The Advanced Investment Theory simulation moves beyond theory, placing you in the role of a portfolio manager at a competitive investment fund, where you must apply advanced concepts to achieve superior risk-adjusted returns in a realistic market.

Modern Portfolio Theory and Efficient Frontier Optimization

Capital Asset Pricing Model and Multi-Factor Models

Alpha Generation and Active Portfolio Management

Risk Decomposition: Systematic vs. Unsystematic Risk

Performance Attribution Analysis

Behavioral Finance Biases in Decision-Making

Derivatives for Hedging and Speculation

Fixed-Income Portfolio Strategies and Duration Management

Alternative Asset Allocation

In the simulation, participants will:

Allocate capital across a diverse universe of equities, bonds, indices, ETFs, and derivatives.

Conduct fundamental and quantitative analysis on simulated company financials and macroeconomic indicators.

Formulate and execute a coherent investment philosophy and strategy statement.

Rebalance portfolios dynamically in response to market shocks and new information.

Use hedging strategies to manage portfolio risk exposures.

Compete against peer-managed funds and market benchmarks.

Present a final investment committee report justifying their strategy and performance.

Construct an optimal portfolio based on advanced risk-return optimization techniques.

Evaluate asset performance using factor models and distinguish between skill-based alpha and market beta.

Manage portfolio risk through diversification, hedging, and strategic asset allocation.

Analyze the sources of portfolio return and underperformance through attribution analysis.

Synthesize economic data and market news into actionable investment decisions.

Defend investment choices using the rigorous language and frameworks of professional asset management.

