Participants act as venture capitalists, evaluating startups, pitching investments, and managing portfolios to drive growth in competitive markets.

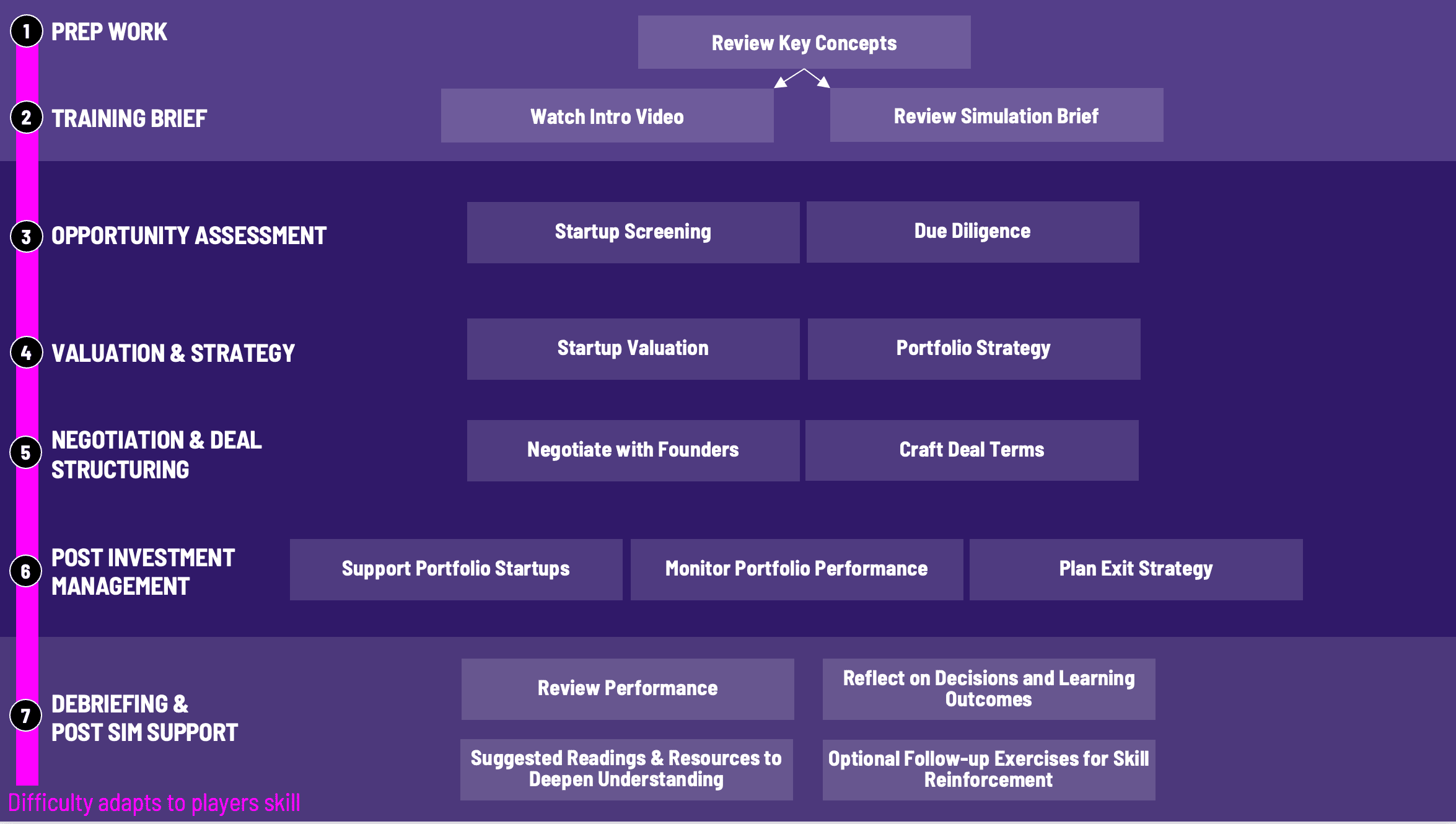

What skills can participants expect to gain from the venture capital training? Participants will gain skills in startup valuation, market analysis, deal structuring, negotiation, and portfolio management.

How is the venture capital training structured? The venture capital training is divided into phases, including startup evaluation, negotiation, portfolio management, and performance review.

What industries are covered in the venture capital training? The venture capital training includes startups from diverse industries, such as technology, healthcare, and consumer goods.

How long does the venture capital training typically take? The venture capital training can be completed in 6-8 hours, depending on the level of detail chosen by the instructor.

Can the venture capital training be customised? Yes, instructors can tailor certain aspects, such as startup industries or investment goals, to align with course objectives.

Is prior knowledge of venture capital required? No, the venture capital training includes introductory materials to bring all participants up to speed.

How is performance evaluated? Performance is assessed based on investment returns, strategic decisions, and stakeholder feedback.

What technical requirements are needed to run the venture capital training? The venture capital training is web-based and requires a computer with internet access and a modern browser.

Can the venture capital training be used in group settings? Yes, the venture capital training is designed to accommodate team collaboration, simulating real-world venture capital dynamics.

What feedback do participants receive post-training? Participants receive detailed feedback on their decisions, outcomes, and areas for improvement, along with guidance for further learning.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the training.

or

Book a 15-minute Zoom demo with one of our experts to explore how the training can benefit you.