The Accounts Payable Simulation plunges you into the high-stakes world of corporate cash flow management. Experience the real-time pressure of optimizing payables to strengthen vendor relationships and maintain financial stability.

Working Capital Management

Cash Flow Forecasting and Analysis

Invoice Processing Cycle

Payment Terms

Early Payment Discounts

Vendor Relationship Management

Days Payable Outstanding

AP Aging Schedule

Liquidity vs. Solvency

Strategic Payment Scheduling

In the simulation, participants will:

Process a high volume of incoming invoices from multiple vendors.

Analyze payment terms and early payment discount opportunities.

Strategically schedule payments to optimize company cash flow.

Manage a limited cash reserve and forecast short-term cash needs.

Navigate scenarios involving key vendor relationships and potential supply chain disruptions.

Analyze performance through a detailed AP Aging Report and Cash Flow Statement.

Compete with peers to achieve the highest financial health score for your simulated company.

Analyze the impact of accounts payable on a company's working capital and liquidity.

Evaluate invoice payment terms to strategically capture early payment discounts.

Manage the critical trade-off between maintaining cash reserves and meeting financial obligations.

Forecast short-term cash flow requirements based on the AP aging schedule.

Calculate and interpret key metrics like Days Payable Outstanding.

Develop a strategic payment schedule that optimizes for both financial efficiency and vendor satisfaction.

1. Introduction Participants are assigned the role of AP Manager at a growing mid-sized company.

2. Invoicing Phase Each round, a new set of invoices arrives in their digital queue. Each invoice has a vendor, amount, due date, and potential discount terms.

3. Decision-Making Participants must decide which invoices to pay immediately and which to schedule for later, based on your available cash, discount opportunities, and strategic priorities.

4. Simulation Engine The platform processes decisions. Paying early may capture discounts (improving profitability) but depletes cash. Paying late preserves cash but may harm vendor relationships or incur late fees.

5. Results and Feedback After each round, participants receive a comprehensive dashboard including a Cash Flow Statement, AP Aging Report, and a Vendor Health Scorecard. Your overall company financial health score is updated.

Who is the target audience for this simulation? This simulation is ideal for business students, finance and accounting professionals, early-career professionals in corporate treasury, and anyone seeking to understand the strategic importance of working capital management.

What makes this simulation different from an AP textbook chapter? Unlike passive reading, our simulation is learning by doing. You experience the consequences of your decisions in real-time, dealing with the pressure of multiple invoices and limited cash, which builds practical, unforgettable skills.

Do I need prior accounting experience? A basic understanding of accounting principles is helpful, but not required. The simulation includes introductory materials that explain core concepts like payment terms and cash flow, making it accessible to motivated learners.

How long does it take to complete the simulation? A typical simulation cycle can be completed in 60-90 minutes. However, to fully explore all scenarios and master the concepts, we recommend budgeting 2-3 hours.

Is this simulation relevant for investment banking or hedge fund careers? Absolutely. Understanding how working capital management, including accounts payable, impacts free cash flow is fundamental to financial modeling, valuation, and analyzing company performance—all core skills in investment banking and asset management.

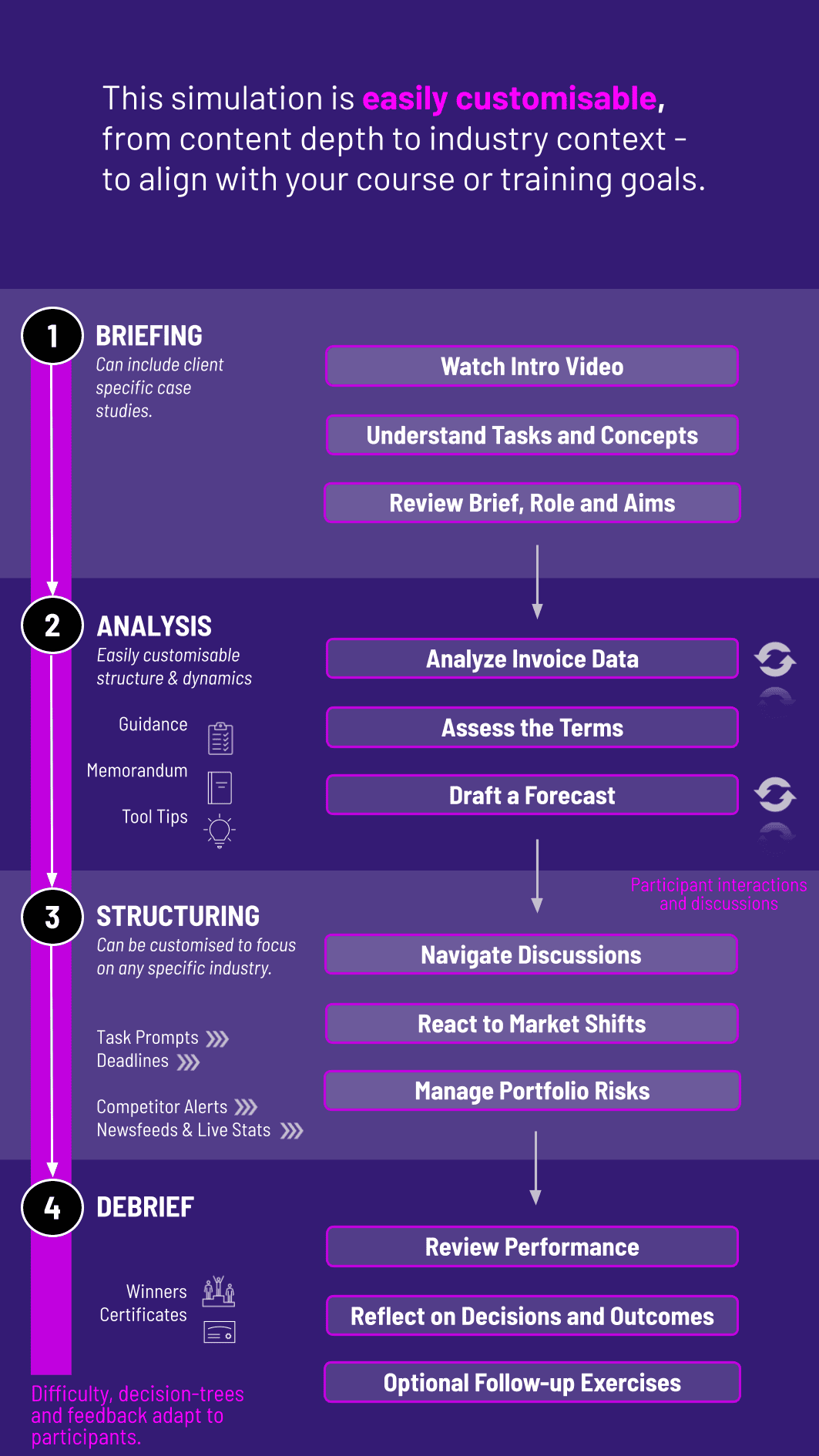

Can the simulation be customized for our corporate training program? Yes, we offer extensive customization options, including tailoring vendor names, invoice volumes, and financial scenarios to match your company's specific industry and challenges.

What technical requirements are needed to run the simulation? The simulation is web-based and runs directly in your web browser (Chrome, Firefox, Safari). A stable internet connection is the only requirement.

A composite score based on profitability, cash reserves, and vendor relationships.

The percentage of available early payment discounts participants successfully captured.

Effectively at which participants are managing the company's payment cycle compared to industry benchmarks.

The health of participants’ supplier relationships based on your payment history.

Assessment of individual contribution within the team to ensure collaborative engagement.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.