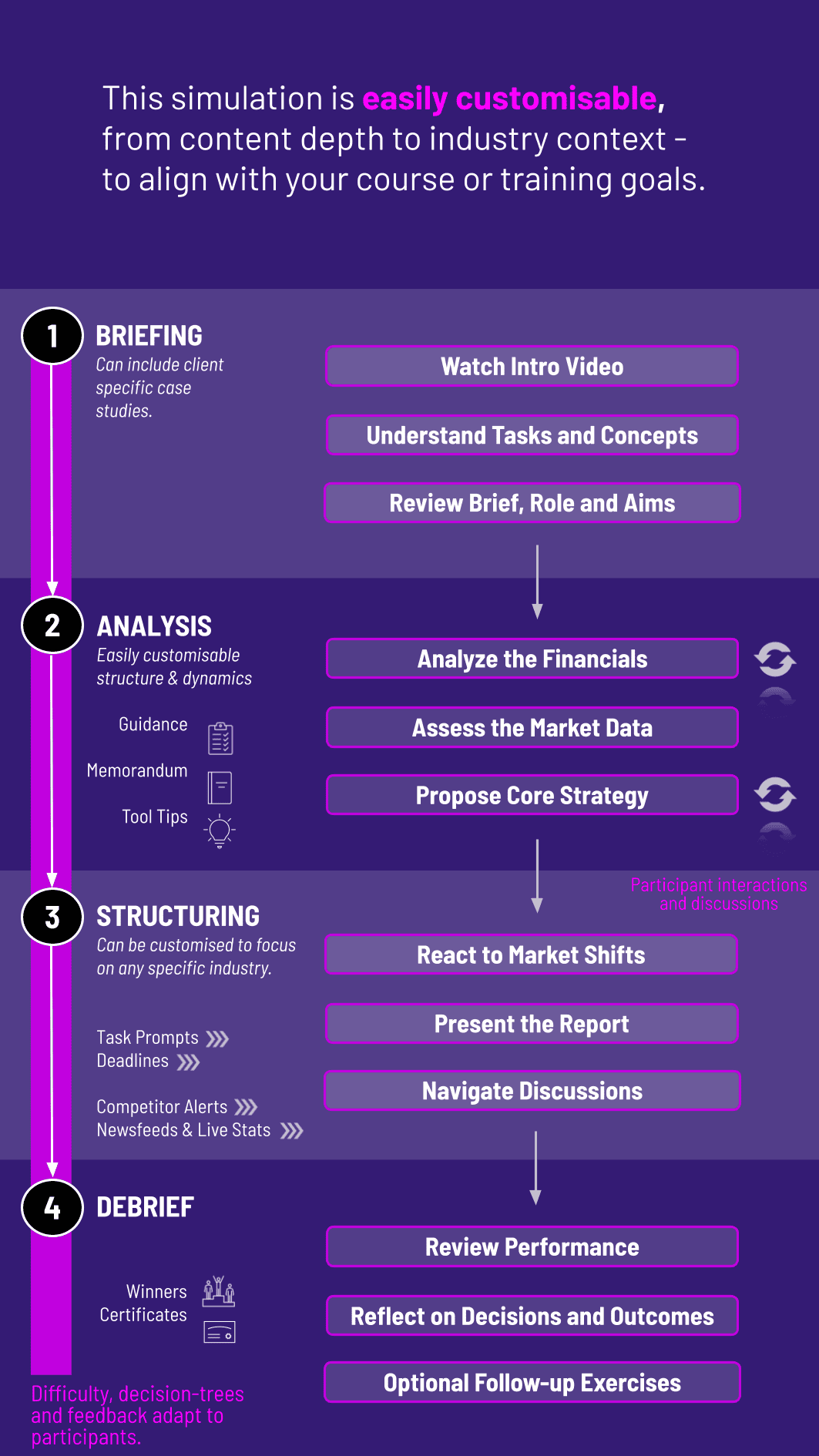

1. Setup and Strategy Participants are assigned capital and access the simulation dashboard. They research the initial economic climate and asset classes before defining their core strategy.

2. Trading Periods The simulation progresses through several rounds. Each round features new market data, earnings reports, and potential "market shock" events.

3. Decision-Making Participants analyze the new information, adjust their forecasts, and execute trades. They can issue orders for long/short positions, options, and other derivatives.

4. Feedback and Analysis After each round, detailed performance reports are generated, showing returns, risk metrics, sector exposures, and a comparison to benchmarks and peers.

** 5. Debrief and Presentation** The simulation concludes with an in-depth debriefing session. Teams or individuals prepare a final analysis linking their decisions to theoretical concepts and their ultimate performance outcome.

Who is the target audience for this finance simulation? This simulation is designed for MBA programs, Masters in Finance students, executive education cohorts, and corporate training programs at investment banks, hedge funds, and asset management firms seeking to deepen their team's practical skills.

Can the simulation be customized for our specific curriculum? Yes. Many aspects, including asset universes, benchmark settings, market event schedules, and key performance indicators, can be tailored to focus on specific learning modules, such as fixed-income strategy or pure equity factor investing.

What technical requirements are needed to run the simulation? The simulation is cloud-based and requires only a stable internet connection and a modern web browser (Chrome, Safari, Edge). No specialized software installation is needed for participants.

How long does a typical simulation cycle last? A comprehensive cycle can be run intensively over 2-3 full days or extended over a 5-to-8-week academic module, with decision rounds scheduled weekly to allow for deep analysis between sessions.

Is this simulation suitable for remote or hybrid learning environments? Absolutely. The platform is built for distributed participation. Teams can collaborate virtually, and all materials, trading, and reporting are accessed online, making it ideal for remote and hybrid classrooms.

Quantitative Performance is measured by risk-adjusted metrics, consistency of returns, and performance versus a stated benchmark.

Quality of the initial investment policy statement and the rationale provided for portfolio adjustments in each period, linking actions to theoretical concepts.

Effective use of diversification, hedging, and adherence to stated risk parameters. Evaluation of drawdown control and volatility management.

Clarity, depth of insight, and honesty in the final performance attribution analysis, including a discussion of what worked, what didn’t, and the theoretical lessons learned.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.