Go beyond theory by building dynamic amortization schedules, analyzing the impact of different loan terms, and making strategic decisions that affect a company's cash flow and financial health.

Loan amortization and amortization schedules

Principal and interest breakdown in payments

Calculation of monthly payments and outstanding loan balance

Loan term versus amortization schedule

Managing intangible asset amortization

Impact of interest rates and loan duration on repayments

Financial decision-making under various loan conditions

Effects of early payments and refinancing options

In the simulation, participants will:

Analyze loan or asset data and inputs (loan amount, interest rate, term)

Calculate amortization schedules and payment breakdowns

Adjust payment timing and amounts to observe effects

Manage varying loan scenarios including fixed and variable rates

Evaluate impacts on cash flow and outstanding balances

Review and interpret amortization charts and reports

Make strategic decisions on loans or asset amortization plans

Prepare reports and presentations explaining amortization outcomes

Understand how loan amortization schedules function and are calculated

Develop practical skills in managing loan repayments over time

Analyze the impact of interest and principal components in payments

Calculate monthly payment amounts using amortization formulas

Differentiate between loan term and amortization schedule implications

Assess how amortization affects financial planning and asset cost allocation

Apply decision-making to optimize loan or asset amortization strategies

Communicate amortization results clearly to stakeholders or clients

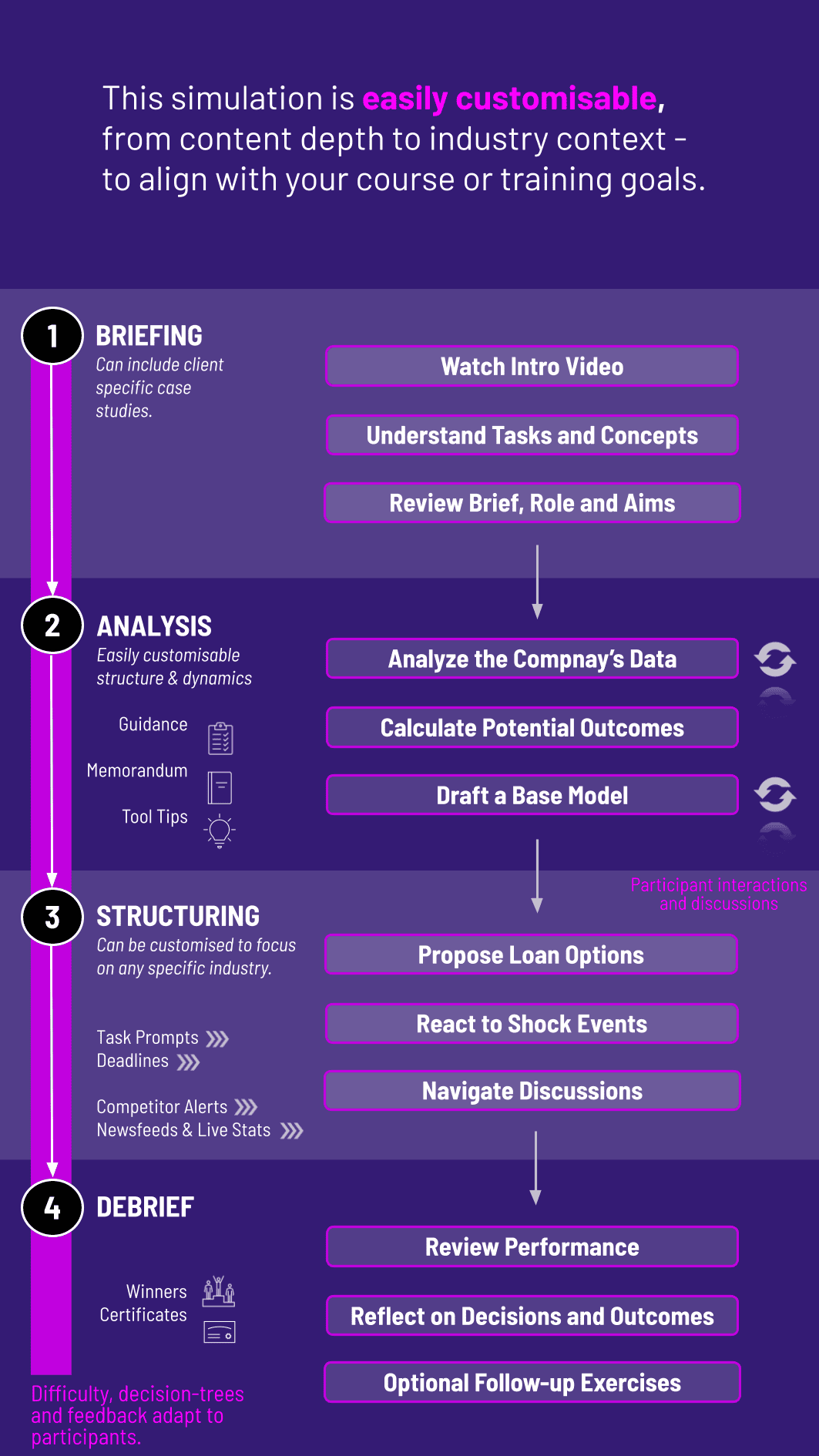

1. Introduction and Case Launch Participants are introduced to a company that requires capital for expansion. They receive the company's financial summary and specific financing needs.

2. Loan Proposal Analysis Participants receive several term sheets from different lenders, each with varying amounts, interest rates (fixed and floating), and terms.

3. Hands-On Modeling Using a provided template, participants build their own amortization schedules. They must correctly use financial formulas to calculate payments, interest, principal, and ending balances for each period.

4. Scenario Testing Once the base model is built, participants are given new challenges: "What if the company makes a $50,000 prepayment in Year 2?" or "What if we switch to monthly payments instead of quarterly?"

