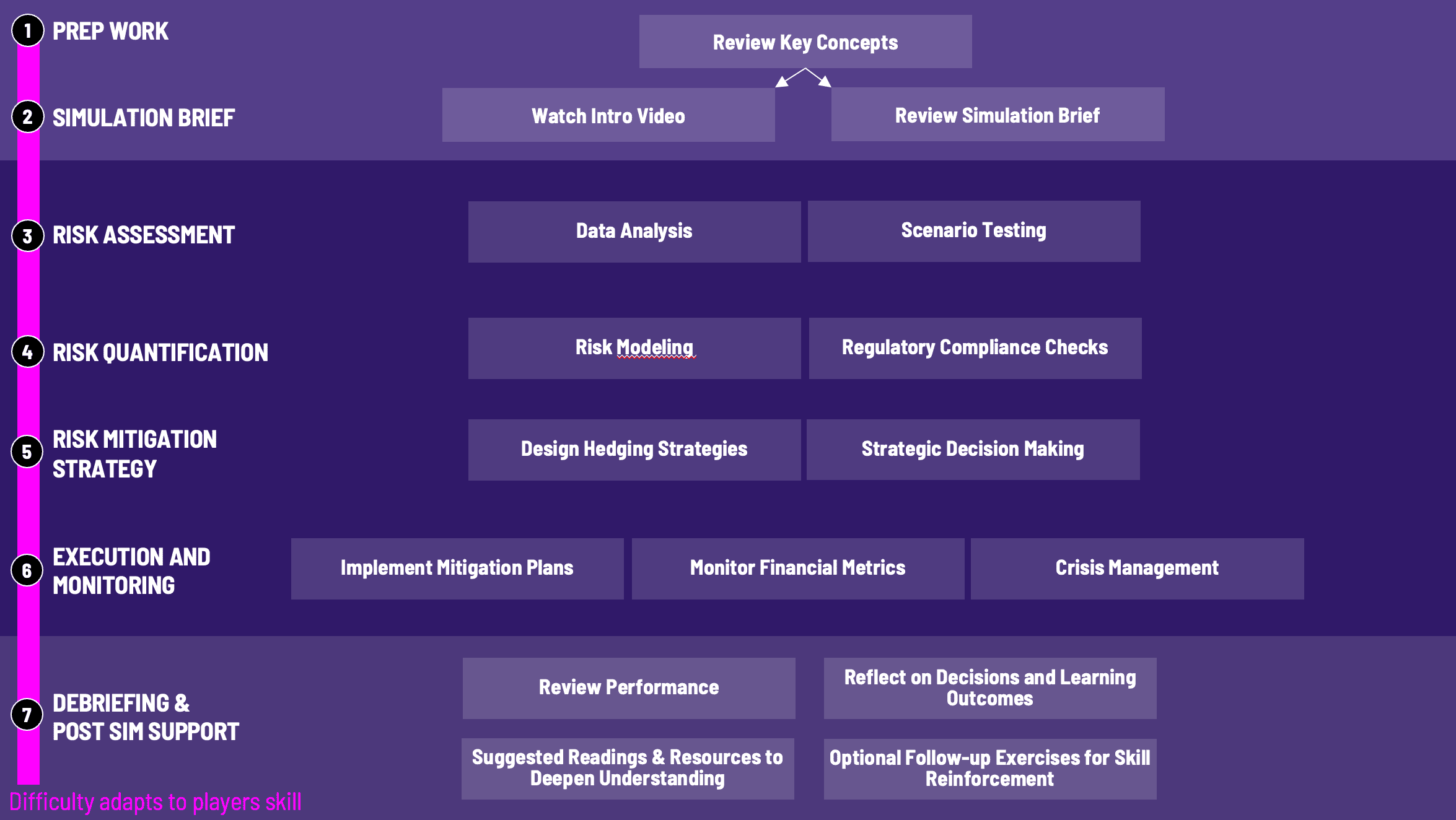

Students act as risk managers, tackling market, credit, and operational risks to protect value in dynamic scenarios.

This simulation integrates cutting-edge tools and techniques, fostering both technical expertise and strategic thinking. By the end of the experience, students not only grasp theoretical frameworks but also acquire the practical skills necessary to thrive in high-pressure financial roles.

What is the primary objective of this simulation? To teach students how to identify, assess, and mitigate financial risks effectively.

Who should participate in this simulation? It is ideal for students studying finance, business, or risk management.

How long does the simulation take to complete? The simulation typically spans 4-6 hours, depending on the institution’s customisation.

What tools are used in the simulation? Students use real-world financial analysis tools and risk modelling software.

Are there prerequisites for this simulation? A basic understanding of finance and risk concepts is recommended but not mandatory.

What industries does this simulation focus on? It covers various industries, including banking, investment management, and insurance.

How are students assessed? Performance is evaluated based on decision-making quality, risk mitigation strategies, and financial outcomes.

Can this simulation be customised for specific courses? Yes, the simulation can be tailored to meet the unique needs of different programs.

What skills will students gain? Students will enhance their analytical, strategic, and communication skills in risk management.

What makes this simulation unique? Its focus on real-world applications and dynamic scenarios sets it apart, ensuring students are prepared for actual financial challenges.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.