Students act as venture capitalists, evaluating startups, pitching investments, and managing portfolios to drive growth in competitive markets.

What skills can students expect to gain from the venture capital simulation? Students will gain skills in startup valuation, market analysis, deal structuring, negotiation, and portfolio management.

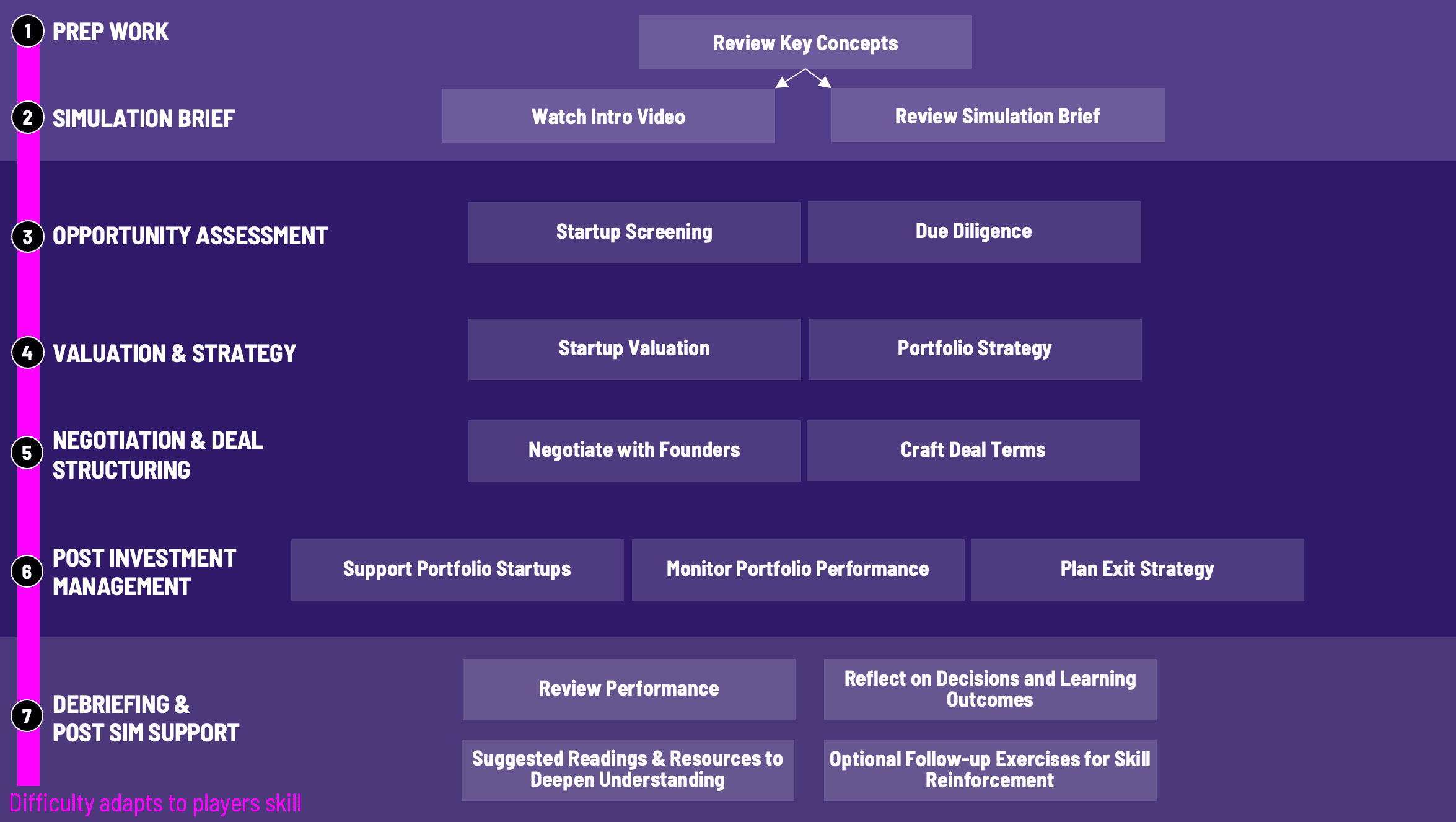

How is the venture capital simulation structured? The venture capital simulation is divided into phases, including startup evaluation, negotiation, portfolio management, and performance review.

What industries are covered in the venture capital simulation? The venture capital simulation includes startups from diverse industries, such as technology, healthcare, and consumer goods.

How long does the venture capital simulation typically take? The venture capital simulation can be completed in 6-8 hours, depending on the level of detail chosen by the instructor.

Can the venture capital simulation be customised? Yes, instructors can tailor certain aspects, such as startup industries or investment goals, to align with course objectives.

Is prior knowledge of venture capital required? No, the venture capital simulation includes introductory materials to bring all students up to speed.

How is performance evaluated? Performance is assessed based on investment returns, strategic decisions, and stakeholder feedback.

What technical requirements are needed to run the venture capital simulation? The venture capital simulation is web-based and requires a computer with internet access and a modern browser.

Can the venture capital simulation be used in group settings? Yes, the venture capital simulation is designed to accommodate team collaboration, simulating real-world venture capital dynamics.

What feedback do students receive post-simulation? Students receive detailed feedback on their decisions, outcomes, and areas for improvement, along with guidance for further learning.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.