In this simulation, participants act as financial investigators uncovering irregularities, analyzing statements, and identifying red flags - balancing skepticism, evidence, and ethics while managing corporate, regulatory, and reputational pressures.

Red flags in financial reporting

Fraudulent earnings management tactics

Internal control failures and risk assessment

Whistleblowing and reporting protocols

Ethical dilemmas in fraud detection

Pressure from management and external stakeholders

Data analytics in fraud detection

Regulatory frameworks and auditor responsibilities

Impact of fraud on stakeholders and markets

Evidence gathering and professional skepticism

Review income statements, balance sheets, and cash flow statements for anomalies

Investigate unusual journal entries, transactions, or ratios

Decide when to escalate findings to regulators, boards, or audit committees

Respond to pressure from executives to downplay concerns

Use data analysis and forensic techniques to uncover hidden risks

Communicate findings through audit memos, reports, or press briefings

By the end of the simulation, participants will be able to:

Identify and analyze red flags in financial reporting

Apply professional skepticism to accounting irregularities

Understand common fraud schemes and manipulation tactics

Evaluate internal controls and compliance risks

Balance ethical responsibility with career and organizational pressures

Communicate concerns effectively to stakeholders

Recognize the role of auditors, analysts, and regulators in fraud prevention

Manage reputational and financial fallout of fraud exposure

Apply data analytics to forensic accounting investigations

Reflect on ethical dilemmas in fraud detection and reporting

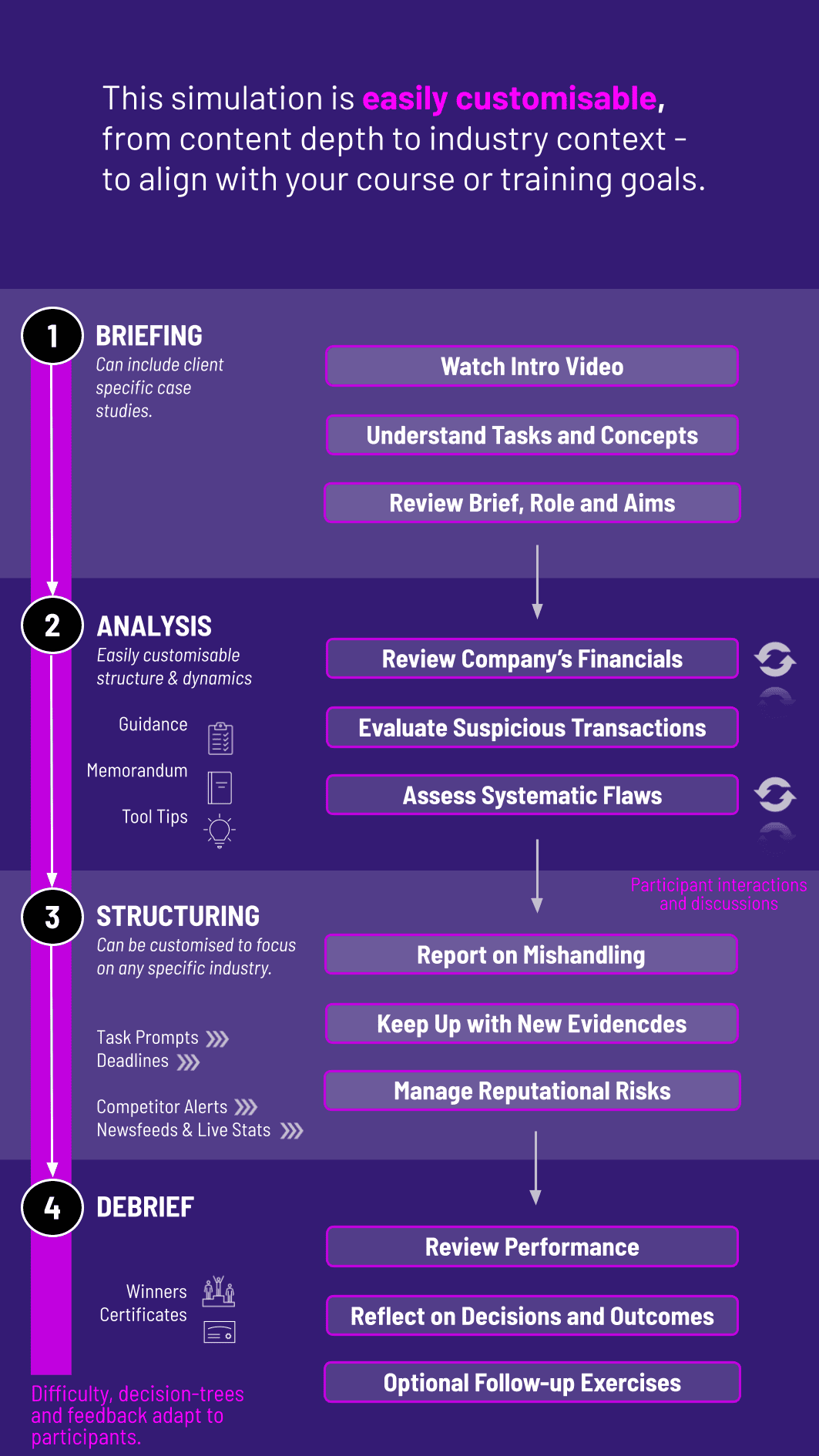

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

This simulation can be run individually or in teams in academic or corporate contexts. Each cycle represents a stage of fraud detection.

1. Receive a Scenario or Brief: Participants receive company financials, reports, and contextual clues—some of which may be misleading.

2. Analyse the Situation: They review statements, ratios, and transactions to identify anomalies.

3. Make Investigative Decisions: Participants decide whether to probe further, escalate findings, or confront management.

4. Collaborate and Debate: In team formats, participants compare interpretations and challenge each other’s conclusions.

5. Communicate Findings: They draft audit memos, board updates, or whistleblower reports based on their discoveries.

6. Review and Reflect: Feedback highlights uncovered frauds, missed red flags, and ethical implications. Participants adapt strategies across rounds.

Do participants need accounting expertise? Basic knowledge of financial statements is helpful, but the simulation is accessible for learners at all levels.

What types of fraud are covered? Revenue manipulation, expense inflation, hidden liabilities, and off-balance-sheet risks.

Is this suitable for corporate training? Yes. It’s ideal for auditors, compliance officers, and finance professionals.

Can the scenarios be customized? Yes. They can reflect specific industries like banking, healthcare, or manufacturing.

Does it include ethical dilemmas? Yes. Participants face pressure from management, boards, or peers when fraud is suspected.

How long does the simulation run? It can be a 2-hour module or part of a multi-day workshop.

Can teams play different roles? Yes. Teams may act as auditors, regulators, or executives.

Is it online-compatible? Yes. It works in digital, hybrid, and in-person formats.

How is success measured? By frauds uncovered, ethical decisions made, and communication quality.

Can this be used in MBA programs? Absolutely. It fits into accounting, finance, and ethics curricula.

Effectiveness in identifying financial irregularities

Judgment in escalating fraud concerns

Clarity and structure of audit or investigation reports

Responsiveness to pressure and ethical challenges

Collaboration and peer/self-assessment in fraud analysis

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.