In this Hedge Funds Simulation, participants act as fund managers - designing strategies, managing portfolios, and responding to volatility while balancing risk, leverage, and investor expectations in highly competitive financial markets.

Participants step into the role of hedge fund managers navigating dynamic markets. Each round introduces new challenges - market swings, investor demands, regulatory scrutiny, or competitive strategies from rival funds.

They must allocate capital, balance long and short positions, apply leverage responsibly, and decide when to pivot strategies. The simulation emphasizes decision-making under uncertainty, blending technical analysis with investor psychology.

This simulation is ideal for university programs, executive training, and corporate workshops. It brings hedge fund strategy to life, showing how performance, risk, and reputation interact in real-world fund management.

Participants work through realistic scenarios, which can be customized to emphasize or exclude specific topics depending on the learning goals. This modular structure allows the simulation to be tailored to any type of session. Key concepts include:

Hedge fund structures and strategies (long/short, global macro, arbitrage)

Portfolio construction and risk management

Leverage and liquidity management

Market timing and tactical asset allocation

Regulatory and compliance issues in hedge funds

Investor relations and fundraising dynamics

Impact of market shocks on portfolios

ESG considerations in hedge fund strategies

Performance measurement and fee structures

Competition and reputation in asset management

Choose investment strategies tailored to market conditions

Construct and rebalance portfolios with long/short positions

Manage leverage, liquidity, and investor expectations

Respond to shocks like volatility spikes or regulatory shifts

Pitch performance updates to investors and stakeholders

Reflect on strategy effectiveness and adaptability

By the end of the simulation, participants will be able to:

