Our Actuarial Services Simulation plunges participants into the high-stakes world of actuarial science, moving beyond theory to the practical application of models that define financial stability and risk for insurance companies and pension funds.

Life Tables and Mortality Risk

Lapse Risk

Reserving and Liability Valuation

Pricing and Premium Calculation

Cash Flow Projection

Capital Adequacy

Investment Strategy

Sensitivity Analysis and Scenario Testing

In the simulation, participants will:

Analyze historical policy data, claims experience, and economic variables.

Build and calibrate actuarial models to project liabilities and cash flows.

Determine optimal premium pricing for a new product launch.

Calculate and justify the level of capital reserves required by the company.

Perform sensitivity analysis on key assumptions.

Compete against other teams to provide the most accurate and profitable consultancy.

Present findings and recommendations to the "board" in a final report or presentation.

Apply core actuarial principles to value insurance liabilities and price products.

Construct a coherent actuarial model to project cash flows and assess capital needs.

Evaluate the financial impact of changes in key demographic and economic assumptions.

Interpret the requirements of solvency capital regimes and their business implications.

Formulate strategic recommendations based on quantitative model outputs and qualitative business judgment.

Collaborate effectively within a team to solve complex, multi-faceted financial problems.

1. Team Formation Participants are divided into consulting teams.

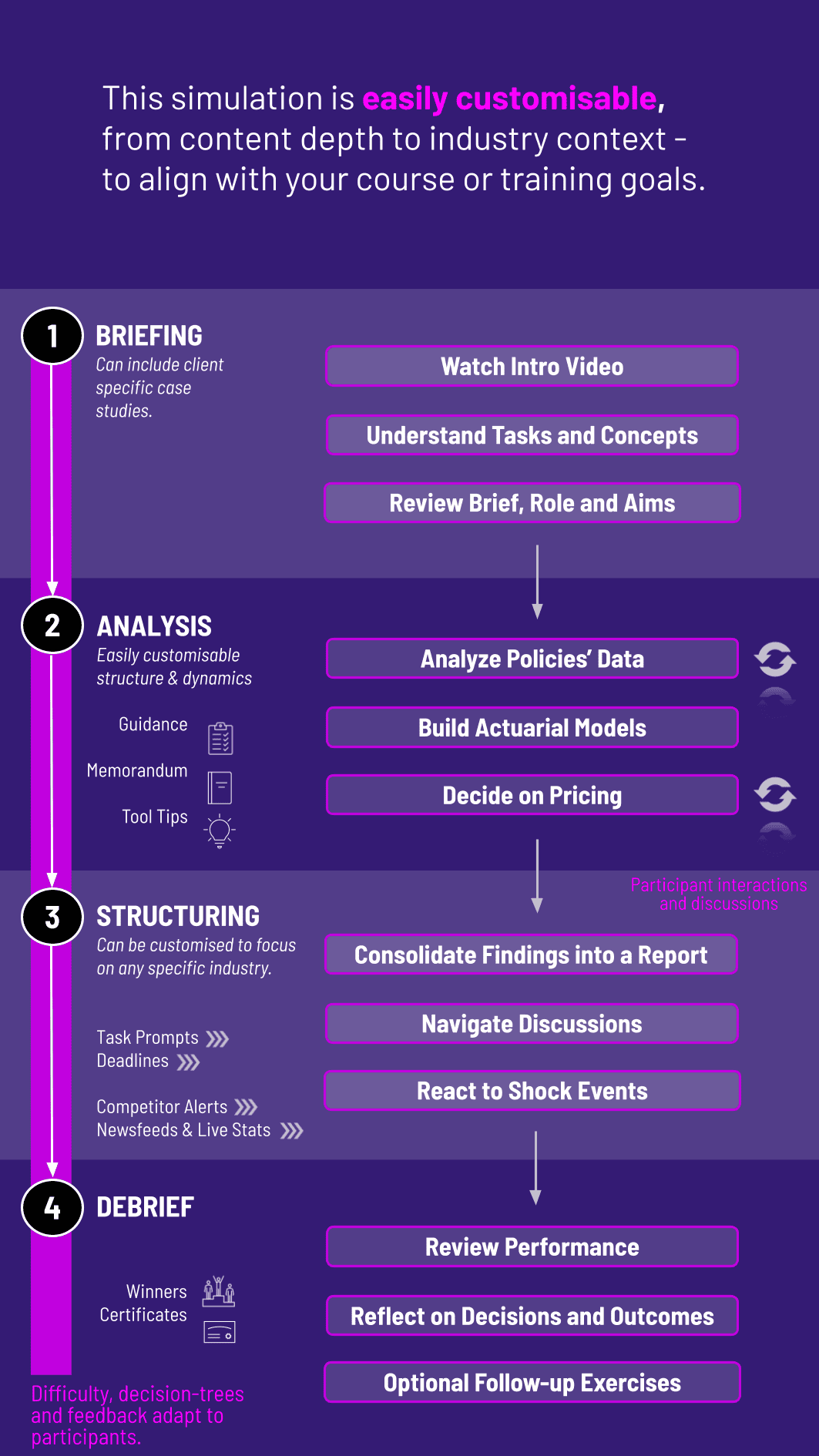

2. Introduction and Briefing Teams receive the "SureLife Insurance" case, including financial statements, product details, and regulatory constraints.

3. Data Analysis and Modeling Over several decision rounds, teams access the simulation platform to input data, run their models, and make key decisions on pricing and reserving. Each round represents a new fiscal year or a new strategic challenge.

4. Results and Market Feedback After each round, the platform generates results, showing the impact of their decisions on the company's profitability, solvency ratio, and competitive ranking.

5. Final Presentation Teams consolidate their learnings into a final actuarial report or board presentation, justifying their strategy and model choices.

Who is the target audience for this simulation? This simulation is ideal for university students in actuarial science, finance, and risk management, as well as early-career professionals in insurance or financial consulting looking to deepen their practical skills.

What prior knowledge is required to participate? A basic understanding of finance, probability, and statistics is helpful. The simulation includes tutorial materials to get everyone up to speed on core actuarial concepts, making it accessible to motivated learners without an extensive background.

How long does the simulation typically last? The simulation is flexible. It can be run as an intensive 1-2 day workshop or extended over a 4-8 week academic module, with weekly decision rounds and supporting lectures.

Is this simulation relevant for professional actuarial exams? Absolutely. While it's a teaching tool, not an exam prep course, it directly illustrates the practical application of concepts covered in professional exams from societies like the SOA and CAS, such as pricing, reserving, and enterprise risk management.

What software or technical skills are needed? The simulation is run through our user-friendly web platform. No advanced programming is required. The focus is on analytical thinking and decision-making, not software proficiency.

How is the performance of participants measured? Performance is measured holistically based on the financial health and solvency of their virtual client, the accuracy of their projections, the profitability of their strategies, and the quality of their final strategic recommendations.

Can this simulation be customized for corporate training? Yes, we can customize case details, regulatory environments, and product types to match the specific needs of your insurance company, reinsurer, or consulting firm.

Capital Adequacy

Profitability

Model Accuracy

Depth of analysis

Clarity of assumptions

Robustness of the model

Strength of the financial recommendations.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.