The Acquisition Modelling Simulation plunges participants into the high-stakes world of mergers and acquisitions tasked with analyzing a target company, building a comprehensive financial model, and executing a strategic acquisition for the client.

M&A Deal Rationale and Strategy

Financial Statement Analysis

Financial Modelling and Forecasting

Discounted Cash Flow (DCF) Analysis

Comparable Company Analysis (Comps)

Precedent Transaction Analysis

Acquisition Mechanics

Financing the Deal

Accretion/Dilution Analysis

Credit Metrics and Leverage

Synergy Modelling

In the simulation, participants will:

Analyze a comprehensive company information packet (CIM) for the target company.

Build a three-statement financial model (Income Statement, Balance Sheet, Cash Flow Statement) for the target from the ground up.

Forecast the target's future revenue, expenses, and working capital needs.

Perform a full business valuation using DCF, Comparable Companies, and Precedent Transactions.

Model the acquisition, including the creation of goodwill and intangible assets.

Evaluate different financing scenarios (all-cash, all-stock, mixed) and their impact.

Conduct a detailed accretion/dilution analysis to determine if the deal creates value.

Prepare a summary of findings and a recommendation for the "Board of Directors".

Construct a professional, three-statement acquisition model in Excel.

Value a company using the three primary valuation methodologies used on Wall Street.

Analyze the strategic and financial merits of a potential acquisition.

Calculate the accretion or dilution of a transaction to the acquirer's EPS.

Assess the impact of different financing structures on the combined entity's balance sheet and credit profile.

Quantify and model potential operational and revenue synergies.

Develop a coherent investment thesis to support an M&A recommendation.

Interpret complex financial data to make informed strategic decisions under time constraints.

