Students structure, price, and analyze securities backed by real-world cash flows - grappling with risk, return, and creditworthiness - in our Asset-Backed Securities Simulation.

Securitization Process: From asset pool selection to security issuance

Tranching and Credit Enhancement: Senior/subordinate structures, overcollateralization, excess spread, and reserve accounts

Cash Flow Modeling: Amortization, prepayment risk, and default scenarios

ABS Types: Auto loans, credit cards, residential mortgages, student loans

Yield and Pricing: IRR by tranche, credit spreads, time to maturity

Credit Ratings and Risk Transfer: Rating agency criteria and regulatory capital treatment

Investor Considerations: Risk appetite, return targets, and portfolio fit

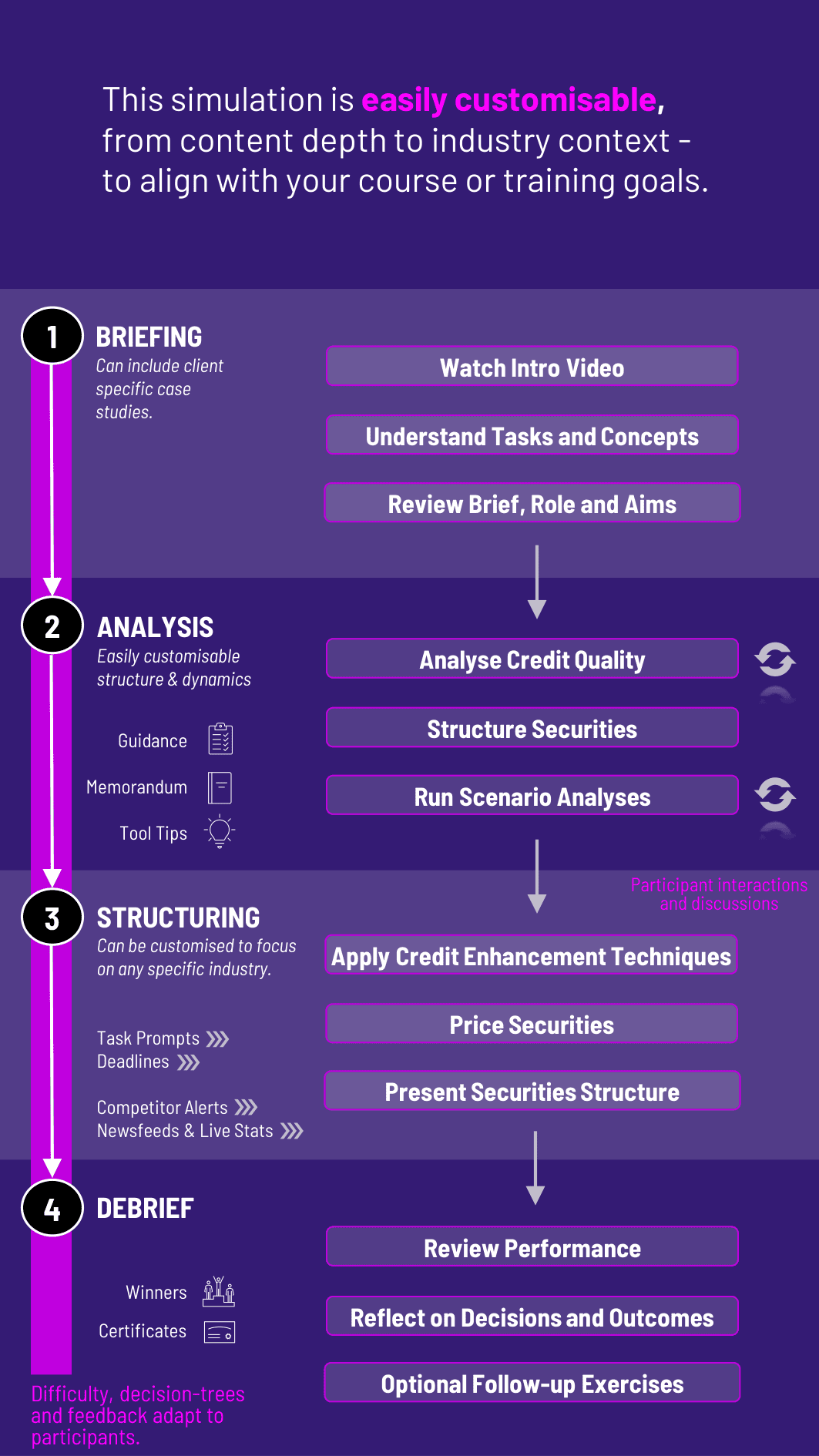

Analyze an asset pool’s credit quality, default history, and cash flow characteristics

Structure the security into tranches with varying levels of risk and return

Apply credit enhancement techniques to improve ratings

Run scenarios for prepayment, delinquency, and macroeconomic stress

Price each tranche based on investor appetite and risk profiles

Prepare and present the structure to internal stakeholders or external investors

The simulation brings structured finance concepts to life, helping students:

Understand how asset-backed securities are created, priced, and sold

Analyze risk and return trade-offs in tranche structuring

Model repayment, default, and prepayment behavior

Appreciate investor needs and regulatory constraints in securitized products

Communicate complex financial structures in clear, persuasive language

Reflect on the role of securitization in expanding credit access—and financial crises

Do students need a background in structured finance? No. Basic knowledge of fixed income and risk-return principles is sufficient. The simulation introduces key ABS concepts through structured onboarding.

What asset types are used in the simulation? The simulation includes auto loans and credit card receivables by default. Optional modules include residential mortgages and student loans.

Can students model cash flows and stress scenarios? Yes. The platform includes built-in modeling tools where students can adjust default rates, prepayment speeds, and interest rates to observe cash flow behavior.

Does the simulation include credit ratings logic? Yes. Students can simulate how credit enhancement techniques affect notional ratings based on simplified agency frameworks.

Is it more suitable for individuals or groups? Both. Group play works well for mirroring real securitization teams, with roles such as structurer, credit analyst, and investor relations.

What is the expected duration of the simulation? Typically 3 - 4 hours for a complete structuring and presentation cycle. It can be extended for deeper analysis or investor negotiation phases.

How is performance evaluated? Performance is based on structural soundness, investor appeal, tranche pricing, credit enhancement adequacy, and communication quality.

Does the simulation include ethical or regulatory components? Yes. Optional debriefs and discussion modules explore the role of securitization in the 2008 crisis, moral hazard, and regulatory reform.

Is coding or spreadsheet use required? No coding is needed. All modeling is done within the simulation interface, using intuitive tools and pre-loaded datasets.

Can instructors customize the asset pool or parameters? Yes. Instructors can upload or select from different asset pools with varied delinquency patterns, interest rates, and maturity profiles.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.