Understand hedge fund structures and operating models

Apply long/short and other common hedge fund strategies

Manage portfolio risk with leverage and liquidity tools

Respond effectively to market shocks and investor demands

Balance risk-adjusted returns with reputation and compliance

Communicate performance clearly to investors

Recognize the role of hedge funds in financial markets

Explore ESG integration in hedge fund strategies

Develop judgment under conditions of volatility and uncertainty

Build confidence in fund management decision-making

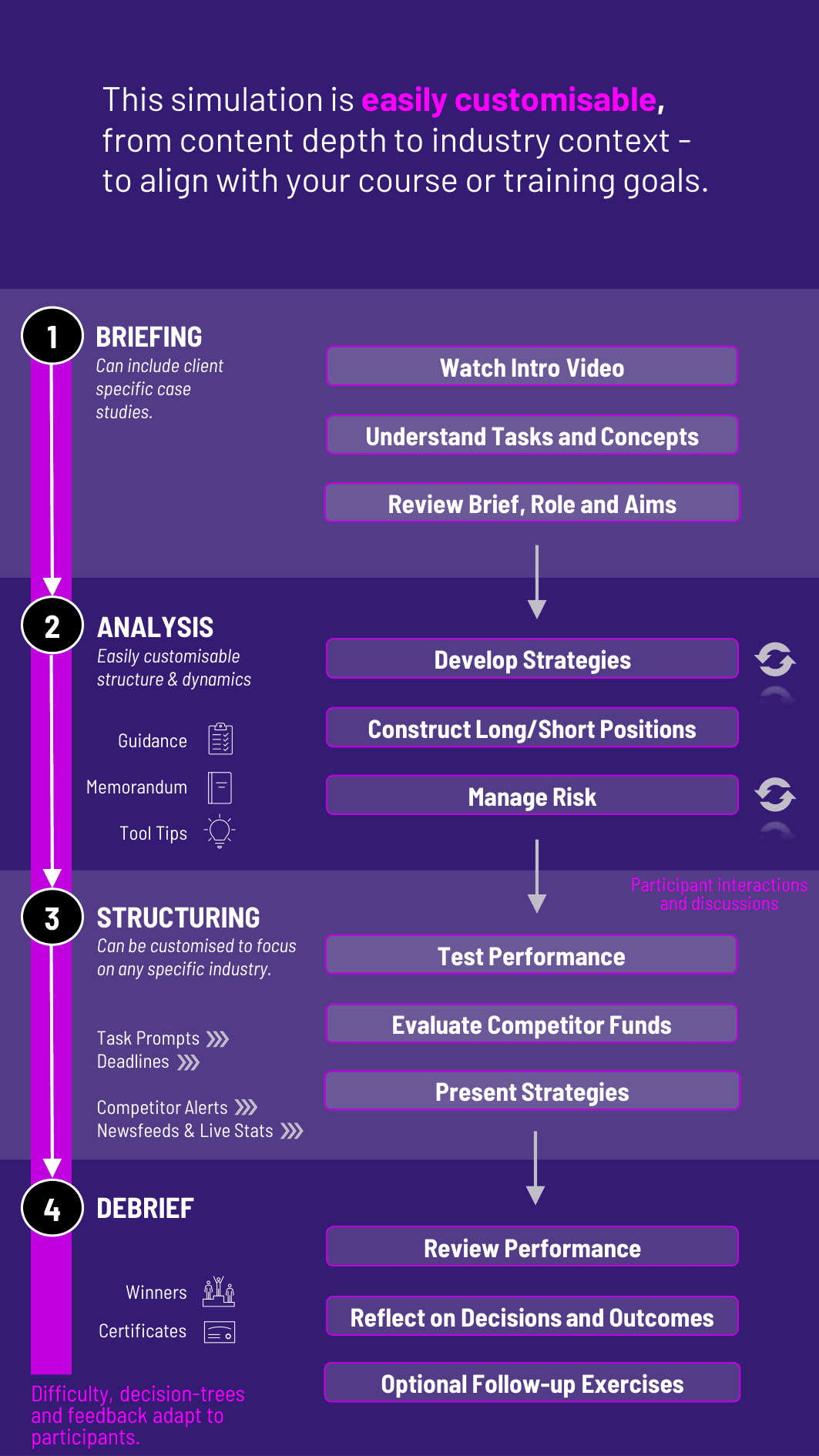

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

1. Receive a Scenario or Brief: Participants are introduced to a market environment with opportunities and risks.

2. Analyse the Situation: They review market data, fund mandates, and investor expectations.

3. Make Strategic Decisions: Participants choose investment strategies, adjust positions, and set risk levels.

4. Collaborate Across Roles: Teams may act as fund managers, analysts, or investors negotiating priorities.

5. Communicate Outcomes: Participants deliver investor updates, memos, or strategy presentations.

6. Review and Reflect: Feedback highlights performance, risk exposure, and investor sentiment. Strategies evolve across rounds.

Who is this hedge funds simulation designed for? It's ideal for participants interested in asset management, hedge funds, trading, or institutional investing.

Do I need prior trading experience? No prior experience is required. The hedge funds simulation includes instructional content for all levels.

How long does the hedge funds simulation run? Typically 3-4 hours, though it can be delivered in shorter modules or extended formats.

Is the hedge funds simulation individual or team-based? It supports both formats and is designed to reflect real hedge fund team dynamics.

What strategies are covered? Long/short equity, market neutral, global macro, event-driven, and more.

Are real-world datasets used? Yes. Participants work with simulated market data based on historical and real-time financial scenarios.

Can instructors customize the hedge funds simulation? Absolutely. Strategy focus, portfolio limits, and industry sectors can be tailored.

How is performance measured? Based on returns, volatility, Sharpe ratio, risk control, and investor communication.

What roles does this hedge funds simulation prepare participants for? It prepares participants for careers in hedge funds, asset management, trading, portfolio analytics, and more.

Assessment can be tailored to focus on financial performance, strategy, or communication. Participants may be evaluated on:

Portfolio performance and risk-adjusted returns

Effective use of hedge fund strategies

Responsiveness to volatility and market shocks

Investor communication clarity and persuasiveness

Collaboration and adaptability in fund management

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.