Participants act as investment analysts, evaluating asset opportunities, optimizing portfolios, and managing risk to maximize returns in dynamic market environments.

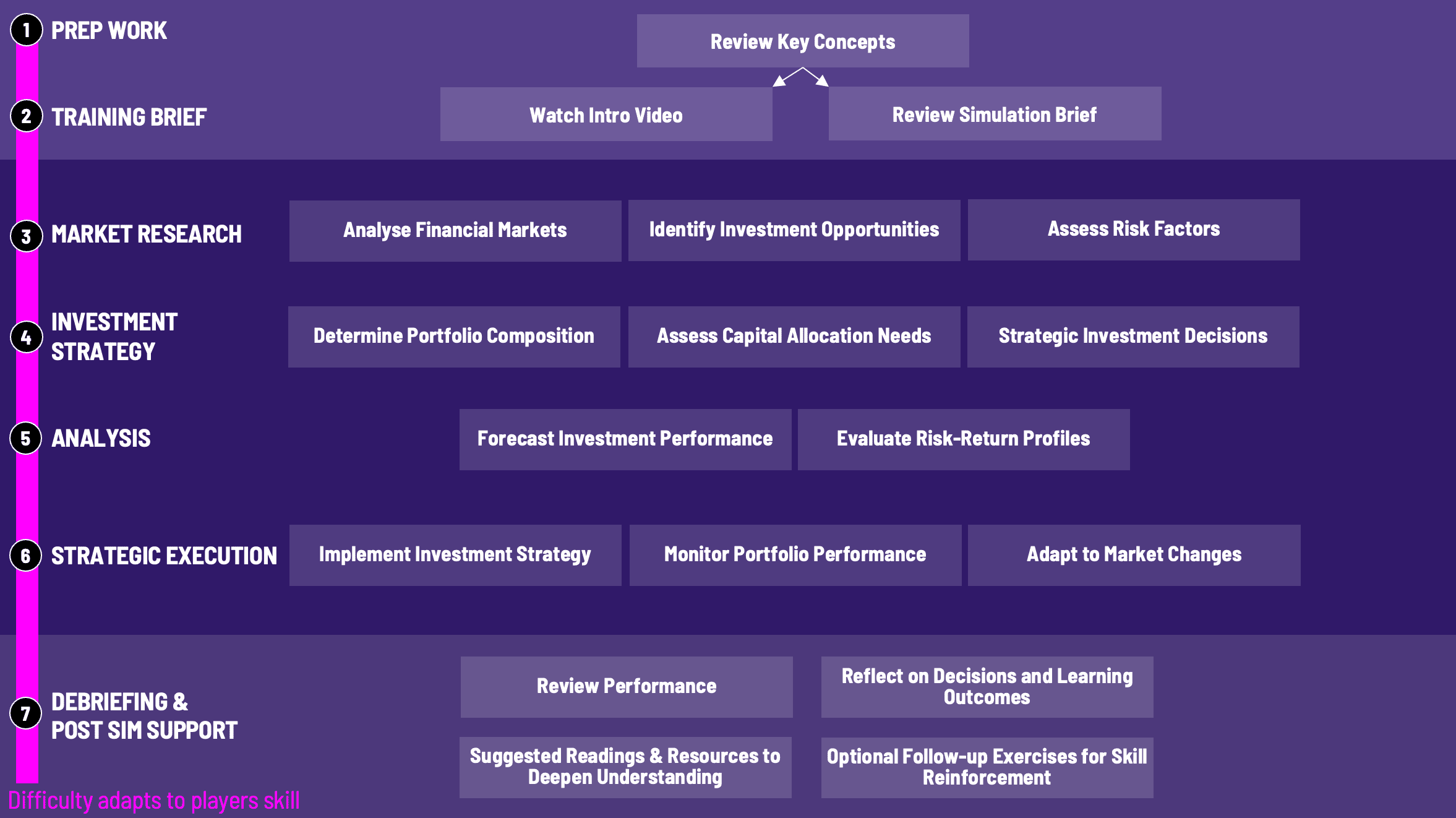

The Investment Analysis Training places participants in the role of financial analysts tasked with evaluating investment opportunities, managing portfolios, and optimising returns in dynamic market conditions. This training offers an immersive experience, challenging students to make strategic decisions based on real-world data and scenarios. By balancing risk and return, participants gain a comprehensive understanding of investment principles while honing their analytical and decision-making skills.

What does the investment analysis training teach? The training focuses on key investment concepts like portfolio management, asset valuation, and risk-return optimisation, giving participants a hands-on learning experience.

Who can benefit from this investment analysis training? Professionals aiming to enhance their investment analysis skills in roles such as asset management, equity research, or corporate finance will find this training highly beneficial.

Do participants need prior financial knowledge? While no advanced expertise is required, familiarity with basic finance concepts, such as valuation methods and portfolio theory, is helpful for success.

How flexible is the investment analysis training duration? The duration is customisable, typically ranging from a single session of 6 hours to a multi-day experience, depending on the instructor's goals.

Can the investment analysis training address specific learning objectives? Yes, instructors can adjust parameters and scenarios to emphasise particular investment strategies or market conditions relevant to their curriculum.

What investment instruments are covered? The training includes a variety of instruments, such as equities, fixed-income securities, and other asset classes, offering a comprehensive learning experience.

Is teamwork required in this investment analysis training? Collaboration is a key aspect, encouraging participants to work in teams, share insights, and develop strategies collectively, reflecting real-world investment practices.

What kind of technology setup is needed? A computer or tablet with an internet connection and a compatible web browser is all that’s required to run the simulation smoothly.

How are participants evaluated? Assessment is based on portfolio performance, decision-making under uncertainty, and the application of strategic thinking, all of which can be tracked in real-time during the investment analysis training.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the advanced corporate finance training.

or

Book a 15-minute Zoom demo with one of our experts to explore how the advanced corporate finance training can benefit you.