In this simulation, participants explore how artificial intelligence transforms investment, risk, and corporate finance decisions - balancing data-driven insights with human judgment, ethics, and organizational strategy under uncertainty.

AI applications in trading, credit, and corporate finance

Data-driven decision-making and predictive analytics

Algorithmic bias and ethical considerations

Regulatory challenges in AI adoption

Human-AI collaboration in financial contexts

Risk management with AI-based models

Transparency, interpretability, and trust in algorithms

Cost-benefit analysis of AI adoption

AI’s role in financial innovation and disruption

Limits of automation and importance of human oversight

Review AI model outputs for trading, lending, or investment decisions

Balance human judgment with machine recommendations

Manage risks from data bias, errors, or system failures

Respond to regulatory scrutiny or stakeholder concerns

Adapt strategies to external shocks such as volatility or market disruptions

Present AI-driven strategies to boards, regulators, or clients

By the end of the simulation, participants will be able to:

Apply AI concepts in financial decision-making

Recognize the strengths and weaknesses of AI models

Balance automation with human oversight in high-stakes contexts

Evaluate data quality and model transparency issues

Manage ethical and regulatory challenges of AI in finance

Respond to external shocks with agility

Communicate AI-based strategies persuasively to stakeholders

Collaborate across technical and business functions effectively

Anticipate long-term impacts of AI adoption in financial services

Build confidence in integrating AI into strategic finance decisions

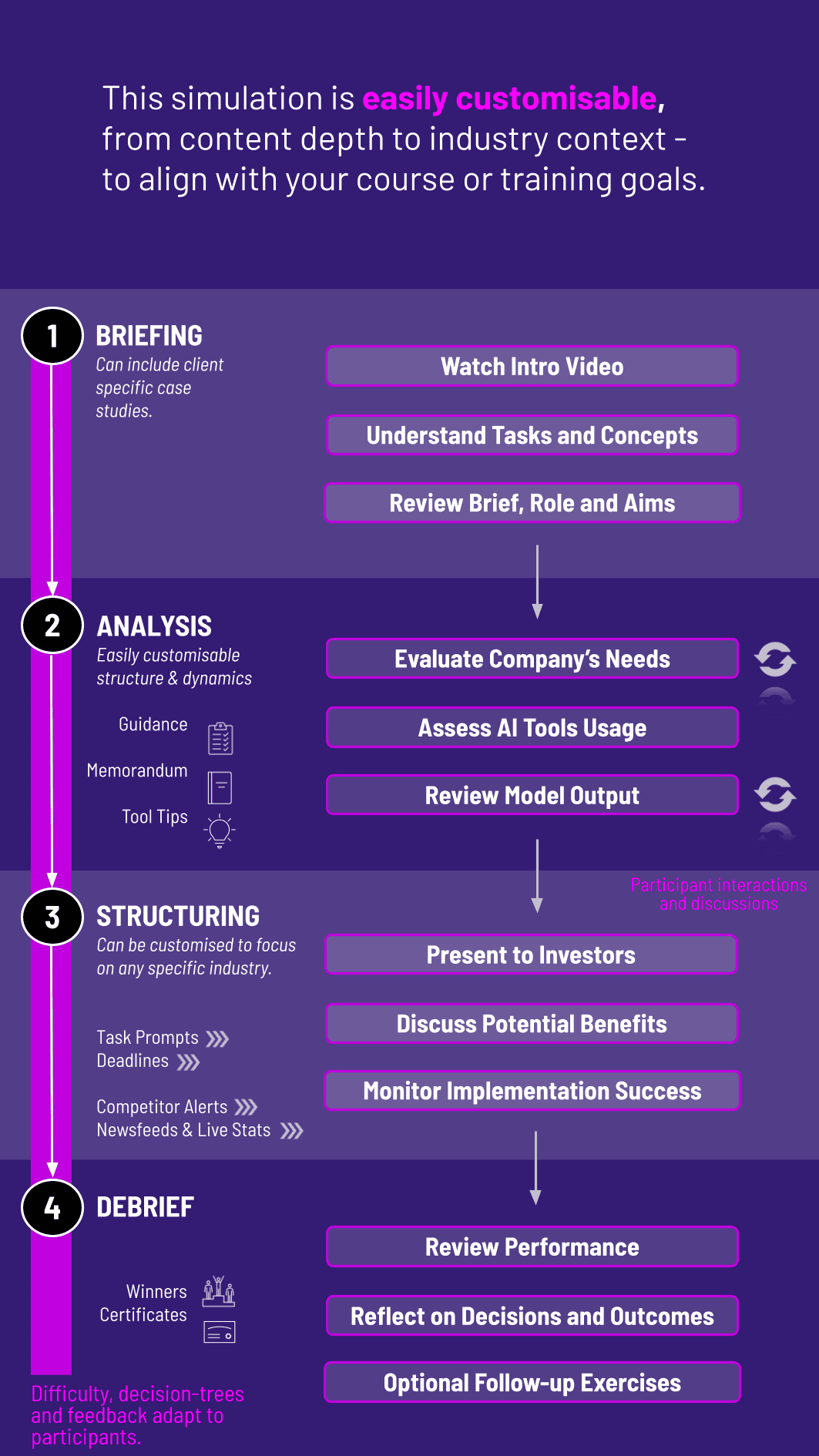

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

The simulation can be delivered individually or in teams, in classrooms, workshops, or executive education. Each cycle mirrors a decision-making round enhanced by AI inputs.

1. Receive a Scenario or Brief: Participants are introduced to a financial challenge where AI tools provide data-driven insights.

2. Analyse the Situation: They review model outputs, financial data, and contextual factors to weigh trade-offs.

3. Make Strategic Decisions: Participants decide whether to follow AI recommendations, override them, or adjust strategies.

4. Collaborate Across Roles: Teams represent different stakeholders - finance leaders, data scientists, regulators - debating risks and opportunities.

5. Communicate Outcomes: Participants deliver strategy memos, board updates, or client presentations explaining their choices.

6. Review and Reflect: Feedback highlights outcomes, AI effectiveness, and ethical implications. Participants refine their judgment in later rounds.

Do participants need technical AI skills? No. The simulation focuses on strategy and decision-making, not coding.

What types of AI are included? Applications like trading algorithms, credit scoring, and predictive models.

Can it be tailored for industries? Yes. Scenarios can reflect banking, investment, or corporate finance contexts.

Is bias in AI models included? Yes. Scenarios highlight fairness, ethics, and transparency issues.

Can teams take different roles? Yes. Teams may represent executives, data scientists, or regulators.

How long does the simulation run? It can be a 4-hour session or extended into a multi-day workshop.

Is it suitable for executives? Absolutely. It’s designed for both students and professionals in finance.

Does it cover regulation? Yes. Compliance and oversight are integral to the gameplay.

Can it run online? Yes. The simulation supports online, hybrid, and in-person delivery.

How is performance measured? By financial outcomes, ethical awareness, and communication effectiveness.

Quality of decisions balancing AI and human input

Recognition of risks and limitations in AI use

Clarity and persuasiveness of communication

Responsiveness to regulatory and stakeholder challenges

Collaboration across technical and strategic roles

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.