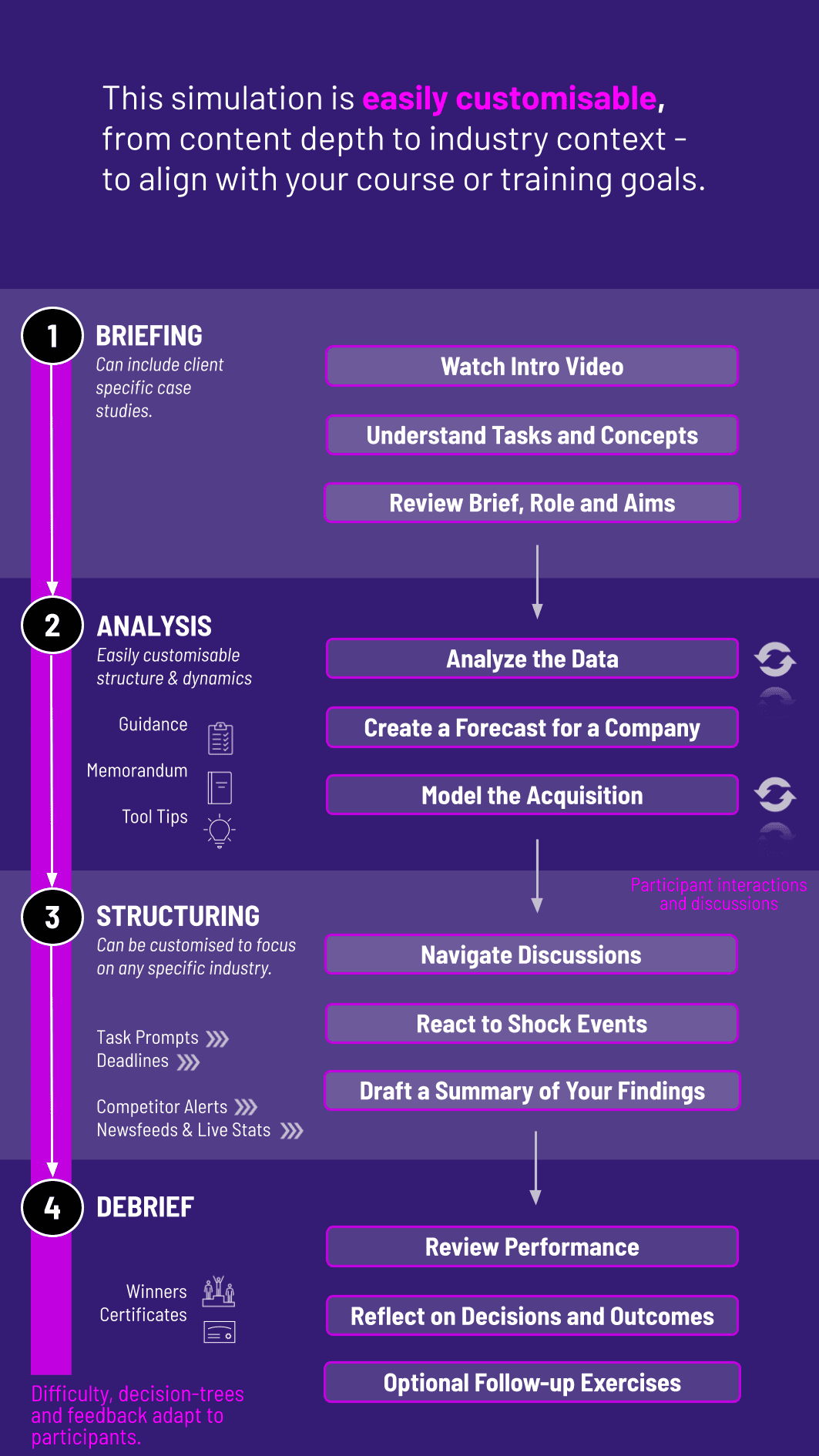

1. Registration and Team Formation Participants are registered and can form teams or work individually.

2. Access the Platform Participants gain access to our proprietary simulation platform, which includes the case study, financial data, and a structured Excel environment.

3. Self-Paced Learning Modules Work through guided modules that cover financial modeling, valuation, and M&A mechanics.

4. Hands-On Modelling Using the provided data, participants will build the acquisition model step-by-step, from historical analysis to the final accretion/dilution output.

5. Scenario Testing The simulation allows for testing different assumptions (growth rates, synergy levels, purchase premiums) and financing options to see their immediate impact on the deal's outcome.

6. Final Submission and Assessment Submit your completed model and a brief executive summary. Your work is then assessed based on technical accuracy, model integrity, and the logic of your conclusions.

What are the technical requirements to run the simulation? All you need is a modern web browser and Microsoft Excel. The simulation is cloud-based and accessible 24/7.

How long does it take to complete the simulation? The simulation is designed to be completed in approximately 10-15 hours. It is self-paced, so participants can fit it around their schedules.

Is this simulation relevant for careers outside of investment banking? Absolutely. The skills learned are directly applicable to private equity, corporate development (in-house M&A), equity research, and strategic consulting roles where evaluating acquisitions is key.

Do I need to download any special software? No. The simulation runs entirely through your browser. Your financial modeling is done in a web-based version of Excel or your own local copy, with no installations required.

How is this different from a traditional finance course? This is applied learning. Instead of just learning theory, you are immediately applying concepts by building a real-world financial model from scratch, mimicking the exact tasks performed by analysts.

Can this simulation be used for corporate training? Yes, we offer tailored versions for corporate training programs, perfect for developing the financial and strategic skills of analysts in corporate development, FP&A, and leadership teams.

What kind of support is available during the simulation? Participants have access to a knowledge base with video tutorials and written guides. For academic and corporate partners, dedicated support and debrief sessions can be arranged.

Review of the final financial model for accuracy, formula integrity, and correct application of valuation and M&A mechanics.

Evaluation of the participant's ability to run different financing and synergy scenarios and provide a logical, data-driven justification for their recommended course of action.

Assessment of the participant's ability to distill complex financial analysis into a clear, concise, and persuasive summary for a senior management audience.

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.