In the world of finance the true differentiator is often not what you say, but how well you listen. Success is directly tied to their ability to listen actively, decode nuanced communication, and build trust.

The Active Listening Loop

Cognitive Biases in Listening

Decoding Non-Verbal Cues

Asking Probing vs. Condescending Questions

Paraphrasing for Alignment

Emotional Intelligence in Client Management

Managing Internal Team Communication

Building Trust and Rapport

In the simulation, participants will:

Role-play as a junior banker in a client pitch, tasked with identifying the client's unstated primary concern.

Conduct a simulated due diligence interview with a target company's management, listening for inconsistencies or evasive answers.

Navigate an internal team conflict where miscommunication is leading to flawed financial models.

Handle an irate client call, using listening techniques to de-escalate the situation and identify the root cause of the problem.

Practice "listening for gaps" in a negotiation with a counterparty to uncover their true walk-away position.

Complete guided reflection exercises to internalize lessons and develop a personal action plan.

Apply a structured framework for active listening in various financial contexts.

Identify and mitigate common cognitive biases that impair judgment and communication.

Demonstrate the ability to build rapport and trust through verbal and non-verbal acknowledgment.

Formulate high-impact questions that uncover critical information and underlying interests.

Accurately paraphrase complex financial terms and client statements to ensure mutual understanding.

Enhance team collaboration and reduce errors by improving internal communication practices.

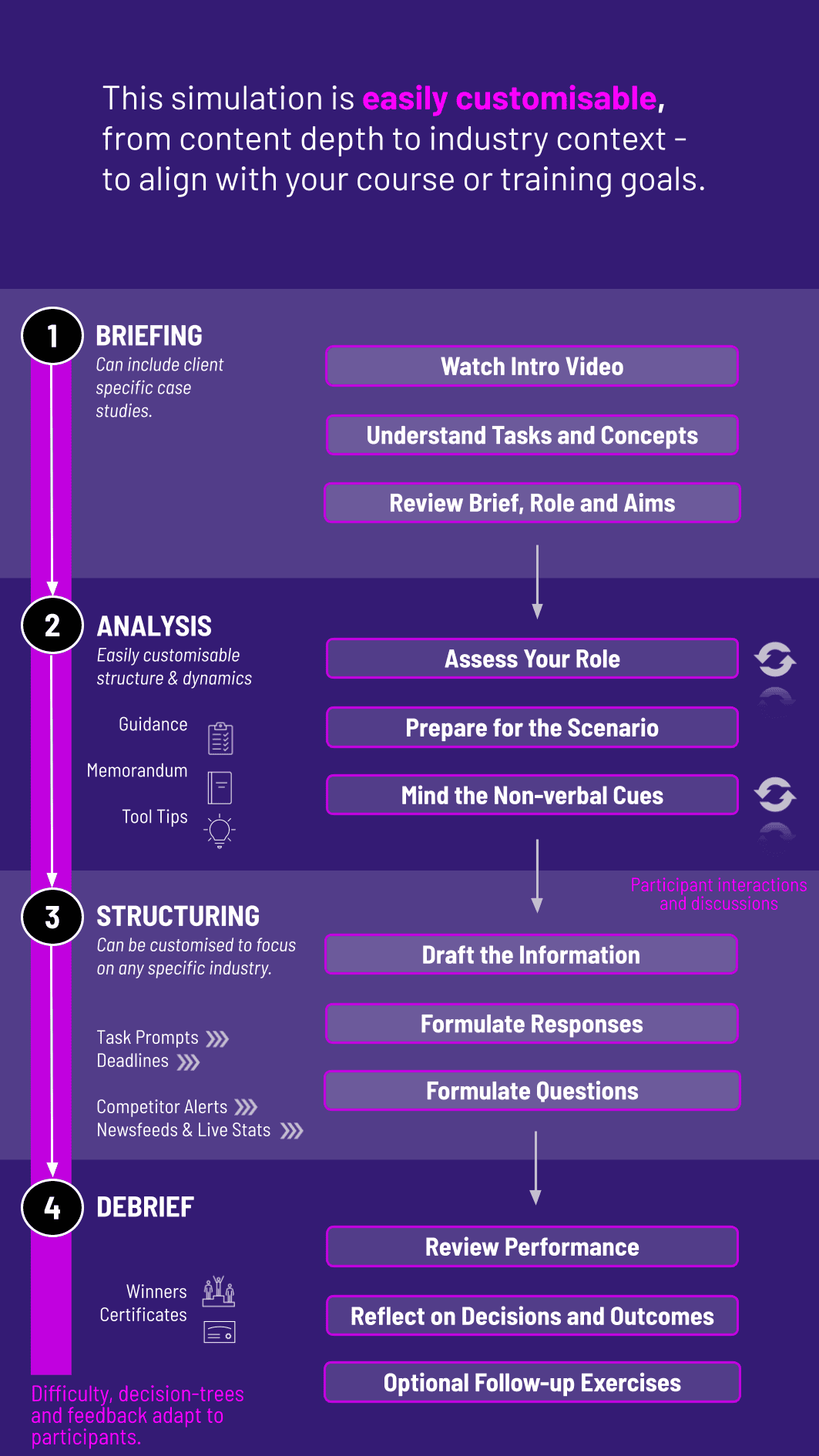

1. Pre-Simulation Briefing Participants receive an introduction to active listening theory and their specific role.

2. Scenario Launch A scenario begins with a video, audio, or live role-play briefing.

3. Immersive Interaction Participants engage in the scenario, which may involve listening to a client call, participating in a video conference, or reading a live chat transcript. They must use listening techniques in real-time.

4. Strategic Decision Points At key moments, the simulation pauses to present participants with multiple-choice questions or open-ended prompts.

5. Debrief and Reflection The session concludes with a comprehensive debrief, analyzing performance metrics, replaying key moments, and facilitating a group discussion on lessons learned.

Do I need any prior finance knowledge? Yes, a basic understanding of financial concepts is recommended, as the scenarios are set in authentic finance contexts (e.g., M&A, client pitching, portfolio management).

How long does the simulation take? The core simulation experience can be completed in approximately 90-120 minutes. Full workshops with in-depth debriefs can be a half-day or full-day session.

Is this a passive e-learning course or an interactive experience? This is a highly interactive experience. Participants are not watching videos; they are making decisions, engaging in role-plays, and receiving dynamic feedback based on their performance.

Can it be customized for our specific company? Absolutely. We can customize scenarios, roles, and learning objectives to reflect your firm's specific products, culture, and common communication challenges.

What technology is required? Participants only need a standard web browser and a stable internet connection. No special software or hardware is required.

How is this different from a generic communication skills course? This simulation is built from the ground up for a finance audience. The language, pressure, stakes, and scenarios are all derived from real-world financial situations, making the learning immediately applicable and highly relevant.

How do you measure improvement in a 'soft skill' like listening? We use a combination of metrics: in-simulation decision scores, feedback from a peer participants on specific behavioral markers, and pre- and post-simulation self-assessments that gauge confidence and competency.

After completing a simulation the data generated from participant’s decisions is constructed into the final Financial Health

Score based on key metrics like Net Worth, Debt-to-Income Ratio, Credit Score, and Savings Rate. This provides a clear, numerical assessment of the participant's strategic success.

A short knowledge check before and after the simulation measures the growth in understanding of core financial concepts. Instructors or facilitators can review the participant's journey, evaluating the quality and consistency of their budgeting, investing, and debt management choices.

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.