5. Decision and Reporting Based on their quantitative analysis, participants must choose the best loan option and prepare a brief summary justifying their decision based on cash flow, total interest cost, and alignment with the company's goals.

6. Debrief An instructor-led session reviews the correct financial models, discusses the strategic implications of the choices made, and solidifies the learning outcomes.

Do I need advanced Excel skills to participate? Basic proficiency in Excel is sufficient. The simulation is designed to build your advanced Excel and financial modeling skills through guided practice.

Is this simulation only relevant for banking careers? Not at all. While crucial for investment banking, this skill is essential for anyone in corporate finance, FP&A, private equity, real estate, and entrepreneurship—any role that involves managing or analyzing corporate debt.

Can the simulation handle complex loan structures like balloon payments or variable rates? The core simulation focuses on building a solid foundation with standard term loans. However, advanced modules or instructor-led extensions can introduce more complex features like variable rates, which teach participants about sensitivity analysis.

How long does the simulation take to complete? The simulation is designed to be completed in 2-4 hours, making it an ideal module for a single finance class or a professional training workshop.

Is this suitable for undergraduate students? Absolutely. The simulation is perfectly tailored for undergraduate students in finance, accounting, and business administration, providing them with a tangible, resume-worthy skill.

How does the simulation incorporate "real-world" decision-making? Participants don't just build a model; they use it to make a strategic recommendation. They must weigh quantitative factors (like NPV of cash flows) with qualitative ones (like cash flow stability), mirroring a real business decision.

What makes this simulation different from an online amortization calculator? Online calculators provide an answer, but they are a black box. This simulation requires participants to build the calculator themselves, ensuring a deep, conceptual understanding of the mechanics and the ability to customize it for any unique scenario.

Correct use of formulas, accurate calculation of principal/interest components, and a correctly declining ending balance.

Accurate modeling of the "what-if" scenarios, such as prepayments or changes in terms.

A clear, concise, and quantitatively-supported rationale for their chosen loan option.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.