the securities they have issued. They must manage their balance sheet and may choose to issue new deals based on their performance and market opportunities.

Who is this simulation for? The content is tailored for Business School Professors, Corporate Trainers in financial institutions, and MBA or Finance Masters Students seeking advanced, practical training, although the simulation can be adapted to any skill level.

What makes this simulation different from a lecture on securitization? This simulation transforms passive learning into active doing. Instead of just hearing about tranches, you structure and price them. This experiential approach leads to deeper, longer-lasting comprehension.

What prior knowledge do participants need? A basic understanding of corporate finance and fixed income is helpful, but not always required. The simulation includes foundational resources and is designed to be a learning tool in itself.

Is this simulation relevant for investment banking careers? Absolutely. Securitization is a core function within investment banking, specifically in the Structured Finance and Securitized Products groups. This simulation provides direct, relevant experience for such roles.

How long does a typical simulation session last? Sessions can be tailored, but a typical session runs over 2-3 rounds, which can be completed in a half-day workshop or across several class sessions.

Can we simulate different types of assets, like Mortgages or Auto Loans? Yes. The platform is flexible and can be configured with different asset pools, allowing you to run simulations focused on Residential Mortgage-Backed Securities, Auto Loan ABS, or other common asset classes.

How is the performance of participants assessed? Performance is quantitatively measured by the simulation based on key metrics like Profit and Loss, Return on Equity, and Market Share. Instructors can also grade based on the strategic rationale behind team decisions.

Final Profitability

Return on Invested Capital

Market Share of New Issuances

Strategic Decision Memo

Peer Evaluation and Contribution

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.