The Advisory Services Simulation plunges participants into the high-stakes world of financial consulting, where technical skill meets strategic negotiation. See beyond the numbers and guide clients through their financial decisions.

Company Valuation

Deal Structuring

Capital Raising

M&A Strategy

Financial Modeling

Client Management

Negotiation Tactics

Regulatory and Legal Considerations

In the simulation, participants will:

Represent either the buy-side or sell-side in live M&A transactions.

Utilize multiple methodologies to determine a target's fair value.

Create term sheets and present strategic rationale to a simulated "Board of Directors."

Engage in multi-round negotiations on price, structure, and covenants.

Advise a client on the optimal capital structure and pitch to potential lenders or investors.

Forecast the combined financials of merged entities.

Juggle multiple client mandates with competing deadlines and resources.

Analyze a company's financial position and strategic options to provide actionable advice.

Value a business using mainstream valuation techniques and justify the assumptions.

Structure a merger, acquisition, or financing deal that aligns with client goals and market realities.

Construct a sophisticated financial model to analyze the impact of a proposed transaction.

Negotiate deal terms effectively, balancing assertiveness with the need to close the transaction.

Communicate complex financial strategies clearly and persuasively to clients and stakeholders.

Evaluate ethical challenges and conflicts of interest common in advisory roles.

Synthesize quantitative data and qualitative factors to form a holistic advisory recommendation.

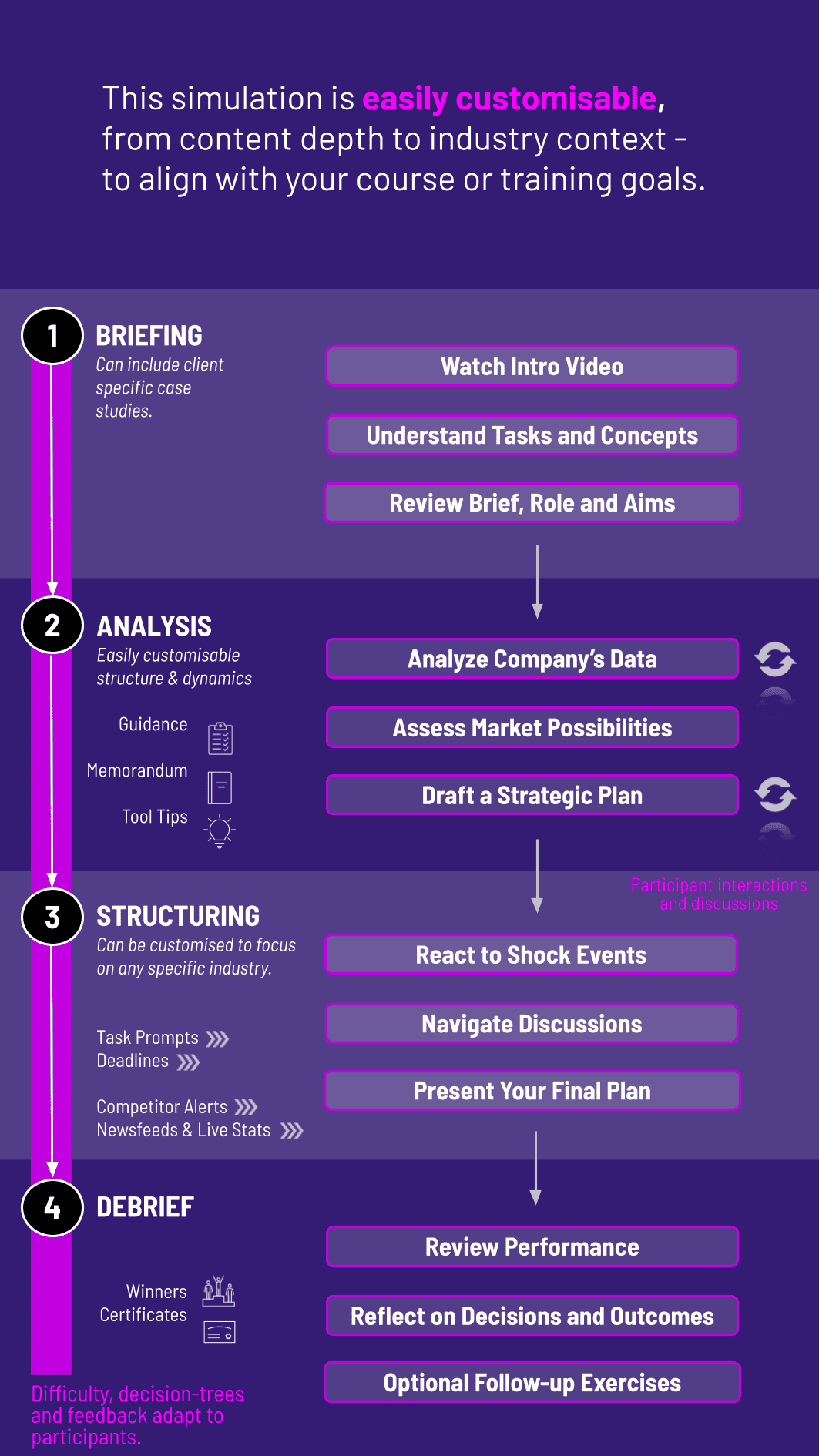

1. Team Formation and Briefing Participants are grouped into advisory firms and receive their first client mandate.

2. Market and Data Analysis Teams access a dynamic market environment, company financials, and research reports.

3. Strategy Development Based on the client's goals, teams develop a strategic plan ("Advise on the acquisition of Company X").

4. Financial Modeling and Valuation Teams build models and perform valuations to support their strategic advice.

5. Negotiation Rounds Teams interact with other teams (representing the counterparty) in structured negotiation rounds, moderated by the platform.

6. Client Pitches and Deliverables Teams present their final recommendations and deal terms to an automated "client" or instructor for a grade.

Who is the target audience for this simulation? This simulation is designed for undergraduate and graduate business students, MBA candidates, finance professionals seeking skill enhancement, and corporate training programs.

Do I need prior finance experience to participate? While beneficial, deep prior experience is not mandatory. The simulation includes foundational materials, but a basic understanding of corporate finance and accounting will help you get the most out of the experience.

How long does a typical simulation last? A full simulation cycle can be run over an intensive 2-3 day workshop or extended across a 5-to-8-week academic module, depending on the depth of coverage.

Is this simulation focused on investment banking? Yes, it covers the core advisory functions of investment banking (M&A, Capital Raising) but is also highly relevant for corporate development, private equity, and strategic finance roles.

Can the simulation be customized for a specific corporate training need? Absolutely. We can tailor client scenarios, industry focus, and deal complexities to match your organization's specific training objectives, such as focusing on leveraged buyouts or cross-border M&A.

What technical requirements are needed to run the simulation? The simulation is web-based and requires only a modern web browser and a stable internet connection. No specialized software installation is needed.

Accuracy of valuation models and assumptions.

Soundness of financial projections and synergy calculations.

Quality of the final deal terms achieved (price, covenants, structure).

Effectiveness in negotiation rounds against counterparties.

Clarity, logic, and defensibility of the strategic recommendation.

Ability to justify decisions based on data and client objectives.

Quality and clarity of the final client pitch deck or advisory report.

Professionalism in all written and verbal communications.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.