The Accrual Accounting Simulation throws students into the heart of a company's financial operations, challenging them to apply accounting principles in a dynamic, competitive environment.

Accrual vs. Cash Accounting

Revenue Recognition Principle

Matching Principle

Adjusting Journal Entries

Financial Statement Preparation (Income Statement, Balance Sheet, Statement of Cash Flows)

Accounting Cycle (from transaction to financial statements)

Depreciation and Amortization

Accruals for Expenses and Revenues

Impact of Accounting Choices on Financial Ratios

Working Capital Management

In the simulation, participants will:

Analyze and record a variety of business transactions using double-entry accounting.

Choose between different operational strategies that have direct accounting implications.

Execute necessary adjusting entries for accruals, deferrals, and depreciation.

Generate accurate and GAAP-compliant Income Statements, Balance Sheets, and Statements of Cash Flows.

Review the financial statements of competing teams within the simulation.

Use financial ratios and trends to assess their company's performance and health.

Strive to achieve the most profitable and financially sound company in the simulated market

Differentiate clearly between cash and accrual accounting and explain the superiority of accrual accounting for measuring performance.

Apply the revenue recognition and matching principles to complex, real-world business scenarios.

Execute the full accounting cycle, from journalizing transactions to preparing and analyzing financial statements.

Construct a Statement of Cash Flows from the changes in Balance Sheet and Income Statement accounts.

Analyze the impact of business decisions and accounting choices on a company's financial health and reported earnings.

Develop critical thinking and professional judgment in selecting appropriate accounting treatments.

