Students take on the role of corporate finance professionals, navigating complex decisions on capital structure, risk management, strategic investments, and mergers to drive financial performance.

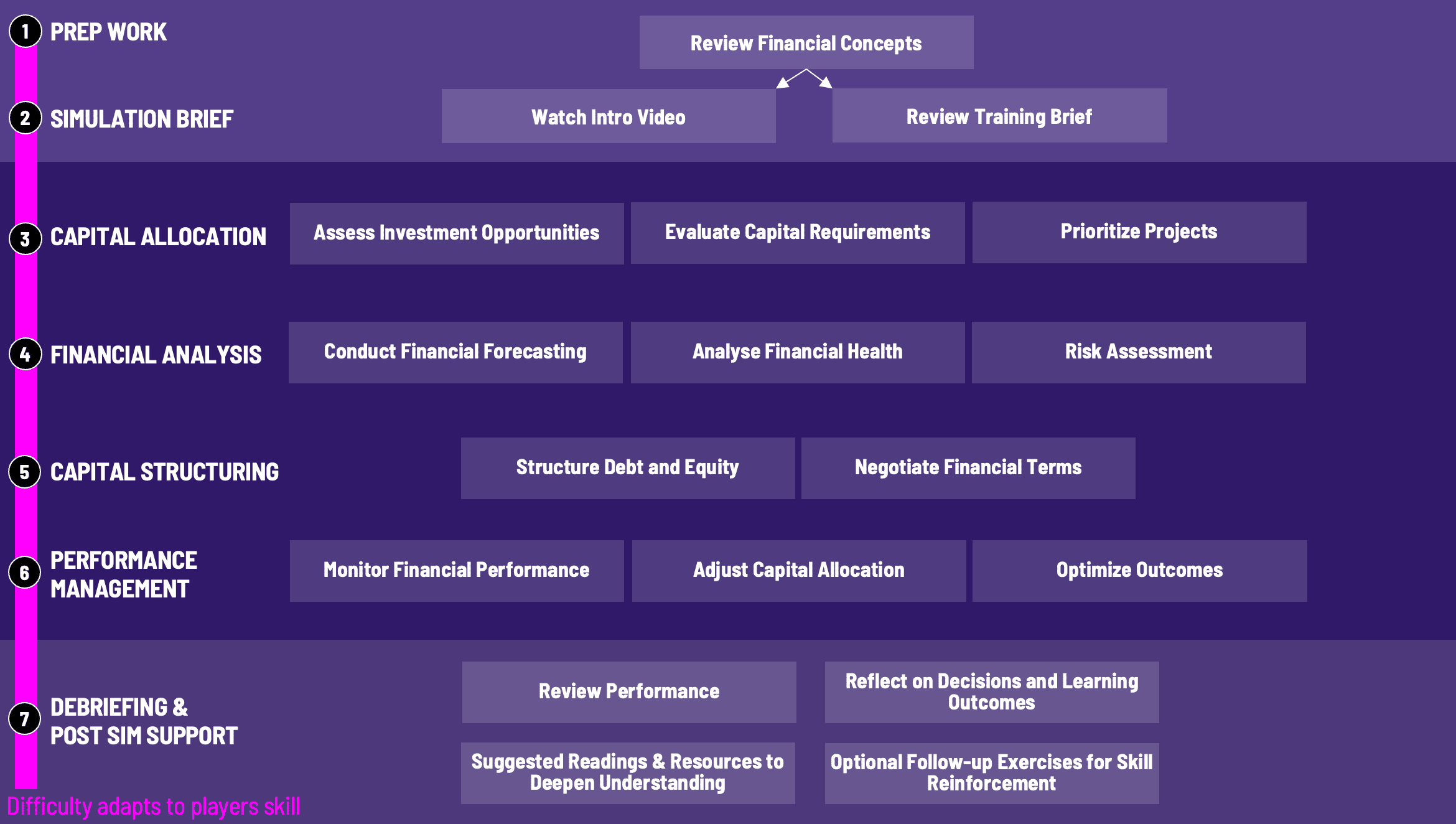

The Advanced Corporate Finance Simulation immerses students in the critical decision-making processes that drive corporate financial strategy. Students step into the role of finance professionals tasked with managing complex scenarios, including capital structure optimization, merger evaluation, and financial risk management.

This simulation replicates high-stakes environments, enabling students to develop and implement sophisticated financial strategies under real-world pressures.

What is the Advanced Corporate Finance Simulation? This simulation is an interactive learning tool that replicates the decision-making processes and challenges faced by corporate finance professionals.

Who is this advanced corporate finance simulation designed for? It is ideal for finance students, MBA candidates, and professionals seeking advanced training in corporate finance.

What skills do students need beforehand? Students should have a basic understanding of financial statements, corporate finance concepts, and Excel modeling.

How long does the advanced corporate finance simulation take? The simulation typically runs for 6 - 8 hours, but the duration can be adjusted to fit curriculum needs.

What technology is required? The advanced corporate finance simulation is web-based and accessible from any device with an internet connection. No additional software is required.

Are group activities part of the advanced corporate finance simulation? Yes, the advanced corporate finance simulation encourages collaborative decision-making, replicating real-world teamwork scenarios.

Can instructors customize the simulation? Absolutely. Instructors can tailor scenarios to focus on specific topics or industries.

What industries does the advanced corporate finance simulation focus on? While the concepts are applicable across industries, the simulation includes scenarios from technology, manufacturing, and healthcare sectors.

How are students evaluated? Students are assessed based on the quality of their financial models, strategic decisions, and ability to adapt to changing scenarios.

What outcomes can be expected? Students will leave the simulation with a stronger grasp of advanced corporate finance strategies, preparing them for high-stakes roles in the field.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the advanced corporate finance simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the advanced corporate finance simulation can benefit you.