Participants build and manage portfolios across private equity, hedge funds, real assets, and more - navigating illiquidity, risk, and return—in our Alternative Investments Training.

Asset Class Fundamentals: Private equity, hedge funds, venture capital, real assets, and commodities

Liquidity and Time Horizons: Capital calls, lock-ups, and exit timelines

Due Diligence and Manager Selection: Track records, alignment of interest, and strategy differentiation

Risk and Return Profiles: Understanding downside protection, volatility, and alpha generation

Portfolio Construction: Strategic vs tactical allocation, correlation, and diversification

Fee Structures: 2/20 models, hurdle rates, and carried interest

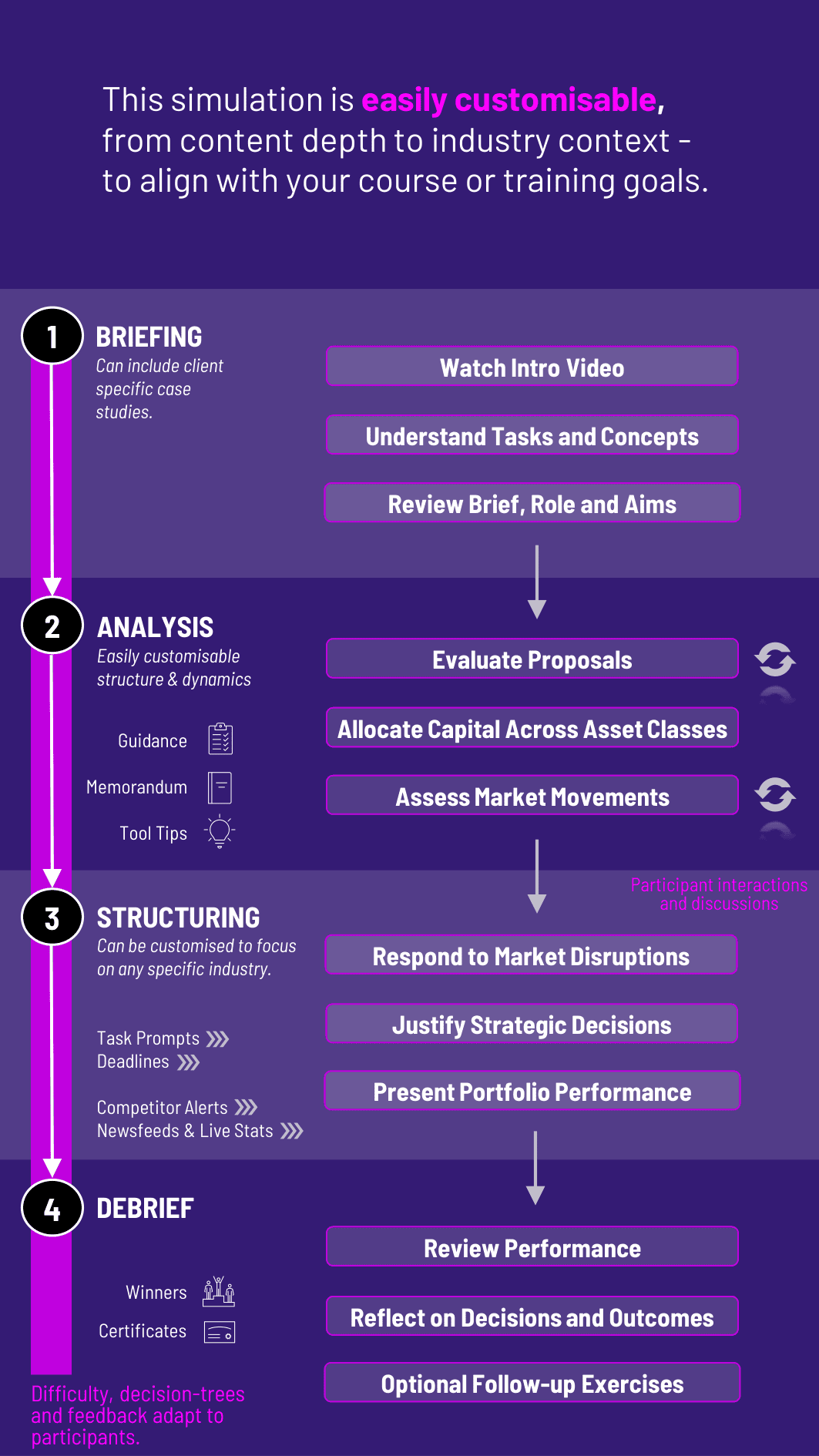

Evaluate proposals from alternative investment managers

Allocate capital across multiple asset classes under risk and liquidity constraints

Respond to simulated macroeconomic scenarios and market disruptions

Reassess portfolios based on fund performance and capital call timing

Justify strategic decisions to a simulated investment board or peer review panel

Reflect on trade-offs between diversification, illiquidity, and long-term returns

Participants gain a nuanced understanding of how institutional investors approach alternative investments. They learn to:

Distinguish between alternative asset classes and assess their role in a broader portfolio

Evaluate fund manager pitches and identify red flags

Allocate capital with an understanding of liquidity risks and drawdown schedules

Defend investment decisions in terms of strategic fit and expected risk-adjusted return

Track performance over time and manage rebalancing decisions

Think long-term under uncertainty and real-world operational constraints

Do participants need to know private equity or hedge fund mechanics? No. The training includes onboarding content that introduces each asset class, their risks, and typical fund structures.

Can instructors customize asset class focus? Yes. The training can be tailored to emphasize specific alternatives (e.g., private equity, real estate, or commodities) based on course goals.

What’s the duration of the training? Typically 2–3 hours for a full allocation cycle, with optional extensions for follow-up performance reviews or strategy presentations.

Is it more suitable for individual or team play? Both formats are supported. Team-based play mirrors real-world investment committees and encourages diverse perspectives.

How is performance assessed? Based on portfolio performance over time, alignment with investment objectives, risk-adjusted returns, and quality of fund evaluation and presentation.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the training.

or

Book a 15-minute Zoom demo with one of our experts to explore how the training can benefit you.