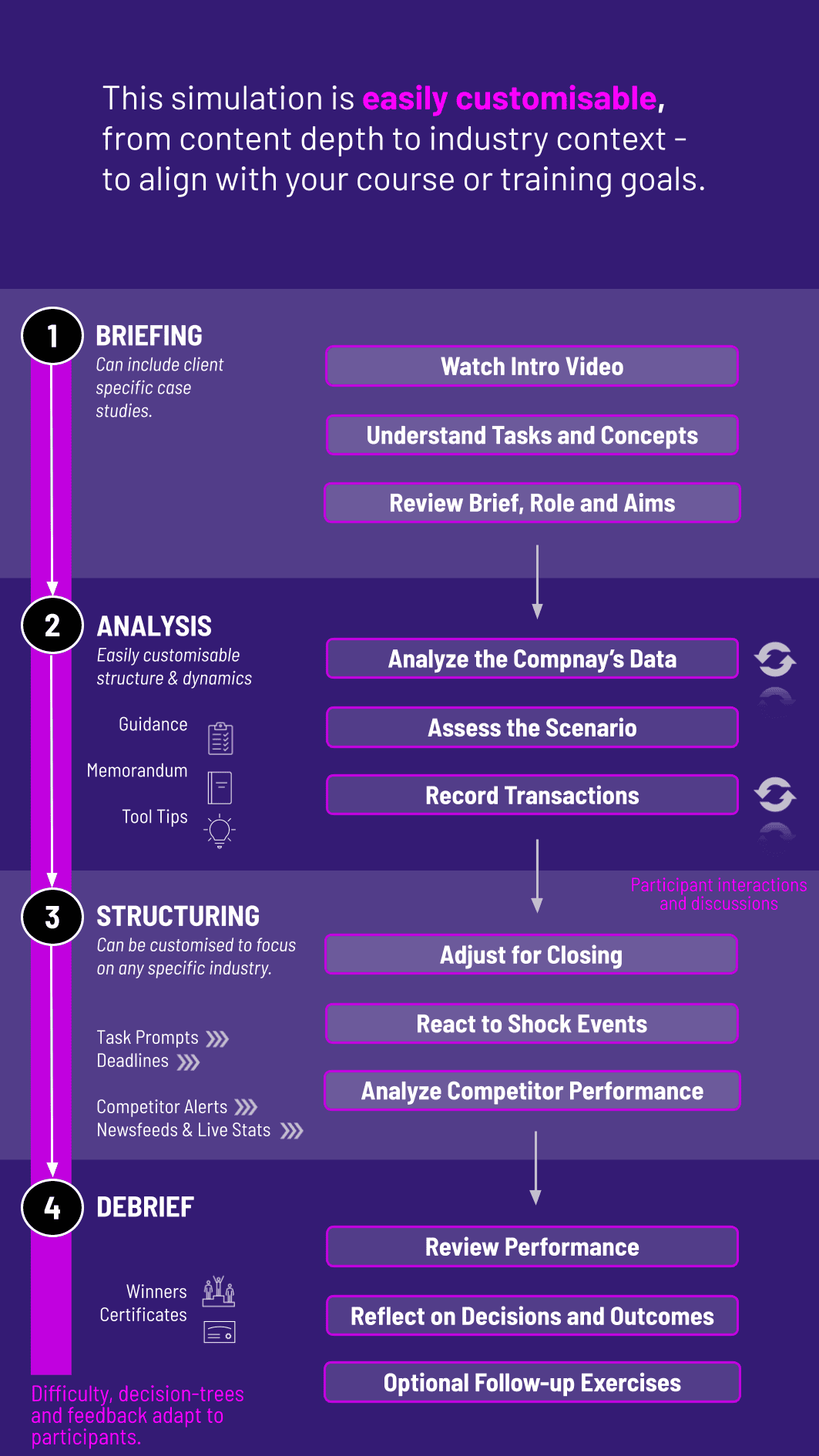

1. Team Formation and Introduction Participants are divided into teams, each managing their own company. They receive the initial scenario and company financials.

2. Decision Periods The simulation is run over multiple rounds, each representing an accounting period. In each round, teams analyze new transactions and make strategic decisions.

3. Accounting Processing Teams record all transactions and must identify and post the necessary adjusting entries before closing the period.

4. Financial Statement Generation The simulation platform generates financial statements based on the teams' entries, providing feedback on their accuracy.

5. Results and Analysis After each period, teams receive a detailed performance report. They can compare their financial results and key ratios against other teams.

6. Instructor Debrief The instructor leads a discussion on the results, highlighting common pitfalls, strategic insights, and the core accounting principles at play, solidifying the learning experience.

Is this simulation suitable for beginners in accounting? Absolutely. The simulation is designed with a learning curve in mind, starting with fundamental transactions and progressively introducing more complex concepts. It serves as an excellent practical application for introductory financial accounting courses.

What is the typical duration of the simulation? The simulation is highly flexible. A standard run can be completed in 2-5 hours of total participant engagement, which can be spread over one or two weeks within an academic syllabus or a single day in a corporate workshop.

What kind of support is provided during the simulation? We provide comprehensive guides, video tutorials, and a dedicated help center. Instructors also have access to a full facilitator's guide and technical support.

Can the simulation be customized for our specific curriculum? Yes, we offer customization options for the transaction set, company scenarios, and specific accounting standards (for example, IFRS vs. GAAP focus) to better align with your course objectives.

How does the simulation improve knowledge retention compared to traditional methods? By learning through doing and seeing the immediate impact of their decisions, participants form stronger neural connections. The competitive and interactive nature of the simulation significantly boosts engagement and long-term retention of core accounting principles.

What are the technical requirements to run the simulation? The simulation is 100% web-based. Participants only need a standard web browser and an internet connection. There is no software to download or install.

How does the simulation assess student performance? Performance is multi-faceted. The platform can grade the accuracy of financial statements. Instructors can also assess the strategic decisions, ratio analysis, and overall financial health of the team's company. The assessment can be tailored to your specific needs.

Is this a single-player or multi-player simulation? It is primarily a team-based, multi-player simulation that fosters collaboration and discussion. However, a single-player mode is available for self-paced practice and individual learning.

The correctness of the prepared Income Statements, Balance Sheets, and Statements of Cash Flows at the end of each period.

Accuracy in recording both standard and adjusting journal entries.

The team's success in managing profitability, liquidity, and solvency, as reflected in key financial ratios and company valuation.

A short quiz on the core concepts reinforced by the simulation.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.